Bitcoin’s Journey: from Mystery to Mainstream 🚀

Once upon a time, in a digital world not too far away, a revolutionary form of money appeared, almost like a secret treasure waiting to be discovered. This treasure, known as Bitcoin, started its journey shrouded in mystery, with only a handful of enthusiasts daring to explore its potential. Fast forward to today, and it´s as if the whole world is buzzing about it! Imagine walking into a coffee shop, overhearing people chat about it, or seeing news headlines flash its latest achievements. It’s astounding, really, how Bitcoin has woven itself into the fabric of daily life, moving from the shadows to stand under the global spotlight. What was once a niche interest for tech wizards and dreamers has now captured the attention of mainstream society, transforming how we think about money itself. Let’s not forget the rollercoaster ride of highs and lows, thrilling early adopters and inviting skeptics to think twice. The tale of Bitcoin´s journey is more than just the rise of a digital currency; it´s a story about how a bold idea can catch the world by surprise, challenging us to envision a future where money isn’t just about notes and coins but about bits and bytes that hold the power to unite a global economy. 🌍🚀💫

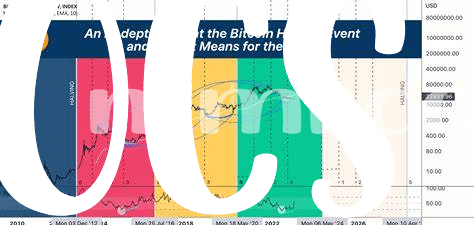

| Year | Significant Milestone |

| 2009 | Bitcoin’s Creation |

| 2010 | First Real-world Transaction |

| 2013 | First Major Price Spike |

| 2021 | Widespread Mainstream Adoption Begins |

| 2024 (Vision) | Global Economic Integration |

Understanding Bitcoin and the Economy 🌍

Imagine a world where every time you buy a cup of coffee, you could choose to use a sort of digital gold, and instead of a bank, a network of computers verifies the transaction. That’s a bit like how Bitcoin works. It’s not tied to any country’s economy, which means it could play a big role on the world stage. As more folks catch on, Bitcoin is moving from an online mystery to a serious player in global economics. Its value changes a lot, which can be risky, but it also means there’s potential for big rewards. Think about buying something from another country. With Bitcoin, you don’t have to worry about exchange rates or bank fees, making things simpler and possibly cheaper. However, this convenience comes with challenges for traditional banks, which have to adapt to stay relevant. Looking ahead, Bitcoin has the potential to make buying and selling goods across borders smoother, potentially shaking up global trade. For a deeper dive into the impact of Bitcoin and to understand how Bitcoin payment gateways are changing online shopping, check this out: https://wikicrypto.news/how-bitcoin-payment-gateways-are-changing-online-shopping. It’s an exciting time, with the path forward full of both opportunities and obstacles that could redefine our understanding of money itself.

Bitcoin’s Role in Shaping Global Trade 💱

Imagine a world where you can buy or sell goods from anywhere, without worrying about the local currency or hefty bank fees. That’s the magic Bitcoin brings to global trade. Just like the internet made information global, Bitcoin is doing the same for money. People and businesses everywhere can now trade directly with one another, cutting out middlemen and making transactions faster and cheaper. This financial flexibility has empowered small businesses to compete on a global stage, previously dominated by giants with deep pockets. Moreover, in countries with unstable currencies, Bitcoin has become a steady ship in choppy waters, allowing merchants to trade confidently without fear of their earnings losing value overnight. As we steer towards 2024, this blend of accessibility and reliability could reshape our global market landscape, making it more inclusive and diverse than ever before.

The Impact of Bitcoin on Traditional Banking 🏦

Imagine walking into a world where your morning coffee doesn’t demand paper cash or a card swipe, but a quick Bitcoin transaction. This once far-off dream is nudging closer to reality, potentially redefining our traditional banking landscape. Banks, the towering pillars of finance, are now at a crossroads. As Bitcoin gains traction, these institutions face a crucial challenge: innovate or risk being left behind. Beyond just enabling quicker, borderless transactions, Bitcoin is stirring up a financial revolution, promising greater access to banking services for everyone, no matter where they live. This vision of financial inclusion is not just a dream. The encouragement and development by bitcoin developer communities in 2024 are paving the way for a world where digital currency and traditional banking coexist. As we stand on the brink of this change, banks are exploring how to integrate Bitcoin, ensuring they remain pivotal in our financial future. Yet, the journey is filled with obstacles and opportunities alike, guiding us towards a potentially more inclusive economic landscape. 🌍💼🔄

Predicting Bitcoin’s Future: Opportunities and Obstacles 🔮

Looking ahead, the path Bitcoin is on seems thrilling yet sprinkled with hurdles. On one side, it promises a future where sending money across the globe is as easy as sending a text message, potentially unlocking new economic opportunities especially in countries where access to traditional banking is a challenge. Imagine, in not too distant a future, a farmer in a remote village trading directly with a buyer in a bustling city halfway around the world, all thanks to Bitcoin. This could revolutionize global trade, making it more inclusive and efficient. 🌍💱 However, this bright vision doesn’t come without its fair share of obstacles. Regulatory challenges loom large, as countries grapple with how to integrate Bitcoin within their existing financial laws and protect their citizens without stifling innovation. Plus, the environmental impact of Bitcoin mining cannot be ignored, demanding sustainable solutions to ensure its growth doesn’t come at the expense of our planet. 🚀🏦

| Opportunities | Obstacles |

|---|---|

| Global Financial Inclusion | Regulatory Challenges |

| Efficiency in Global Trade | Environmental Concerns |

Each step forward in this journey comes with its set of questions, prompting a balance between embracing the potential while navigating the complexities Bitcoin brings to the economic landscape.

Bitcoin and Global Economic Stability: a Reality? 🌐

As we sail into the world of tomorrow, our financial compass points towards an intriguing question: Can the digital gold we know as Bitcoin really anchor the ships of global economic stability? The journey has been nothing short of a rollercoaster ride, with ups and downs that have kept economies on their toes. Yet, there’s a growing chorus among experts and enthusiasts alike that Bitcoin, with its decentralized charm, might just be the stabilizing force the global market needs. Its influence on cross-border transactions, evident through bitcoin payment gateways in 2024, showcases its potential to streamline and secure international trade, making it a crucial puzzle piece in the grand scheme of global economic harmony.

However, before we plant our flags into the ground proclaiming Bitcoin as the savior of economic stability, it’s important to navigate the challenges. The digital currency world is like uncharted waters, filled with regulatory icebergs and technological storms that could deter its path. But if navigated wisely, Bitcoin could offer a beacon of light for economies wrestling with inflation and currency devaluation. Its role in providing an alternative, albeit complex, financial ecosystem could foster a new era of economic stability, benefiting both bustling metropolises and remote corners of the globe. The key lies in creating a balanced synergy between traditional financial infrastructures and the burgeoning world of digital currencies, a challenge that the coming years will certainly unfold.