What Is Bitcoin Halving? 🤔

Imagine a game where the prize gets cut in half every few years. That’s a bit like what happens in the world of Bitcoin, a digital form of money online. This event, called “halving,” is a rule written into Bitcoin’s digital code and happens roughly every four years. At the start, when people used their computers to process transactions and were rewarded with new Bitcoins, the prize was 50 Bitcoins. However, this reward gets cut in half regularly, so after the first four years, it dropped to 25, then 12.5, and so on. This clever design is meant to control how new Bitcoins are made, ensuring they aren’t produced too quickly or too plentifully, much like limiting the amount of gold mined each year to keep its value.

| Happening | Reward Before | Reward After |

|---|---|---|

| 1st Halving 🎉 | 50 Bitcoins | 25 Bitcoins |

| 2nd Halving ✨ | 25 Bitcoins | 12.5 Bitcoins |

| 3rd Halving 🚀 | 12.5 Bitcoins | 6.25 Bitcoins |

This mechanism not only ensures the digital scarcity of Bitcoin, making it more valuable over time as rewards decrease but also introduces a fascinating dynamic to its overall value. It is akin to a game that not only rewards players for their efforts but also ensures that the game can’t be won all at once, keeping things exciting and valuable for everyone involved.

The History of Bitcoin Halvings 📚

Bitcoin halving is like a big birthday party for Bitcoin, happening roughly every four years – but instead of getting more presents, Bitcoin gets a little diet on its rewards for miners. This special event first kicked off in 2012, followed by more celebrations in 2016 and 2020. Each time, the number of new bitcoins created and earned by miners for verifying transactions is cut in half. It’s Bitcoin’s way of using a magic formula to make sure not too many Bitcoins are made too quickly, aiming to keep Bitcoin rare and, hopefully, more valuable over time.

To really appreciate the significance of these halving events, it’s worth taking a glance back at each milestone. Following the very first halving, Bitcoin’s value gradually began to soar, leading up to an astronomical increase during 2017. The subsequent halvings have also witnessed an initial surge in Bitcoin’s price, followed by various ups and downs. This historical journey of halving events is not just a story of what’s happened, but a peek into the delicate balance of supply and demand that drives Bitcoin’s value. For more insights on how Bitcoin compares to other cryptocurrencies, like Ethereum, check out https://wikicrypto.news/decoding-cryptocurrency-choosing-between-bitcoin-and-ethereum.

How Halving Affects Bitcoin’s Value 💸

Imagine you have a special type of chocolate that everyone loves, and every four years, the company making it decides to cut the production in half. This would likely make each chocolate bar more valuable over time because they’re scarcer. This is similar to what happens with Bitcoin every four years in an event called halving. The number of new Bitcoins created and earned by the miners is reduced by half. With fewer new Bitcoins being created, the idea is that their value will go up, as long as people’s desire for them remains the same or increases. 🚀🍫 This halving process is designed to limit the total number of Bitcoins that will ever exist, mimicking precious metals like gold. Just as with gold, scarcity can make each Bitcoin more valuable. However, it’s not all about scarcity; anticipation and public sentiment play a huge role too. People might start buying more Bitcoin before a halving, hoping the price will increase after the event, which can also impact its value. 🌟💫

Comparing Halvings: Expectations Vs. Reality 📈

When we look back at every Bitcoin halving, everyone seems to have a crystal ball, predicting sky-high prices and a new era for cryptocurrencies. But the reality often hums a different tune. Before each halving event, enthusiasts and skeptics alike dive into discussions, with forecasts ranging from monumental surges in value to more cautious, moderate bumps. Amidst these predictions, the real outcomes have showcased a fascinating pattern of initial hype followed by more measured, gradual increases in value. This dance between expectations and reality not only shapes investor attitudes but also sheds light on the underlying mechanisms of the market.

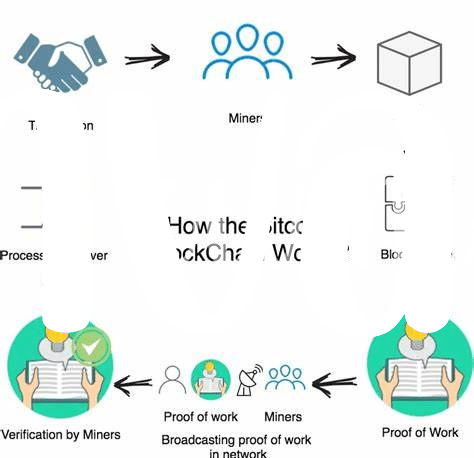

Adding to the intrigue, each halving has its own story, influenced by a myriad of factors beyond just the reduction in new Bitcoin supply. Market maturity, global economic conditions, and evolving regulatory landscapes play significant roles. For those curious about how the mechanics of Bitcoin compare to another heavyweight in the cryptocurrency arena, Ethereum, diving into the intricacies can provide valuable insights. A good starting point is understanding the fundamentals of how each operates, and how does bitcoin work versus ethereum offers a clear, step-by-step guide. This exploration not only demystifies halvings but also enriches our grasp of the broader crypto ecosystem.

The Global Impact of Halving Events 🌍

When Bitcoin halves, it’s not just a big deal for those who own Bitcoin 🤑. This event sends ripples across the globe, influencing economies and the way people see and use digital money. Think of it as a game where the rules change slightly, affecting everyone in the world who plays it. Countries that are big into Bitcoin, like some in Asia, Europe, and North America, might see shifts in how they invest, save, or even spend money. This change nudges everyone, from big banks to the average Joe, to rethink their money strategies.

But there’s more than just economies twisting and turning. Halving puts Bitcoin in the spotlight, sparking conversations everywhere 🌐. This buzz can lead to more people jumping on the Bitcoin bandwagon, increasing demand, and sometimes, its value. Here’s a quick look at past halvings and their impact:

| Halving Year | Global Impact |

|---|---|

| 2012 | Increased awareness and adoption |

| 2016 | Stirred interest in digital currencies |

| 2020 | Highlighted Bitcoin as a potential hedge against inflation |

Every time a halving happens, it’s a little nudge to the world, reminding us of the growing role digital currency plays in our lives and finances.

Future Predictions: Beyond the Next Halving 🔮

Peering into the crystal ball to predict what’s next for Bitcoin after the upcoming halving is a bit like trying to catch a glimpse of the future through a foggy lens. However, insights from past events and current trends can guide us. As we stand on the brink of another significant reduction in the reward for mining Bitcoin, speculations are running high. Many enthusiasts and experts believe that this event could usher in a new era of valuation highs, spurred by a decrease in the new supply of Bitcoin, thereby potentially making each existing Bitcoin more valuable. This anticipation hinges on the simple principles of supply and demand; as the supply growth slows, and if demand remains constant or increases, prices could rise. Furthermore, this event could trigger more global interest and awareness of Bitcoin, pushing it further into the mainstream. Such transitions may encourage more people to learn what are bitcoin wallets and the blockchain, deepening their understanding and possibly impacting the currency’s value and how it’s perceived worldwide. Beyond mere speculation, the pivotal role of technological advancements and regulatory landscapes cannot be overstated, as they will greatly influence Bitcoin’s journey post-halving. 🌐💫