Unveiling Market Sentiment: the Hidden Driver 🚦

Imagine you’re at a giant amusement park, but instead of roller coasters, it’s filled with the ups and downs of cryptocurrency prices. Here, the hidden hand guiding the ride isn’t just cold hard numbers; it’s how people feel about those numbers—a mysterious force known as market sentiment. This unseen wizard works in the shadows, whispering in people’s ears, making them feel excited or scared about the future of Bitcoin, Ethereum, and the gang. When a lot of people start feeling the same way, whether hopeful or fearful, it’s like they’re all pushing the ride together, making it climb higher or drop faster.

| Emotion | Effect on Crypto |

|---|---|

| Excitement | 📈 Prices might soar |

| Fear | 📉 Prices might fall |

But here’s the twist: it’s tough to see this force or measure it with a ruler or a scale because it lives in people’s thoughts and chats. It’s in the news we read, the tweets we scroll through, and the gut feelings we get about what’s going to happen next. Market sentiment is a bit like the weather—constantly changing and affecting everyone, capable of turning a calm sea into a tempest or a stormy voyage into smooth sailing. Understanding this hidden driver is like learning to read the sky, helping us predict when to brace for a storm or when to enjoy the ride.

How Emotions Fuel Crypto’s Wild Rides 🎢

Imagine a rollercoaster where instead of cars, you have cryptocurrencies like Bitcoin or Ethereum, and the riders are investors from all around the globe. This rollercoaster doesn’t follow a predetermined track but moves based on how these riders feel at any given moment. When most of them are happy, confident, or downright ecstatic about the future of these digital coins, the rollercoaster shoots up, creating a sense of exhilaration. This is when you hear stories of massive gains and breakthroughs. But the moment worry, doubt, or fear creeps in, it’s like a collective gasp that sends the rollercoaster plummeting down steep drops, sometimes leaving everyone’s stomachs in knots. These ups and downs are more about how people feel than the nitty-gritty details of the coins themselves. Whether it’s a tweet from a tech mogul or a sudden government regulation, the crypto market reacts swiftly, magnified by the echo chamber of social media. Meanwhile, knowing how to secure those digital treasures becomes crucial as navigating these emotional waves can sometimes lead to unexpected splashes. For insights on securing your gains amidst the market’s mood swings, consider reading https://wikicrypto.news/must-know-tips-to-secure-your-crypto-wallets-effectively.

The Ripple Effect of News on Crypto Waves 🌊

Imagine you’re sitting by the ocean, watching waves. In the world of cryptocurrencies, news acts like a giant rock thrown into this calm water, creating ripples that grow into big waves. Whether it’s a government announcing new regulations or a tech giant investing in Bitcoin, the splash hits the market instantly. People react, buying or selling based on what they hear, making the prices dance like the sea during a storm. 🌊📰💬

Just like a tweet can go viral, news about cryptos spreads fast, causing big waves of change. Sometimes positive news can lift the market up, like a big wave carrying surfers towards the shore. Other times, scary headlines can cause panic, making the market drop quickly, just as a wave crashes back down. This shows how the moods and decisions of people, influenced by what they read and hear, shape the rhythms of the crypto market. 📊❤️🔻

Social Media: Amplifying the Ups and Downs 📈📉

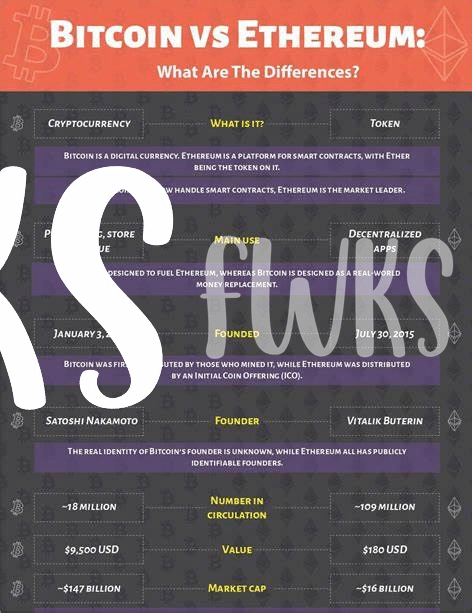

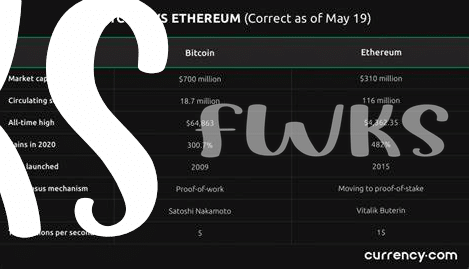

In today’s digital world, every tweet, post, or blog can act like a stone thrown into the calm waters of the cryptocurrency market, creating ripples that can grow into waves. It’s fascinating how a single influencer’s opinion can sway thousands, turning confidence into doubt or skepticism into investment almost overnight 🚀. This power of social media isn’t just about spreading news; it’s about shaping the very emotions that drive market swings 🎭. One moment, a positive post can send prices soaring, and the next, a negative tweet can plunge them into the depths. This delicate balance is a dance between the upbeat cheer of potential riches and the sobering gulp of possible losses. To better understand the intricate dance between digital currencies like Bitcoin and Ethereum, especially in light of their ongoing challenges and opportunities, exploring solutions to bitcoin scalability issues and future prospects versus ethereum offers a glimpse into how technology continues to evolve and impact market sentiment. Navigating this landscape requires not just an understanding of the financial implications but also an awareness of the ebb and flow of digital discourse 🌐.

The Tug of War between Fear and Greed 😨💰

In the world of crypto, two giant forces control the swings: fear and the desire for wealth. It’s almost like watching a suspenseful game where the players are our emotions. On one hand, fear creeps in when prices dip, and tales of losses spread, prompting a rush to sell and avoid the same fate. On the other, the glimmer of making money tempts individuals to jump in, pushing prices up as excitement builds. This emotional rollercoaster isn’t just thrilling; it shapes the market, guiding the peaks and troughs we witness.

To better understand this, imagine a seesaw balancing between fear on one end and greed on the other. Every news piece, tweet, or rumor adds weight to one side, tilting the market in that direction. The table below showcases how this dynamic plays out in real scenarios, highlighting the significant shifts fueled by emotional responses.

| Emotion | Market Impact | Example Scenario |

|---|---|---|

| Fear 😨 | Prices Fall | News of a major crypto hack leads to widespread panic selling. |

| Greed 💰 | Prices Rise | Announcement of a new, promising crypto project causes a buying frenzy. |

In navigating this tempest, understanding this tug of war is crucial. It’s not just numbers; it’s human nature playing out in digital currency markets.

Strategies to Navigate the Emotional Crypto Ocean 🚣♂️

Embarking on the journey through the volatile seas of cryptocurrency requires not only a sturdy boat but also a keen sense of direction. Think of market sentiment as the wind: it can either propel you forward or push you back, depending on how you set your sails. The key is to remain calm in the storm of emotional trading, focusing on long-term goals rather than getting swayed by the tidal waves of short-term fluctuations. This approach is like building a lighthouse on a rocky shore, offering guidance and safety amidst the chaos. By keeping a close eye on the horizon and filtering the noise, investors can navigate these waters with greater confidence and peace of mind.

Moreover, it’s crucial to arm yourself with the right tools and knowledge, much like a sailor charting unknown territories. Educating yourself about the fundamentals of cryptocurrency and understanding the nuances of market sentiment can make a significant difference. For those looking to safeguard their digital treasures, understanding bitcoin transaction fees and how to minimize them versus ethereum is an essential part of the journey. This awareness acts as a compass, helping you steer clear of common pitfalls and guiding you towards safer harbors. Just as a captain respects the sea, respecting the volatile nature of cryptocurrencies and being prepared can turn what seems like a perilous voyage into an exhilarating adventure.