Why Bitcoin? a Global Phenomenon 🌍

In a world where the lines between the digital and the physical blur more each day, Bitcoin has emerged as a shining beacon of what the future of money might look like. Imagine a type of money that isn’t bound by borders, that can be sent across the globe as easily as sending an email, and that is not controlled by any single government or institution – that’s Bitcoin for you. This revolutionary digital currency leverages technology to allow people to exchange value directly with one another, cutting out the need for traditional middlemen like banks. Its appeal spans various continents, capturing the imagination of individuals and businesses alike, and igniting discussions about financial freedom and innovation. However, its rise has not been without challenges. Countries around the world are grappling with how to handle this new form of money, leading to a patchwork of regulatory responses. Here’s a quick look at how widespread Bitcoin has become:

| Continent | Number of Bitcoin ATMs |

|---|---|

| North America | 34,500 |

| Europe | 1,400 |

| Asia | 130 |

| Oceania | 200 |

| South America | 90 |

| Africa | 20 |

These numbers only scratch the surface of Bitcoin’s global footprint. It’s not just about being able to buy a coffee using digital currency; it’s about reimagining what global financial participation looks like.

Navigating Legal Waters: Bitcoin Around the World ⚖️

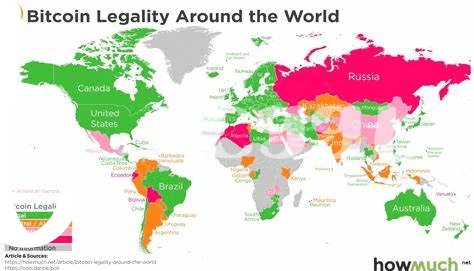

As you dive into the world of Bitcoin, you’ll find that the rules can be pretty different depending on where you are. Picture a world map, and on this map, there are places glowing bright, welcoming Bitcoin with open arms, and then there are areas shaded in, cautious or outright saying “no” to it. It’s a bit like being a traveler; in some countries, you feel right at home, and in others, you need to learn the local customs to fit in. This global patchwork of laws and attitudes shapes not just where you can use Bitcoin but how you use it. For those looking to secure their corporate Bitcoin investments, finding the right tools and practices is crucial. A deep dive into this topic can be found at https://wikicrypto.news/securing-corporate-bitcoin-investments-best-practices-and-tools, offering valuable insights into navigating these tricky waters. It’s a fascinating journey, exploring how different corners of the world react to the same digital phenomenon, impacting investors, businesses, and everyday users alike.

The Bitcoin Bans: Where and Why? 🚫

Imagine a world where, in some places, you’re free to grow a magical digital money tree in your backyard, but in others, there’s a big “No Gardening Allowed” sign. That’s kind of what’s happening with Bitcoin. 🚫👀 Certain countries have rolled up the welcome mat, banning Bitcoin and other digital coins. Why? It mainly boils down to two reasons: protecting their own money and keeping a close eye on transactions to prevent naughty activities like money laundering. 🕵️♂️💰 Think of it as the difference between a free-for-all playground and one where the rules are super strict. In places like Algeria, Bolivia, and Bangladesh, the governments have decided it’s safer to keep the digital playground closed, worried that if they don’t, it might lead to financial chaos or become a hidden alley for illegal dealings. It shows us just how diverse the world is when it comes to welcoming or waving goodbye to new financial adventures. 🌏💼

Embrace the Change: Countries Welcoming Bitcoin 💖

As we explore the digital currency landscape, it’s heartwarming to see a growing number of countries opening their arms to Bitcoin. Imagine stepping into a world where using Bitcoin is as easy as swiping your credit card. This isn’t a distant dream but a reality in some parts of the globe. Nations like Japan, Canada, and the European Union are leading the charge, setting progressive policies that not only legitimize but also encourage the use of this digital gold. By creating a friendly environment, they’re not just attracting investors but are also setting the stage for a tech-savvy future. These countries understand that innovation shouldn’t be stifled by fear but embraced with open arms.

For anyone looking to dive into the world of Bitcoin and navigate its potential waters safely, understanding how different regions interact with this digital currency is crucial. One might wonder how to blend the excitement of investing with the solidity of wise decision-making. To bridge this gap, consider exploring bitcoin and defi ecosystems investment strategies. This resource sheds light on high-yield opportunities within Bitcoin investments, echoing the embracing stance of progressive nations. The clear takeaway? In countries where Bitcoin is welcomed, the future looks not just bright but also promising for investors seeking to tap into the groundbreaking potential of digital currencies.

Impact of Regulations on Your Bitcoin Investment 💡

When it comes to investing in Bitcoin, it’s a lot like taking a raft into the ocean—regulations are your weather forecast. Some countries have tight rules, making the waters choppy for Bitcoin investors. These regulations can affect everything from how much tax you pay to what you can do with your Bitcoin. On the flip side, in places that roll out the welcome mat for Bitcoin, you might find your investment can grow more freely, benefiting from clearer rules or even incentives. Remember, understanding these regulations is crucial because they can either protect your investment or pose challenges. Here’s a simple breakdown:

| Country | Regulation Overview | Impact on Investment |

|---|---|---|

| Country A | Tight regulations, high taxes | 📉 Potentially lower profits |

| Country B | Bitcoin-friendly, low taxes | 📈 Greater potential for profit |

Navigating these waters wisely, by keeping informed about the regulatory climate, can mean smoother sailing for your Bitcoin investment strategy.

Future Prospects: Bitcoin and Global Regulation 🚀

As we drift into the future, the dialogue surrounding Bitcoin and its integration into our global financial fabric is becoming louder and more intricate. 🌐💬 Looking ahead, it’s clear that a dance between innovation and regulation is underway. Countries worldwide are recognizing the power and potential of cryptocurrencies, leading to a gradual shift from strict regulations to more open and supportive frameworks. This evolution is crucial for investors, as it directly influences the stability, accessibility, and profitability of investing in digital currencies like Bitcoin. Moreover, the corporate world is not standing idle. With an eye on the future, many companies are exploring bitcoin and corporate adoption investment strategies, signaling a growing acceptance of Bitcoin as a legitimate asset class. This synergy between governmental regulation and corporate adoption hints at a future where Bitcoin is not just an outlier but a fundamental component of global economic systems. 🚀💼 The journey ahead is promising, yet filled with hurdles. Nonetheless, for those navigating the Bitcoin investment landscape, staying informed and adaptable to regulatory changes will be key to unlocking its full potential.