🌐 Decoding the Global Take on Bitcoin Regulations

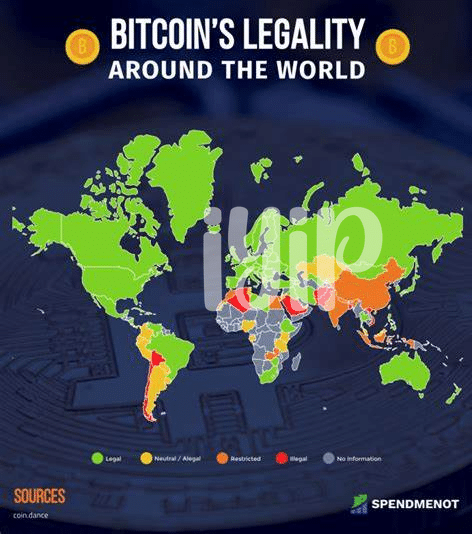

Imagine a world where each country has its own rules for a game; that’s pretty much how Bitcoin operates globally. Every nation has taken a unique stance on Bitcoin, ranging from rolling out the red carpet to showing the stop sign. Some places like 🏝️ El Salvador have embraced it fully, making it legal tender, a bold move that says, “Bitcoin is welcome here!” Meanwhile, other countries remain on the fence, cautiously peering over to see how this digital currency plays out before making a move. Then there are those with a 🚫 no-entry sign for Bitcoin, where the use and trade of this cryptocurrency face strict restrictions or outright bans. This mix of reactions creates a fascinating patchwork quilt of regulations that Bitcoin holders and enthusiasts need to navigate. To understand this better, let’s look at a simple breakdown of various countries’ positions on Bitcoin:

| Country | Status |

|---|---|

| 🏝️ El Salvador | Legal Tender |

| 🇺🇸 USA | Regulated |

| 🚫 China | Banned |

This global game of red lights and green lights influences everything from investment opportunities to how one might use Bitcoin in daily life. By understanding these regulations, Bitcoin users can better navigate this evolving landscape, ensuring they play by the rules and make the most of their digital currency adventure.

🚦 Red Lights, Green Lights: Countries Welcoming Bitcoin

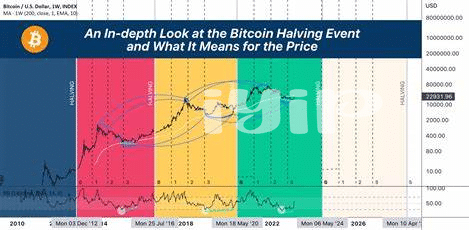

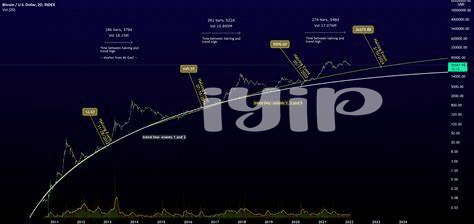

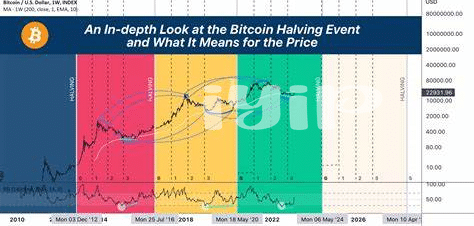

As we navigate through the year 2024, it’s fascinating to see how different parts of the world react to Bitcoin. Imagine a world map, colorful and vibrant, where some countries are painted in welcoming shades of green, offering a warm embrace to Bitcoin users and investors. These green zones are bustling with opportunities, where businesses and consumers engage freely with Bitcoin, leveraging its potential to streamline transactions and foster economic growth. Initiatives in these regions are supported by favorable laws and regulations, making them hotspots for Bitcoin enthusiasts looking to participate in an environment that champions their choice of currency.

On the flip side, the map also reveals areas shaded in cautious red, where authorities have decided to hit the brakes on Bitcoin. In these countries, the road to embracing digital currencies is filled with regulatory speed bumps. However, it’s crucial to understand that these red zones don’t necessarily signify a complete stop. Instead, they represent a phase of assessment and perhaps, future adaptation. For those looking to explore the depths of Bitcoin’s integration into various sectors, the journey doesn’t end here. By visiting https://wikicrypto.news/navigating-bitcoin-privacy-the-2024-perspective, adventurers can gain insights into sectors where Bitcoin makes significant strides, navigating through both the welcoming green and the cautious red with informed confidence.

📜 Bitcoin on Paper: Understanding Legal Documents

When you hear the term “legal documents,” you might think of piles of papers filled with hard-to-understand language. However, these documents are crucial in the world of Bitcoin, acting kind of like the rulebooks that determine how this digital currency is used around the world. They cover everything from how Bitcoin can be bought and sold, to who can use it, and even how it needs to be reported to the government, if at all. Think of it like the guidelines on a board game; knowing them helps ensure you play right and stay out of trouble. 📄🔍 It’s especially important because these rules can vary a lot depending on where you are in the world. Understanding these documents helps make sure that your Bitcoin adventure is both fun and within the lines of the law. 🌍👩⚖️

🏛 Inside the Courtroom: Landmark Bitcoin Cases

Diving deep into the heart and soul of Bitcoin’s journey through the legal system might seem as complex as solving a block in the blockchain, but it’s quite a story to tell. Picture a world where each court case is like a giant leap, setting new grounds for how Bitcoin fits (or doesn’t fit) into our existing legal frameworks. From small disputes to headline-making decisions, these cases shape the road ahead, not just for the digital currency, but for all who use it. Think of it as a legal roadmap, informing us about where Bitcoin stands in the eyes of the law. Amidst this, the growth in bitcoin adoption rates in 2024 further highlights the urgency for clear regulations. So, whether you’re a Bitcoin enthusiast or just curious about digital currencies, understanding these landmark cases is key to grasping the bigger picture of Bitcoin’s place in our world.

💡 Navigating Taxation: Keeping Your Bitcoin Legit

Talking about Bitcoin and taxes might sound like a snooze fest, but it’s more like figuring out how to keep your treehouse club running without getting into trouble with the grown-ups. Imagine every time you traded your favorite baseball cards, there was a rule about giving a slice of your pizza to the neighborhood watch. That’s sort of what dealing with Bitcoin taxes is like. Governments around the world are really interested in how people are using Bitcoin, and they want their piece of the pie too. But unlike the neighborhood watch, they have a lot of fancy rules about how much pizza you owe them.

To stay on the right side of these rules, you’ve got to understand the game. Each country has its own playbook, but most of them boil down to a few common points. When you make money from selling Bitcoin for more than you paid, it’s like scoring a goal, and the tax folks want to celebrate with you by taking a share. If you’re smart, you keep track of these wins and losses because the rules can get pretty tangled. Think of it as keeping score in your backyard games; only this score helps you figure out how much pizza you’ll owe at the end of the day. Here’s a quick look at some handy terms:

| Term | What It Means |

|---|---|

| Capital Gains | The profit you make from selling your Bitcoin for more than you bought it for. |

| Capital Losses | The loss when you sell your Bitcoin for less than you bought it for. This can sometimes work in your favor come tax time. |

| Taxable Events | Specific actions like selling Bitcoin or paying for something with it that the tax folks want to know about. |

So, whether you’re saving up for the next big game or just keeping your treehouse club’s snack fund in check, knowing the ins and outs of Bitcoin taxation will keep the game fun and fair. And remember, staying informed and keeping good records is like having the best strategy for winning any game.

🛡 Staying Safe: Scams and Legal Protection Tips

In the bustling world of digital currency, staying one step ahead is key, especially when it comes to protecting your digital gold. Navigating the waters of Bitcoin requires not just savvy investment strategies but also an acute awareness of the scams and swindles that litter the space. It’s a digital Wild West out there, and every miner or trader needs to be mindful of the bandits. Knowing the common scams, from phishing emails pretending to be reputable wallets to too-good-to-be-true investment promises, is the first line of defense. But awareness alone isn’t enough; applying practical steps, like using secure and reputable wallets, enabling two-factor authentication, and never sharing your private keys, can make the difference between a fortune made and a fortune lost.

Alongside these personal safety measures, there’s a bigger picture to consider: the evolving legal framework around Bitcoin. In 2024, the conversation around bitcoin in e-commerce is more prominent than ever, highlighting the necessity for legal knowledge in safeguarding your investments. This legal landscape dictates not just the future of Bitcoin’s usage worldwide but also outlines the protections available to you as an investor or trader. Engaging with this topic isn’t just about keeping your Bitcoin safe; it’s about ensuring that your dealings are within the legal confines of your jurisdiction. By staying informed through reading up-to-date legal documents and understanding the significance of landmark Bitcoin cases, you ensure a smoother journey through the complex world of cryptocurrency.