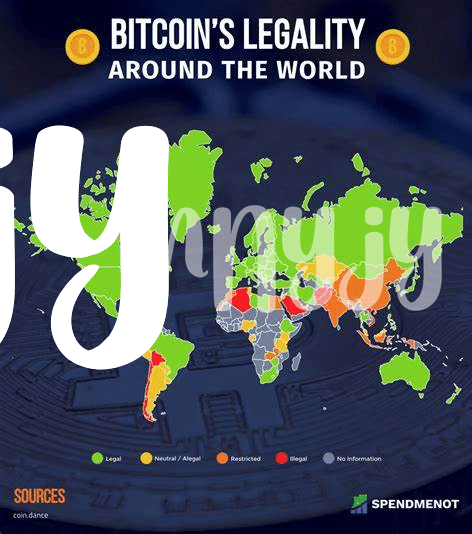

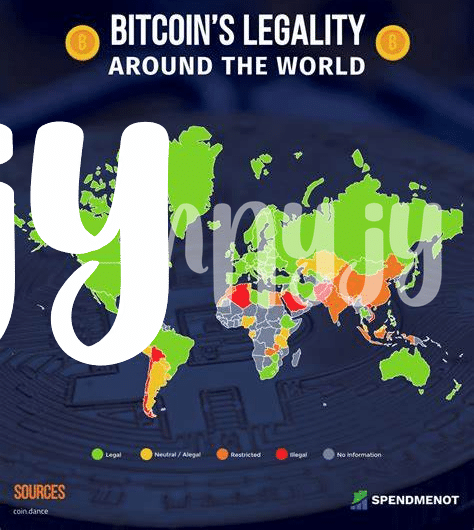

Regulatory Challenges and Bitcoin Banking 🌍

Understanding the dynamics of Bitcoin banking in North Macedonia unveils a landscape fraught with regulatory challenges. Navigating the compliance intricacies in the evolving fintech realm requires a delicate balance between innovation and regulation. The regulatory framework must adapt swiftly to the disruptive nature of cryptocurrencies, ensuring a secure environment that fosters financial inclusion and integrity across borders.

Technology Solutions for Compliance 🛠️

When it comes to ensuring compliance for Bitcoin banks in North Macedonia, leveraging technology solutions is paramount. These tools not only streamline regulatory processes but also enhance security measures to safeguard against cyber threats. By implementing advanced software and blockchain technologies, Bitcoin banks can stay ahead of evolving compliance requirements and mitigate risks effectively. Moreover, incorporating innovative tech solutions enables these banks to demonstrate transparency and accountability, fostering trust among stakeholders. Continuous technological advancements in compliance tools empower Bitcoin banks to navigate the complex regulatory landscape more efficiently, ensuring long-term sustainability and growth.

Importance of Continuous Monitoring 📊

Continuous monitoring plays a crucial role in ensuring that Bitcoin banks in North Macedonia adhere to compliance standards and regulations. By consistently observing transactions and activities, these institutions can quickly identify any irregularities or potential risks, allowing for timely intervention and mitigation strategies. In a rapidly evolving financial landscape, the importance of continuous monitoring cannot be understated, as it provides a proactive approach to maintaining regulatory compliance and safeguarding the integrity of the banking system.

Implementing Risk Management Strategies ⚖️

Risk management is imperative for Bitcoin banks in North Macedonia. By implementing robust strategies, institutions can safeguard against potential threats and vulnerabilities. This involves proactive identification and assessment of risks, followed by the development of effective mitigation plans. Ensuring compliance with regulatory requirements is a key aspect of risk management, helping institutions navigate the evolving landscape of digital finance securely.

For more insights on Bitcoin banking services regulations in Nepal, visit bitcoin banking services regulations in Nepal.

Role of Education and Training for Staff 📚

Education and training for staff play a crucial role in ensuring the effective implementation of compliance measures within Bitcoin banks in North Macedonia. Equipping employees with the necessary knowledge and skills not only enhances their understanding of regulatory requirements but also empowers them to identify and address potential risks proactively. Ongoing education programs help cultivate a culture of compliance and professionalism, fostering a secure and trustworthy environment for both the institution and its clients.

Collaborative Efforts with Regulatory Bodies 🤝

Building strong relationships with regulatory bodies is crucial for Bitcoin banks in North Macedonia to ensure compliance with evolving regulations. By fostering collaboration, banks can gain valuable insights, clarify ambiguities, and collectively work towards a regulatory framework that supports both innovation and consumer protection. These collaborative efforts not only enhance transparency and accountability but also contribute to the development of a sustainable and resilient financial ecosystem that benefits all stakeholders involved.

bitcoin banking services regulations in nauru