🌐 What Is Bitcoin and How Does It Work?

Imagine a digital coin that you can send to anyone, anywhere, without needing a bank in the middle. That’s what Bitcoin is – a kind of money that exists entirely online. It was created back in 2009 by a mysterious figure using the name Satoshi Nakamoto. Unlike traditional money that you carry in your pockets, Bitcoin lives on a public ledger on thousands of computers all over the world. When you send or receive Bitcoin, that transaction is recorded on this ledger, making it nearly impossible to cheat or fake. The technology that makes this possible is called blockchain, a kind of digital chain of blocks where each block holds a bunch of transactions. Everyone who owns Bitcoin helps to keep this ledger up to date by participating in a process known as mining. This is where it gets a bit technical, but think of mining as a really complicated puzzle. When someone solves the puzzle, they get to add a new block to the chain and are rewarded with some Bitcoin for their hard work.

| 🌐 Bitcoin | A digital currency or form of money that exists only online. |

| 💾 Blockchain | The technology that powers Bitcoin; a digital ledger of all the transactions. |

| ⛏️ Mining | The process of validating transactions and adding them to the blockchain. |

Bitcoin is not controlled by any single government or company, which is a big part of its appeal. Instead, it’s decentralized, meaning it’s run by all its users collectively. This might sound like a small detail, but it’s actually a huge shift from how traditional money works. With Bitcoin, you have a lot of freedom, but also a lot of responsibility, since there’s no bank to help if things go wrong. Just imagine sending cash through your computer or phone, directly to someone else, no middleman involved – that’s the revolution Bitcoin brought into the financial world.

💡 Breaking down Collateral in Simple Terms

Imagine you’re buying a new phone and the store lets you take it home after you promise to pay them back. To make sure you follow through, you leave something valuable behind, like your old phone or a favorite watch. That valuable item is like a safety net for the store, ensuring they have something of worth if you don’t come back to pay. This concept is very similar to what we call collateral in the financial world. It’s about borrowing money and leaving something valuable with the lender as a promise you’ll return the cash. Bitcoin, with its growing value and popularity, is stepping into this role quite impressively, becoming a favored choice for securing loans in the digital age. Loans aren’t just for houses or cars anymore; they’re becoming a crucial part of expanding our digital portfolios and investments. To understand why Bitcoin makes such good collateral, especially considering its digital nature and how its value can be more stable than you might think, reading about securing and leveraging corporate bitcoin can be enlightening. For more in-depth insights, this is well-explained in an article about the potential of high-yield bitcoin accounts at https://wikicrypto.news/high-yield-bitcoin-accounts-myth-or-reality.

🚀 the Rise of Defi: a Game Changer

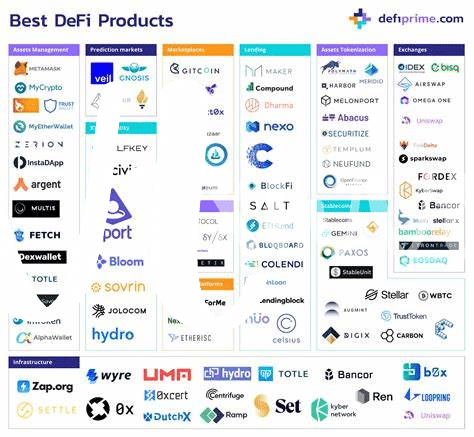

Imagine a world where you can borrow money without having to sit in a stuffy bank, answering endless questions about your finances. Welcome to the world of decentralized finance, or DeFi for short, where borrowing, lending, and investing get a modern upgrade, making them easier and more accessible than ever before. Picture DeFi as a big, vibrant marketplace – but instead of fruits and flowers, it’s filled with financial services, all available at your fingertips, no middlemen required. 🌍💼 What sets DeFi apart is its use of blockchain technology, the same tech that powers Bitcoin, allowing transactions to be secure, quick, and without needing a central authority’s approval. This game-changing shift not only makes financial services more inclusive by allowing more people to join in, regardless of where they are in the world 🌎✨, but it also introduces innovative ways to manage and grow your money. Whether you’re looking to lend, borrow, or invest, DeFi opens up a world of possibilities, offering the freedom to take control of your financial destiny like never before.

🛠️ How to Use Bitcoin as Your Loan’s Backbone

Imagine diving into a world where your digital gold, yes, Bitcoin, can open doors to new financial opportunities without having to sell your precious coins. It’s quite a leap from the traditional borrowing scene, where physical assets or your credit score dictates your borrowing power. In the revolutionary DeFi space, Bitcoin shines as a solid backbone for securing loans. Think of it as using your car or house as a guarantee to borrow money, but in this case, it’s your digital assets doing the heavy lifting. This approach allows you to hold onto your Bitcoin while leveraging it to gain access to liquid funds. Whether you’re eyeing an investment opportunity that you can’t pass up or need funds for personal reasons, using Bitcoin as collateral could be your golden ticket. The process is straightforward—deposit your Bitcoin into a DeFi platform, agree to the terms, and voilà, you have the funds you need. Plus, with platforms upping their game in security and user experience, it’s safer and easier than ever. Fascinated about diving deeper into how this all plays into bitcoin and corporate adoption investment strategies? Swing by bitcoin and corporate adoption investment strategies for an insightful read that could illuminate your investment journey. Just remember, as exhilarating as it sounds, navigating through the DeFi space with your precious Bitcoin requires a good understanding of the risks and a clear plan for managing them.

📈 Benefits of Choosing Bitcoin as Your Collateral

Choosing Bitcoin as your collateral is like hitting the jackpot in the world of borrowing and lending. Imagine having a treasure chest in the digital realm, one that grows not just in value but also in its power to unlock financial opportunities. Bitcoin, with its soaring popularity and acceptance, stands out as a robust and dependable security for loans. Unlike traditional assets, it doesn’t need a physical space for storage, slashing down the handling costs significantly. The digital nature of Bitcoin ensures that transactions are swift, allowing borrowers to access funds quicker than ever before. Moreover, this approach opens up avenues for individuals worldwide, making geographical boundaries irrelevant. Whether you’re in a bustling city or a remote village, if you have Bitcoin, you have a ticket to financial inclusivity.

Now, let’s crunch some numbers and understand the real impact.

| Pros | Details |

|---|---|

| Global Access | Bitcoin’s digital form transcends geographical boundaries, offering worldwide opportunities for borrowing. |

| Lower Costs | Minimal physical handling and storage requirements significantly reduce the costs associated with using Bitcoin as collateral. |

| Speed | Transactions and access to funds are remarkably swift, enhancing borrowing efficiency. |

| Appreciation Potential | Bitcoin’s value has the potential to appreciate over time, providing added advantages to borrowers. |

One cannot overlook the potential appreciation in value that Bitcoin offers. While traditional assets may depreciate, Bitcoin holds the promise of growing in value over time. This unique benefit not only secures a better deal for the borrower but also paves the way for a potentially lower interest rate, considering the asset backing the loan might increase in value. It’s a win-win, offering both security and growth, something that traditional collateral options struggle to match.

🚨 Risks and Considerations: What You Should Know

When thinking about using Bitcoin as your loan’s foundation, it’s like embarking on a thrilling adventure; however, every adventure has its dragons. Firstly, Bitcoin’s price can be a rollercoaster – imagine climbing up fast but also potentially dropping down just as quickly. This volatility means the value of your collateral can change drastically, sometimes overnight. If the value plummets, you might need to add more Bitcoin or face the dreaded ‘margin call,’ where your loan conditions suddenly change. Security is another dragon. While the blockchain itself is pretty secure, the platforms where you manage your Bitcoin might not be impregnable castles. Hacks happen, and when they do, it’s not just a fairy tale – it’s your money at stake. Also, remember the legal landscape is like an uncharted territory; regulations can shift, affecting how these loans work or are recognized. But fear not, learning about bitcoin interest accounts investment strategies can arm you with knowledge, turning these dragons into mere shadows on your quest. Being aware and prepared means you can venture into using Bitcoin as collateral with your eyes wide open, ready for both its rewards and risks.