Smart Contracts 101: Powering Ethereum’s Economy 💡

Imagine a world where contracts can execute themselves, without needing a middleman. That’s the magic behind smart contracts, which are like automatic digital deals living on the Ethereum network. These aren’t just any contracts; think of them as self-operating programs that spring into action once certain conditions are met. They’re the muscles flexing behind Ethereum’s bustling economy, allowing everything from secure transactions to decentralized finance (DeFi) applications to operate smoothly. The beauty of smart contracts is not just in the automation; it’s also in the trust and efficiency they bring to the digital table. By cutting out the middleman, they reduce costs and increase speed, making digital dealings more straightforward than ever. Here’s a quick look at the types of applications powered by smart contracts:

| Application Type | Description |

|---|---|

| DeFi Platforms | Enables borrowing, lending, and earning interest directly between users. |

| NFT Marketplaces | Facilitates the buying, selling, and trading of digital collectibles authenticated through blockchain. |

| Gaming DApps | Provides decentralized gaming experiences with in-game assets owned by users. |

| Decentralized Exchanges (DEXs) | Allows trading of cryptocurrencies without the need for a centralized authority. |

Smart contracts are not just a technological leap; they’re transforming how we think about agreements in the digital world, making Ethereum’s economy more vibrant and immersive. 🚀🌍

Gas Fees Unpacked: What Drives the Cost? ⛽

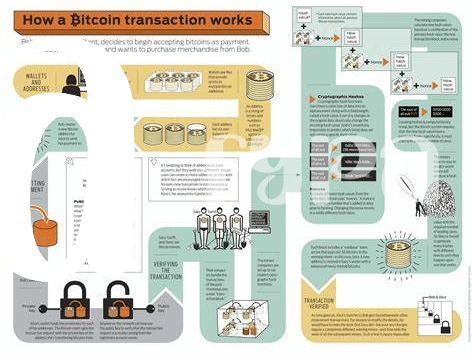

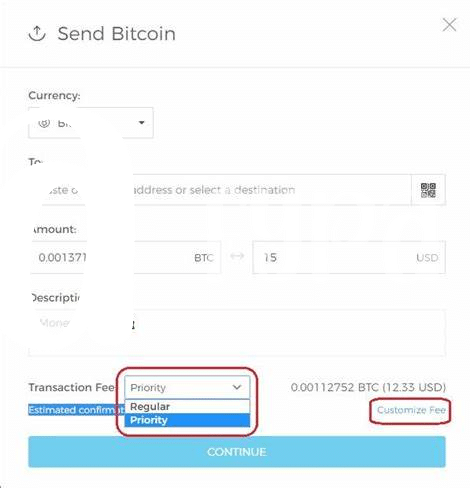

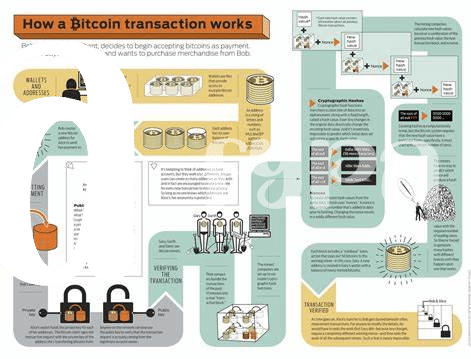

Imagine sending a letter and needing to pay for postage, except this “postage” varies in price depending on how busy the post office is—that’s a bit like Ethereum’s gas fees. In Ethereum’s world, smart contracts are like the letters, automated agreements that do something when certain conditions are met, like transferring ownership of a digital cat picture or automating payments. These contracts need a bit of computational power from the network to work, and gas fees are the charges for that power. Just as a more significant letter or a faster delivery option costs more in postage, more complex contracts or wanting a transaction processed quicker ups the gas fee. The network can get really crowded, and when many people are sending their “letters” at once (like during a big sale on those digital cat pictures), everyone has to pay a bit more to get their transactions through. It’s a bit of a bidding war for the network’s attention. Understanding this, it’s clear why there’s been such a buzz around finding ways to reduce these costs—nobody likes paying high fees! For a deeper dive into how Ethereum’s approach to blockchain differs from others like Bitcoin, consider reading the comparison at https://wikicrypto.news/how-bitcoins-blockchain-differs-from-ethereums-a-comparative-study.

Sky-high Fees: When Smart Contracts Get Pricey 🚀

Imagine a bustling digital marketplace, where Ethereum acts as the bustling streets and smart contracts are the busy shops. Just as more shoppers in a physical store can lead to longer checkout lines, in the Ethereum network, a surge in smart contracts can cause a traffic jam. This is where things get pricey. With everyone rushing to get their transactions processed, the network can get crowded. Think of it like a taxi service during peak hours; the more people wanting a ride, the higher the fare. In the digital world of Ethereum, this fare is known as gas fees. These fees can rocket skyward when the network is overloaded, making transactions costly.

Now, let’s dive a bit deeper. Each smart contract operation requires computational resources to execute. Imagine your smart contract is a complex LEGO set that needs to be put together. The more intricate your LEGO set (or smart contract), the more pieces (or computational power) and time you need to put it together. This is why, when many users are building their LEGO sets simultaneously, the cost of using these resources – the gas fees – can soar, making it an expensive endeavor. This phenomenon highlights the delicate balance of supply and demand within the Ethereum ecosystem, showcasing how pivotal smart contracts are to both its utility and its challenges. 🚀⛽💡

Balancing the Books: Reducing Ethereum Transaction Costs 📉

In the world of Ethereum, where every click and action costs you, finding ways to lower these transaction fees, or “gas fees,” is like finding a secret path in a maze – absolutely thrilling! The key lies in optimizing the way transactions are executed. Imagine you’re sending letters through a postal service that charges you by the weight of your letter. To save money, you’d probably try to make your letter as light as possible, right? Well, developers work on making the code of smart contracts simpler and more efficient, which in turn, uses less computational power and lowers fees. It’s a bit like packing lightly for an airplane trip to avoid extra charges.

Moreover, the Ethereum community is buzzing with conversations about upcoming updates that promise to make transactions faster and cheaper. These changes are like the city planning to add more lanes to a congested road – it means less waiting and paying for everyone. For anyone keen to understand how similar innovations are shaping up elsewhere in the digital currency space, taking a glimpse at how bitcoin supports philanthropic initiatives globally in 2024 can offer some fascinating insights. There’s a genuine excitement about how these developments could make using Ethereum not just more affordable but also more accessible to a global audience, ensuring that the digital revolution leaves no one behind.

Future Forecast: Ethereum Updates and Fee Changes 🌈

Looking ahead, the Ethereum landscape is ripe for transformation, thanks to planned updates aimed at enhancing user experience and efficiency. One key upgrade on the horizon is Ethereum 2.0, significantly altering the way transactions are processed and, subsequently, how fees are calculated. This update promises to shift from a proof-of-work to a proof-of-stake mechanism, potentially lowering costs for users and reducing the environmental impact. Additionally, the introduction of sharding will split the database to spread the load, further speeding up transactions and reducing bottlenecks that often lead to increased fees. These changes are eagerly anticipated, as they could usher in a new era of accessibility and speed for Ethereum’s network. Here’s a glance at what the fee changes might look like post-updates:

| Update | Expected Impact on Fees |

|---|---|

| Ethereum 2.0 | Significantly lower due to efficiency improvements |

| Sharding | Reduced due to increased transaction speed |

While these updates are under development, their successful deployment could revolutionize how we interact with smart contracts, making Ethereum an even more attractive platform for developers and users alike.

Real-world Examples: Smart Contracts in Action 💼

Smart contracts on Ethereum are like magic spells for finance and business. Imagine this: A farmer in Kenya uses a smart contract for crop insurance. When drought hits, the contract automatically pays out, no lengthy paperwork required. Or a musician in Brazil who gets royalties every time someone plays their song – again, all handled by smart contracts ensuring fairness and speed. These examples show the incredible ways smart contracts are used today, making transactions safer, faster, and cheaper.

On the techy side of things, understanding the magic behind smart contracts and Ethereum can be quite the adventure. If you’re intrigued by how all of this works and are also curious about how it compares to Bitcoin’s own technological evolutions, you’ll find insights on explaining bitcoin blockchain technology to beginners versus Ethereum particularly enlightening. This comparison sheds light on the innovative pathways these platforms are carving towards a decentralized future. Whether it’s making insurance claims hassle-free or ensuring artists get their dues, the real-world applications of smart contracts are revolutionizing industries one block at a time.