🚀 Exploring the Future: Bitcoin Lending Revolution

Imagine a world where borrowing and lending money is as easy as sending a text message, but instead of using regular money, we’re talking about Bitcoin. This isn’t a fantasy for the distant future but a reality that’s unfolding right now in 2024. In this new age of finance, the way we think about borrowing, lending, and even investing is getting a massive makeover, thanks to Bitcoin. It’s like opening a treasure chest of opportunities for everyone – from someone in a bustling city to another in a quiet countryside, all thanks to the internet and this digital gold. With innovative technologies leading the charge, the process of getting a loan or lending some of your savings has never been more straightforward, safer, or more inclusive. It’s no longer just about the big banks or financial institutions holding the reins. Now, it’s also about regular folks having the power to lend to one another, all facilitated by the magic of Bitcoin. This shift towards digital currency lending is more than just a trend; it’s a revolution that promises to make the financial world a lot more democratic and accessible. Dive into this adventure, and you’ll see how Bitcoin is not just changing the way we think about money but also how we can use it to empower each other. Here’s a quick glance at how this landscape is evolving:

| Feature | Benefit |

|---|---|

| Decentralized Lending Platforms | Lower fees and more control over your finances. |

| Smart Contracts | Automatic, secure loan agreements with no middleman. |

| Global Access | Opportunities for anyone, anywhere with an internet connection. |

| Peer-to-Peer Networks | Community-focused, supporting mutual financial growth. |

In embracing this digital currency, we’re not just witnessing a financial transformation; we’re participating in a revolution that’s reshaping our world’s economic foundations.

🌐 the Global Impact of Bitcoin Loans in 2024

In 2024, the world of finance has been significantly transformed by the arrival of Bitcoin lending, a phenomenon reshaping how people across the globe borrow and invest money. This innovative approach to lending has not only made it easier for individuals in less financially accessible regions to secure loans without the traditional banking hassles but has also forged a path for investors looking for new ways to grow their wealth. With the advent of Bitcoin loans, opportunities for financial inclusion have expanded dramatically, extending a lifeline to those previously marginalized by conventional financial systems. This shift has spurred economic growth in unexpected places, empowering small businesses and entrepreneurs with the capital they need to innovate and expand. Furthermore, the ripple effect of these changes is felt globally, as the increased movement of Bitcoin across borders fosters a more interconnected economic landscape. For a deeper dive into how these shifts might play out, especially how they intertwine with trading strategies, check out https://wikicrypto.news/game-theorys-role-in-bitcoin-trading-strategies-for-2024, offering a glimpse into the potential future shaped by these innovations.

🛠 New Tools for Safe and Secure Bitcoin Borrowing

In 2024, the world of Bitcoin lending welcomes shiny new tools that make borrowing with digital currency safer and more reliable than ever before. Imagine walking into a digital world where every transaction is like a handshake – trustworthy and secure. That’s what these innovations aim to create. From advanced encryption techniques to smart contracts that automatically execute agreements without a hitch, these tools are designed to shield both lenders and borrowers from the bumps and bruises of the digital finance world. Moreover, with user-friendly interfaces, they make navigating the complexities of Bitcoin lending as easy as scrolling through your favorite social media feed. It’s like having a financial guardian angel by your side, making sure your digital transactions are safe, seamless, and secure. This leap forward not only boosts confidence in Bitcoin lending but also opens the gates to a more inclusive global financial system.

🎢 the Risks: Navigating Bitcoin Lending Volatility

When it comes to bitcoin lending, the excitement of unlocking new financial opportunities comes hand in hand with the unpredictability of the market. Imagine being on a roller coaster – thrilling highs can swiftly turn into nail-biting lows. This volatility is a key concern for both borrowers and lenders in the digital currency world. Fluctuations in bitcoin’s value can significantly affect loan repayments. For instance, the amount you owe could skyrocket, making repayments more challenging than initially expected. Conversely, lenders may find the value of the returned bitcoin lower than anticipated. This financial seesaw stresses the importance of understanding and managing risk. Strategies such as carefully choosing lending platforms, setting clear agreement terms, and staying updated with the latest market trends are crucial. For those eager to dive deeper into navigating these waters safely, a visit to bitcoin technical analysis in 2024 offers insights into future market behaviors. Embracing community discussions and leveraging innovative financial instruments can also provide a cushion against the unpredictability, making the journey in bitcoin lending a more measured and rewarding adventure.

🤝 Community Power: Peer-to-peer Lending Growth

In 2024, the world of Bitcoin lending is experiencing a warm, community-driven breeze, signaling a shift toward greener, more personal finance pastures. Imagine a world where your neighbor or friend across the globe could lend you Bitcoins for your dream project, no daunting paperwork needed. Here, the digital handshake over the internet replaces the cold, impersonal agreements of traditional banking. This transformation is powered by peer-to-peer (P2P) lending platforms that act as a meeting ground for borrowers and lenders, fostering a tight-knit community vibe. These platforms have seen a surge in popularity, as they offer a more direct, human approach to lending. With innovative features like social media integration, reputation systems, and mutual aid funds, they bridge trust gaps, while also enabling users to support each other’s financial goals. It’s a digital age tale of mutual prosperity, where everyone has the potential to be both a borrower and a lender.

Below is a snapshot of the vibrant growth seen in these platforms:

| Year | User Growth | Total Loans Processed |

|---|---|---|

| 2022 | 15% | $500 million |

| 2023 | 25% | $750 million |

| 2024 | 40% | Estimated $1.2 billion |

This trend showcases not just an appetite for alternative finance, but a massive leap toward making financial support and growth universally accessible and more inclusive.

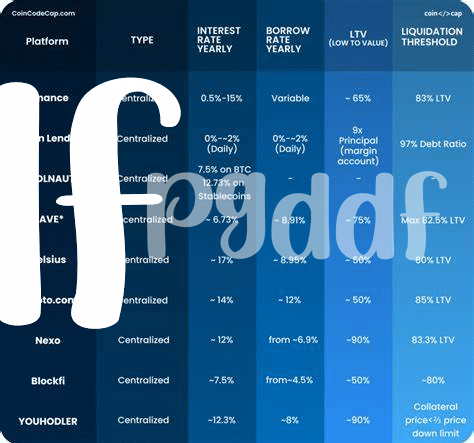

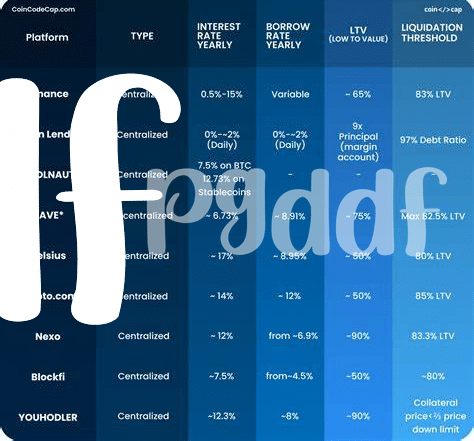

💡 Innovative Platforms Changing the Bitcoin Lending Scene

In the bustling world of digital currency, a wave of fresh, dynamic platforms is reshaping how we think about borrowing and lending Bitcoin. Gone are the days of one-size-fits-all solutions. Instead, these innovators are crafting tailored experiences, from intuitive platforms that make getting a loan as easy as ordering a cup of coffee, to high-tech security measures ensuring every transaction is safe as houses. 🚀🌐🔒 Think of it as your financial toolbox, but now it’s smarter, faster, and more connected than ever. At the heart of this transformation is the community, with peer-to-peer networks flourishing, turning the idea of the lone borrower on its head and fostering a space where everyone can share in the success. This renaissance is more than just technology; it’s about creating a system that’s accessible, efficient, and — most importantly — built on trust. For those curious about how these advancements tie into the larger picture, a deeper dive into bitcoin and nfts in 2024 might shed some light on the subject, illustrating just how intertwined financial innovations and digital currencies are becoming in our ever-evolving digital landscape. As we stand on the brink of 2024, these platforms aren’t merely changing the game; they’re redefining the very fabric of Bitcoin lending.