🚀 Unveiling the Latest Blockchain Innovations

In the world of digital currency, blockchain is like the ever-evolving backbone that keeps things exciting. Picture this: it’s a bit like upgrading from a cozy campfire to a dazzling fireworks show. Some of the newest sparks lighting up the sky include technology that makes transactions faster than a snap of your fingers and ways to keep your digital cash safer than a treasure chest under the sea. These innovations aren’t just cool; they’re changing the game, making everything more secure and super speedy.

| Innovation | Description | Impact |

|---|---|---|

| Lightning-fast transactions | Imagine sending bitcoin as quickly as sending a text message. | More people using bitcoin for everyday transactions. |

| Treasure-like security | Advanced methods to lock down your digital gold. | Peace of mind for current and future investors. |

Now, think of these advancements like a secret sauce. They’re making everything in the blockchain world tastier. It’s not just about keeping your bitcoins snug and safe or making things zip along faster; it’s also about opening up a world of possibilities. Who knows? With all these shiny new toys, the way we think about digital money might just take a giant leap forward.

💡 How Innovations Shape Bitcoin’s Value

In the fascinating world of cryptocurrency, every new tweak or innovation in blockchain technology can feel like a mini adventure for those holding or trading Bitcoin. Imagine finding a hidden treasure map where X marks the spot. In this scenario, blockchain updates are the map, leading us towards potential treasures or challenges. Bitcoin, with its value ever on the swing, dances along to the tune of these technological advancements. The beauty of it all? When developers come up with smarter ways to make transactions more efficient, secure, or user-friendly, it can boost confidence in Bitcoin, sometimes making its value soar like a kite catching a strong updraft.

However, it’s not just about soaring; it’s also about steering. Innovations in blockchain can equally influence traders and businesses to rethink their strategies. For instance, as new platforms and technologies emerge, savvy investors keenly watch for hints that might predict the market’s movement. This anticipation and reaction to blockchain innovations create a dynamic environment where Bitcoin’s value is as much about perception as it is about technical upgrades. For those looking to dive deeper into the world of cryptocurrency, gaining insights into such connections is essential. A great resource to explore further is an insight-packed comparison on https://wikicrypto.news/from-fiat-to-digital-buying-cardano-with-traditional-money, bridging the knowledge gap for enthusiasts venturing from traditional to digital currencies.

🌐 Global Trends Influencing Blockchain Evolution

In the world where everything is connected, what happens in one corner of the globe can ripple across to all others. This is especially true for blockchain, the technology underpinning Bitcoin. From the bustling streets of Tokyo where cashless payments reign supreme, to the tech-savvy corridors of Silicon Valley, innovative trends are shaping the future of blockchain. Countries and companies are racing to embrace digital currencies, each bringing new ideas to the table. These global currents not only speed up the adoption of blockchain but also spark exciting changes, making every day an adventure in the digital world.

As we navigate through these changes, the way businesses and individuals interact with blockchain is evolving too. Innovations such as faster transaction speeds, enhanced security protocols, and greener, more energy-efficient operations are just the tip of the iceberg. These advancements promise to make blockchain more accessible and useful, attracting more people to use Bitcoin and other digital currencies. Watching these global trends unfurl is like watching a thrilling drama where technology is the star, promising a future where digital currencies are as common as the smartphones in our pockets.

💼 Impact on Business and Trading Strategies

As blockchain technology keeps evolving, it’s fascinating to see how this is changing the game for businesses and those engaged in trading. It’s like watching a complex puzzle come together, where each new piece can change the whole picture. For instance, advancements such as smart contracts enable tasks and agreements to be completed without a middleman, simplifying processes and slashing costs. This not only speeds things up but also opens up novel opportunities for companies to operate more efficiently and transparently, attracting more interest and investment in the sector. On the trading side, these innovations are shaking up strategies. Traders now have more tools at their disposal, like real-time data analysis and automated trading systems, making it easier to make informed decisions quickly. In a market where timing can mean everything, these advancements can be the difference between profit and loss. Moreover, for anyone looking to understand the intricacies of blockchain and its implications on various cryptocurrencies, including Bitcoin, information is key. For a deeper dive into related topics, such as what is ethereum classic, it’s crucial to access reliable resources that shed light on these complex subjects. This blend of innovation and information is creating a more dynamic and possibly more profitable landscape for businesses and traders alike, encouraging a more strategic approach to their decisions.

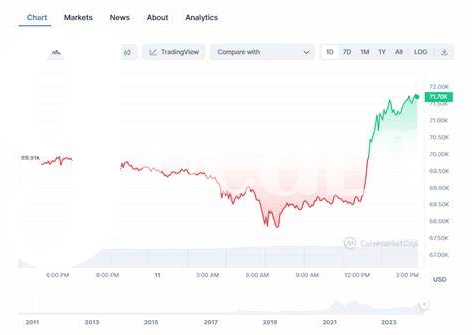

📈 Predictive Analysis: Bullish or Bearish Futures?

When it comes to predicting whether Bitcoin will see a surge (🚀) or a dip (📉) in its value, it’s a lot like forecasting the weather in a complex digital landscape. The innovations rolling out in the blockchain arena have the power to sway Bitcoin’s prices in significant ways. Imagine blockchain advances as winds that can either fill the sails of Bitcoin, propelling it to new heights, or bring about storms that could see its value waver. Analysts pore over data, much like meteorologists study weather patterns, to predict these shifts. The crux of the matter lies in understanding how these innovations are embraced globally, their integration into current systems, and the subsequent effects on investor sentiment. Businesses, too, play a pivotal role; as they adopt these groundbreaking technologies, the ripples are felt across the market. Here’s a glance at what the future might hold:

| Predictive Indicator | Impact Direction | Notes |

|---|---|---|

| Adoption by Major Corporations | Bullish 🚀 | Increase in legitimacy and trust. |

| Regulatory Changes | Bearish 📉 | Depends on the nature of regulations. |

| Technological Breakthroughs | Bullish 🚀 | Enhancements in security and efficiency. |

| Market Saturation | Bearish 📉 | Too many alternatives can dilute value. |

This predictive analysis hinges on multiple factors that sway investor decisions, illustrating a future that could swing towards optimistic growth (🚀) or cautious decline (📉), contingent on how these innovations unfold and intertwine with economic, social, and regulatory fabrics globally.

🤔 the Ripple Effect on Investors’ Decisions

When new tricks and features come out in the world of blockchain, people who put money into things like Bitcoin really sit up and pay attention. This is kind of like when a new update comes out for your phone, and suddenly everyone’s talking about it and deciding whether they need that new feature. But in the Bitcoin world, these updates can change the game, making the value of Bitcoin swing up or down. Imagine trying to catch a ball that moves every time you blink; that’s how investors feel, always on their toes, trying to guess their next move based on these updates.

For those looking to dive into the crypto market, keeping an eye on these trends is crucial. Speaking of which, if you’re pondering over expanding your portfolio and are curious about how to buy Cardano with USDT price, it’s a move that coinsides well with keeping a close eye on market trends. Understanding how blockchain innovations influence investor decisions can guide you through the uncertainties. Whether you’re a seasoned investor or new to the scene, knowing when to hold or sell can make all the difference in navigating the choppy waters of cryptocurrency investments.