Understanding Bitcoin and Aml 🧐

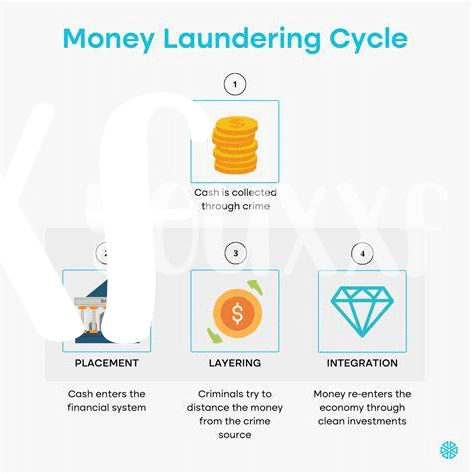

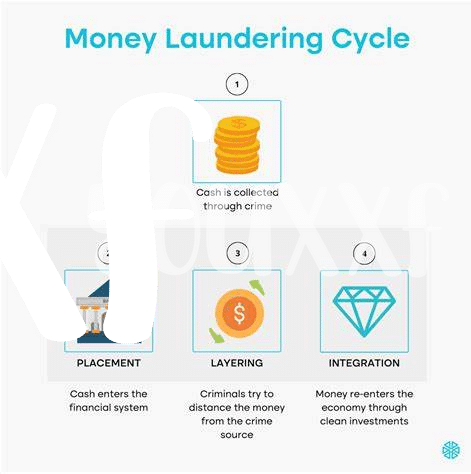

Bitcoin, a digital currency that operates without a central authority, has been gaining popularity worldwide. In the realm of Anti-Money Laundering (AML), understanding how Bitcoin transactions work and the importance of AML compliance is crucial. AML regulations aim to prevent illegal activities such as money laundering and terrorism financing. The decentralized nature of Bitcoin presents unique challenges for AML compliance, requiring innovative solutions to track and monitor transactions effectively. By grasping the fundamentals of Bitcoin and AML, individuals and organizations can navigate this evolving landscape with confidence and integrity.

Regulatory Challenges Faced in Ghana💡

Regulatory Challenges Faced in Ghana: The evolving landscape of Bitcoin AML regulations in Ghana presents unique hurdles, blending traditional financial compliance norms with the complexities of decentralized cryptocurrencies. Striking a balance between fostering innovation and safeguarding against illicit activities poses a significant challenge for regulatory bodies in the country. Factors such as limited resources, gaps in existing frameworks, and a need for specialized expertise further compound the regulatory challenges faced by Ghana in effectively monitoring and enforcing AML measures within the Bitcoin sector.

Importance of Aml Compliance 👍

Ensuring compliance with Anti-Money Laundering (AML) regulations within the realm of Bitcoin transactions is crucial to safeguarding financial systems and preventing illicit activities. By adhering to AML guidelines, individuals and companies can uphold transparency, integrity, and trust in the digital currency landscape. Compliance with AML standards not only mitigates financial risks but also fosters a more secure and sustainable environment for the widespread adoption of Bitcoin in Ghana.

Technologies for Bitcoin Aml Compliance 👾

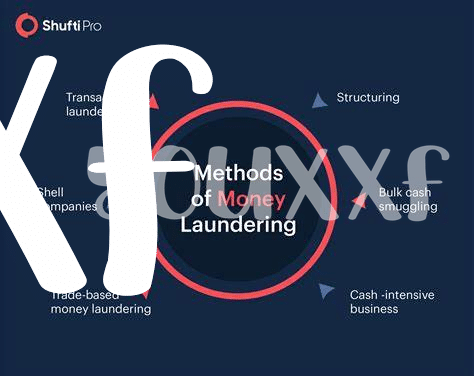

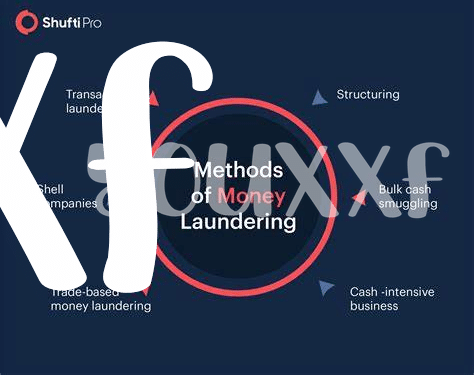

For the effective implementation of Bitcoin Aml Compliance, leveraging advanced technologies plays a pivotal role. These tools and systems are designed to monitor and analyze transactions in real-time, flagging suspicious activities that may be indicative of money laundering or other illicit behaviors. By utilizing blockchain analysis and other innovative solutions, financial institutions and regulators in Ghana can enhance their AML processes and safeguard against potential risks. To dive deeper into the role of technology in ensuring AML in Bitcoin transactions, check out this insightful article on bitcoin anti-money laundering (AML) regulations in Indonesia.

Training and Education for Awareness 📚

Training and Education for Awareness involves equipping individuals and organizations with the knowledge and skills needed to understand the intricacies of Bitcoin Aml Compliance. By offering comprehensive training programs and educational resources, stakeholders can improve their understanding of regulations and best practices in this evolving landscape. This not only enhances compliance efforts but also fosters a culture of transparency and accountability within the industry. Through continuous learning and awareness initiatives, Ghanaians can navigate the complexities of Aml requirements more effectively, ultimately contributing to a safer and more secure environment for all participants.

Collaborative Efforts for Effective Compliance 💪

In order to enhance Bitcoin AML compliance outcomes, collaborative efforts among various stakeholders play a pivotal role. By fostering partnerships between regulatory bodies, financial institutions, and technology providers, a unified approach towards combating money laundering activities can be achieved. Information sharing and coordinated actions can lead to a more robust compliance framework that stays ahead of evolving illicit practices in the cryptocurrency space. Through collaborative efforts, not only can the effectiveness of AML measures be heightened, but it also promotes a culture of transparency and accountability within the industry.

To read more about Bitcoin anti-money laundering (AML) regulations in Guinea, click on this link: Bitcoin anti-money laundering (AML) regulations in Honduras.