A Quick Trip down Memory Lane 🕰️

Let’s dive into the fascinating world of Bitcoin, a digital treasure that’s caught everyone’s attention since it first appeared on the scene. Imagine it’s 2009, and someone tells you about this new internet money that isn’t controlled by any government or bank—it’s called Bitcoin. At first, it sounds like something out of a sci-fi movie, but fast forward a few years, and it’s the talk of the town. The journey from being an experimental project to becoming a household name is nothing short of incredible. This adventure has had its ups and downs, with moments that have made holders gasp and skeptics nod. Alongside, an intriguing event called “Bitcoin halving” plays a pivotal role in this saga, stirring the market and sparking widespread discussions every four years.

The halving is a scheduled part of Bitcoin’s DNA, ensuring that only 21 million coins will ever exist. This inbuilt scarcity mechanism has led to significant conversations and speculations among investors and enthusiasts alike. To better understand its impact, let’s glance at how halvings have historically influenced Bitcoin. Here’s a simple table outlining the past events:

| Halving Year | Pre-Halving Price | 1 Year Post-Halving Price |

|---|---|---|

| 2012 | $12 | ✨$1,150✨ |

| 2016 | $650 | 🚀$2,525🚀 |

| 2020 | $8,787 | 💸$63,558💸 |

Each halving event marks a significant milestone, not just in Bitcoin’s history but in the broader narrative of digital currency. Through these pivotal moments, the mysterious world of cryptocurrency becomes a bit more familiar, paving the way for an intriguing future.

What Exactly Is Bitcoin Halving? 🤔

Imagine Bitcoin being a gold mine in the digital world. Every four years, the amount of gold (or Bitcoin rewards, in our case) miners receive for their work is cut in half. This is known as Bitcoin Halving and it’s like a digital game of musical chairs. Initially, miners get rewarded handsomely with more bitcoins for solving complex puzzles. But post-halving? The rewards shrink, heating up competition and efficiency among miners. It’s nature’s way in the Bitcoin ecosystem to keep things balanced, ensuring not all bitcoins are mined too quickly and keeping inflation in check. This clever mechanism encourages sustainability in mining and makes sure the bitcoin treasure doesn’t run out too fast. And for those who are concerned about the future of Bitcoin and its energy usage, discovering how these events might push for more renewable energy sources in mining can be intriguing. For a deeper dive into this, visiting https://wikicrypto.news/renewable-energy-in-bitcoin-mining-a-2024-outlook can shed some light on the subject.

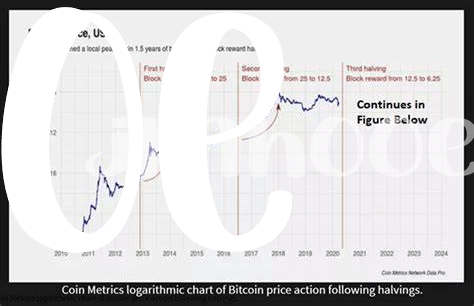

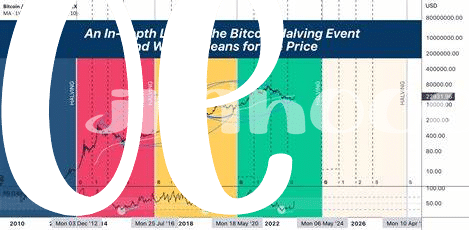

The Ripple Effect: Prices before and after 📈

Imagine Bitcoin as a rollercoaster with its ups and downs, especially when we look at what happens around halving events. Picture halving as a pitstop where Bitcoin’s reward for mining cuts in half, making it scarcer. This can be a bit like making a cake half the size for the same amount of guests; suddenly, everyone realizes there’s not as much to go around. Before these halving moments, there’s often a buzz, speculators and investors might start buying up Bitcoin, hoping its scarcity will drive up its value. Then, after the halving, you might expect the price to skyrocket, but the reaction can be as unpredictable as the weather in April. Sometimes, prices soar, creating a wave of excitement. Other times, they dip, leaving folks scratching their heads. It’s this suspense and post-halving price dance that captures the attention of anyone keen on the crypto space.

Surprise, Surprise! the Market’s Unexpected Twists 🎢

When we dive into the Bitcoin world, it’s like getting on a roller coaster with no map, especially when it comes to halving events. These occurrences have a knack for throwing investors and enthusiasts for a loop. Picture this: everyone’s huddled around, making educated guesses on how the market will react, yet Bitcoin has a history of pulling rabbits out of its hat. Before one halving event, predictions were grim, with fears of price plunges steering the conversation. However, in an exhilarating twist, prices soared, leaving naysayers baffled. It’s moments like these that remind us of the unpredictable heartbeat of the cryptocurrency sphere. So, where do we go for a bit of stability in this wild ride? Well, for those looking ahead, keeping a finger on the pulse of the latest trends and forecasts within the bitcoin community projects in 2024 might just lend the roadmap we’ve been seeking. Through it all, Bitcoin’s journey teaches us to expect the unexpected, embracing each surprise twist with anticipation and a bit of caution.

Lessons Learned: Investors’ Takeaways 📚

When looking back at the Bitcoin halving events, a common thread weaves through the fabric of the crypto market: adaptability and learning. For many investors, these moments served as a crash course in patience and timing. The halving, a built-in feature of Bitcoin, inherently shakes the landscape every four years, sometimes resulting in price surges and at other times, unexpected stability. It teaches investors the importance of looking beyond immediate fluctuations and focusing on the long-term potential of their investments. History has shown us that those who resist the knee-jerk reaction to sell during the initial post-halving price dips often see more favorable outcomes as the market adjusts to the new supply rate. Moreover, it highlights the value of diversification—not only across different cryptocurrencies but also within one’s broader investment portfolio. This strategy has helped many navigate through the volatile waves of the crypto sea. As we look towards future halvings, these lessons form a guiding light for both seasoned and new investors, emphasizing research, patience, and a steady hand at the helm.

| Lesson | Description |

|---|---|

| Patience and Timing | Resisting quick sell-offs post-halving could lead to better returns as the market stabilizes. |

| Long-term Outlook | Focusing on the potential growth over years, rather than immediate price changes. |

| Diversification | Spreading investments across different assets to mitigate risk. |

Looking Ahead: Predictions for the Next Halving 🔮

Peering into the crystal ball, the next halving event sparks endless speculation and intrigue within the crypto community. These events have historically signaled a shift, not just in the scarcity of Bitcoin, but often setting off a chain reaction impacting its value and the broader financial landscape. It’s a moment that combines a dash of mystery with a hefty dose of excitement, as enthusiasts and investors alike ponder whether the past trends of growth and adjustment will hold true or if new, unforeseen patterns will emerge. Amidst this, the environmental footprint of Bitcoin mining and how regulatory landscapes adapt remain hot topics, further fueling discussions around the bitcoin regulation updates in 2024.

Taking these lessons and speculations to heart, savvy observers are keeping a keen eye on various indicators and market sentiments. It’s not just about observing numbers and charts; it’s about understanding the subtle and not-so-subtle ways in which these halvings alter the dynamics of supply and demand, investor behavior, and overall market psychology. In this way, the anticipation builds a narrative that’s rooted in past lessons but is eagerly looking forward to the unknown possibilities. The upcoming halving is more than an event; it’s a pivotal moment that could redefine the boundaries and expectations of what’s next for Bitcoin.