Risks 💰

Money laundering poses a significant threat to the integrity of Bitcoin transactions, introducing a range of risks that can undermine trust and stability in the digital currency realm. Illicit actors utilize the perceived anonymity of cryptocurrencies to obfuscate the origins of funds, facilitating the laundering process and potentially tarnishing the reputation of legitimate users. These risks extend beyond financial implications, impacting regulatory frameworks and the broader adoption of blockchain technology. As financial institutions and governments strive to combat money laundering, the dynamic nature of the crypto market presents ongoing challenges in identifying and mitigating nefarious activities. By understanding and addressing these risks, stakeholders can work towards a more secure and transparent ecosystem for Bitcoin transactions.

Regulation 📝

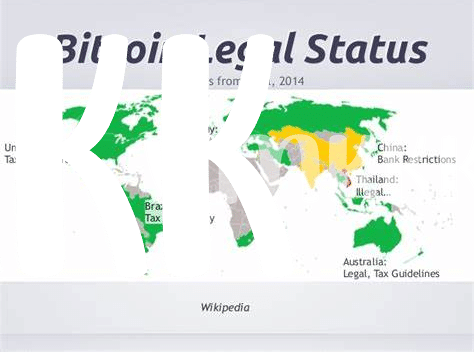

Regulation in the realm of Bitcoin transactions is a crucial element that sets the framework to ensure transparency and legality in the increasingly popular digital currency arena. With governments around the world grappling to keep up with the fast-paced advancements in technology, the need for clear and concise regulations becomes paramount. Regulatory bodies play a critical role in safeguarding investors, preventing illicit activities, and fostering trust and stability in the cryptocurrency market.

Moreover, effective regulation not only mitigates risks associated with money laundering and illegal transactions but also paves the way for innovation and growth in the digital economy. By establishing guidelines and standards for compliance, regulators can strike a balance between nurturing innovation and protecting consumers. Embracing a forward-looking regulatory approach is key to unlocking the full potential of Bitcoin and other cryptocurrencies, shaping the future landscape of finance.

Compliance 🛡️

Compliance with money laundering laws is crucial in the realm of Bitcoin transactions. Ensuring adherence to these regulations not only safeguards against illicit activities but also promotes trust and legitimacy within the cryptocurrency ecosystem. By implementing robust compliance measures, such as KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures, companies operating in the crypto space can mitigate risks and build a more secure environment for all stakeholders involved. Embracing compliance not only demonstrates a commitment to ethical practices but also fosters long-term sustainability and credibility in the ever-evolving landscape of digital finance.

Innovation 💡

Innovation plays a pivotal role in shaping the future of Bitcoin transactions. Constant advancements in technology are driving innovative solutions to enhance the security and efficiency of cryptocurrency transactions. From the development of secure wallets to the implementation of smart contracts, innovation in the crypto space is paving the way for a more seamless and transparent financial ecosystem. As the industry evolves, new opportunities arise for businesses and individuals to harness the benefits of blockchain technology. Embracing innovation is essential to stay ahead in the dynamic realm of digital currencies.

To explore more about the legal implications of Bitcoin transactions in Australia, including potential pitfalls to avoid, visit legal consequences of bitcoin transactions in Australia.

Challenges 🚫

Navigating the landscape of money laundering laws in Bitcoin transactions presents a myriad of hurdles for stakeholders. From ensuring stringent compliance to detecting illicit activities, the challenges loom large. Understanding the evolving regulatory framework, grappling with the anonymity of cryptocurrency transactions, and staying ahead of sophisticated money laundering techniques are key obstacles. Additionally, the interdisciplinary nature of combating financial crimes in the digital era poses a formidable barrier. Overcoming these challenges demands a proactive and adaptive approach from all involved parties.

Future 🔮

As we look ahead to the future of Bitcoin transactions, the landscape continues to evolve rapidly. Advancements in technology and regulations are shaping the way we perceive and interact with cryptocurrencies. The potential for mainstream adoption and integration into everyday financial activities is becoming more tangible. With these changes come new opportunities and challenges, from enhancing security measures to ensuring compliance with stringent laws. The future holds a promise of innovation and growth, but also a need for vigilance and adaptability in the face of emerging risks and uncertainties. It is essential for stakeholders to stay informed and proactive in navigating this dynamic environment. For more insights on the legal consequences of bitcoin transactions in different jurisdictions like Azerbaijan and Antigua and Barbuda, visit here.