🎉 the Exciting World of Bitcoin Halving

Imagine a party that happens not once but every few years, a celebration in the world of Bitcoin that enthusiasts and investors alike await with bated breath. This event, known as Bitcoin halving, is a bit like a financial magic trick that happens right in front of our eyes. Every four years or so, the reward for mining Bitcoin is cut in half. Why does this matter, you might wonder? Well, it’s all about scarcity and demand. With fewer new Bitcoins being created, the rarity of Bitcoin increases, often leading to a festive uptick in its value. Think of it as if suddenly, the world decided there would only be half as many new gold discoveries. The anticipation of this event creates a buzz in the community, stirring discussions and predictions about the future landscape of digital currency. To give you a clearer picture, here’s a simplified table showing the past halving events and their impact:

| Halving Event | Date | New BTC Reward | Notable Price Impact |

|---|---|---|---|

| 1st Halving | 2012 | 25 BTC | Gradual price increase |

| 2nd Halving | 2016 | 12.5 BTC | Spike in value |

| 3rd Halving | 2020 | 6.25 BTC | Set off a bull run |

This halving not only strengthens Bitcoin’s position as a digital treasure but also keeps the conversation going, fueling both dreams and debates among those who see cryptocurrencies as the money of the future.

🚀 Ethereum 2.0: a Leap into the Future

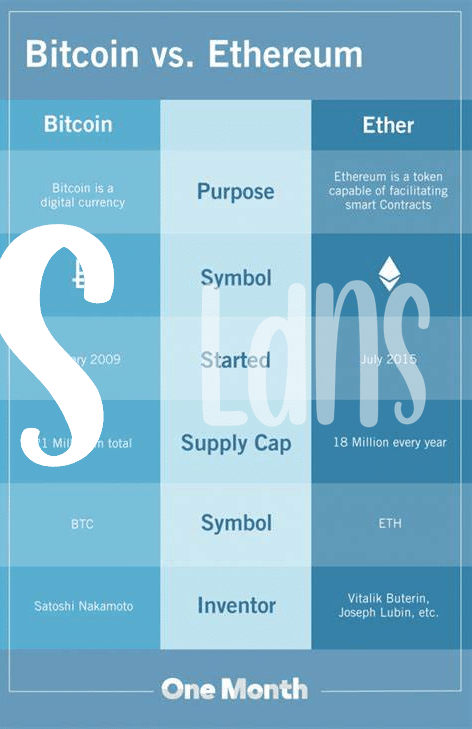

Imagine stepping into a world where technology breathes new life into old systems. That’s the essence of Ethereum’s big update. As we dive deeper into the ocean of digital currencies, Ethereum is making waves with a transformation that’s all about speed, efficiency, and opening the door to a future where transactions don’t get stuck in digital traffic jams. Unlike the familiar Bitcoin, which follows a set schedule to cut down on new coins, Ethereum aims to revolutionize how transactions and applications run in the crypto space. It’s like switching from a congested, one-lane road to a multi-lane superhighway.

For folks looking into the intricate world of cryptocurrencies, making sense of where to start can be daunting. Whether you’re considering your very first Bitcoin wallet or weighing the merits between Bitcoin and Ethereum, guidance is just a click away. Visit https://wikicrypto.news/your-first-bitcoin-wallet-setting-up-step-by-step for a step-by-step journey into the world of cryptocurrency. This leap by Ethereum is not just about faster transactions; it’s a leap towards a more sustainable and eco-friendly digital asset world, setting a new benchmark for others to follow.

💰 Impact on Investors: Risks and Rewards

In the world of digital money, where Bitcoin and Ethereum are like the two big kids on the block, changes are brewing that could shake things up for people who’ve put their money into these cryptocurrencies. Think of it like this: when you hear about Bitcoin halving, it’s basically like Bitcoin going on a diet, cutting in half how many new bitcoins get made. This can make the bitcoins you already have more valuable, like a rare toy. On the other side, Ethereum is hitting the gym with its 2.0 upgrade, aiming to get faster and stronger, potentially increasing its value too. Both events promise the possibility of making your wallet heavier if you play your cards right. But, just like any adventure, there are dragons to face. The value of these coins can jump up and down like a kangaroo, making the journey thrilling but a bit scary for investors. It’s a mixed bag of sweet potential rewards and biting risks, shaping a future where the brave might find treasure, while the cautious keep their maps open, always ready to navigate the unpredictable waves of the crypto sea.

🌐 the Role of Community in Shaping Trends

In the digital currency world, the voices and actions of the community often steer the ship towards new horizons. Whether we’re talking about those who invest in these currencies, the developers who tweak and improve them, or even those who simply chat about them over social media, everyone plays a part. This collaborative effort not only helps to shape current trends but also paves the way for future developments. It’s a bit like having a huge group of friends all chipping in to decide what game to play next – except this game could potentially change the financial landscape forever.

Furthermore, understanding the nitty-gritty of entering this exciting world might seem daunting at first. For newcomers eager to get their feet wet, learning how to buy bitcoin versus ethereum is a great starting point. As these communal discussions evolve, they not only influence which technologies gain traction but also highlight the evolving security practices and scalability solutions that benefit everyone involved. It’s a vibrant, ever-changing ecosystem where every tweet, forum post, and developer update potentially tips the scales, setting the stage for the next big leap forward.

⚖️ Comparing Scalability: Faster Transactions Ahead

In the thrilling race between Bitcoin Halving and Ethereum 2.0, a pivotal area of focus is how each upgrade aims to make transactions quicker, akin to choosing between two express lanes in the world of digital currency. Imagine a bustling market where transactions are the heartbeat, and speed is the lifeline. Here, Bitcoin halvings are like scheduled train arrivals that reduce the supply of new coins, potentially making each coin more valuable and impacting how quickly transactions are verified. On the flip side, Ethereum is on the brink of a transformative leap with its 2.0 upgrade, promising a remarkable shift from a congested roadway to a multi-lane expressway, thanks to its transition to a proof-of-stake consensus mechanism. This not only paves the way for faster transactions but significantly broadens the road by enhancing the network’s capacity. The essence of this leap revolves around the ability to handle a greater volume of transactions with efficiency and speed, which for users, translates to less waiting and more doing. This comparative journey between Bitcoin’s strategic scarcity-induced value spike and Ethereum’s ambitious scalability plans beckons a future where digital transactions glide smoothly, much like a streamliner over calm seas.

| Feature | Bitcoin Halving | Ethereum 2.0 |

|---|---|---|

| Objective | Reduce new coin supply to increase value | Increase network capacity and transaction speed |

| Impact on Transactions | Potentially slower due to increased value | Faster and more efficient |

| Consensus Mechanism | Proof of Work | Proof of Stake |

| Future Outlook | Valuable but potentially slower transactions | Highly scalable and rapid transactions |

🔍 Security Enhancements: a Safer Crypto Space

In the ever-evolving landscape of cryptocurrency, ensuring the safety and security of digital assets has never been more crucial. Both Bitcoin and Ethereum are stepping up their game with significant security advancements, making the crypto space safer for everyone involved. Bitcoin’s halving and Ethereum’s shift to Ethereum 2.0 aren’t just about reducing rewards or moving to proof of stake. They’re about building a fort around our digital treasures. These changes aim to make attacks more expensive and less appealing to would-be wrongdoers, ensuring that your digital wallet remains untouched. For those curious about diving deeper into the foundations of these cryptocurrencies, brushing up on what are bitcoin wallets and the blockchain could provide insightful knowledge. As we navigate through these changes, the collective input from the community will be paramount in shaping a secure digital currency landscape, making the crypto universe a safer galaxy for all space travelers.