Understanding Bitcoin Basics 🌟

Bitcoin operates on a decentralized platform known as blockchain technology, allowing peer-to-peer transactions without the need for intermediaries like banks or governments. Each transaction is recorded on a public ledger, ensuring transparency and security. Wallets store Bitcoin, which can be bought, sold, or exchanged on cryptocurrency exchanges. The total supply of Bitcoin is capped at 21 million, a key factor in its value appreciation. Understanding the basics of how Bitcoin works is crucial before delving into its legal landscape and implications for anti-money laundering regulations.

Evolution of Aml Regulations 📜

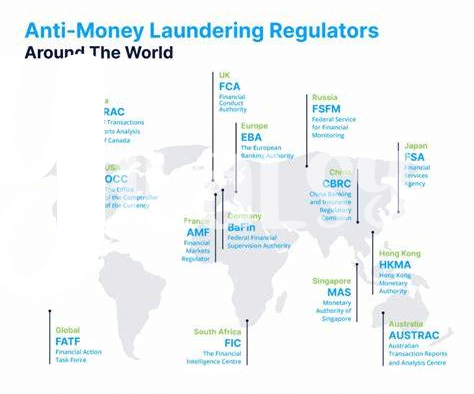

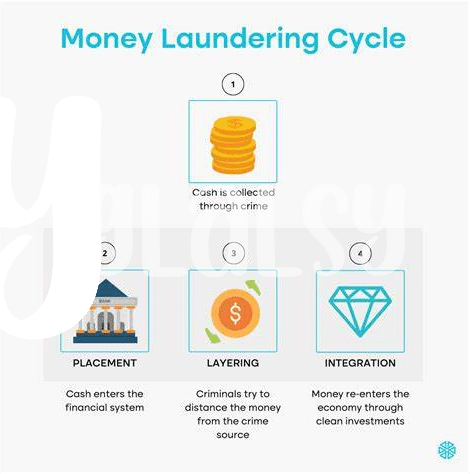

A narrative is woven through the fabric of Anti-Money Laundering (AML) regulations, emphasizing the dynamic interplay between evolving financial technologies and regulatory frameworks. Initially, AML laws primarily targeted traditional financial institutions but have progressively extended their reach to encompass emerging digital assets like Bitcoin. This shift reflects an industry striving for transparency and security in an era of rapid technological transformation. As regulators adapt to the inherent complexities of cryptocurrencies, a delicate balance emerges between safeguarding against financial crimes and fostering innovation within the digital economy. The evolution of AML regulations signifies a pivotal moment in the intersection of finance and technology, shaping the future landscape of compliance and accountability.

Unique Challenges in Grenada 🌴

Grenada faces distinctive challenges when it comes to navigating the legal landscape of Bitcoin and AML regulations. The small size and limited resources of the country pose obstacles in effectively enforcing regulations and monitoring cryptocurrency transactions. Additionally, the lack of specialized expertise in this emerging field further compounds the challenges Grenada encounters. These unique factors require tailored approaches and collaboration with international partners to address AML concerns effectively within the Bitcoin ecosystem.

Global Perspectives and Implications 🌎

Global Perspectives: As Bitcoin continues to gain traction globally, it is crucial to consider the implications of varying AML regulations across different countries. The decentralized nature of cryptocurrencies poses a challenge for regulators seeking to combat money laundering and terrorist financing on a global scale. Countries like the United States and the European Union have been actively refining their AML frameworks to address the evolving landscape of digital assets. Understanding the diverse approaches taken by different jurisdictions is key to shaping a more cohesive and effective international regulatory environment.

Link: bitcoin anti-money laundering (aml) regulations in greece

Compliance Strategies for Businesses 💼

1) -Understanding Bitcoin Basics 🌟

2) -Evolution of Aml Regulations 📜

3) -Unique Challenges in Grenada 🌴

4) -Global Perspectives and Implications 🌎

6) -Future Outlook and Potential Changes 🚀

Implementing effective compliance strategies is essential for businesses operating in the realm of Bitcoin and cryptocurrency in Grenada. By staying abreast of the evolving AML regulations and adopting robust KYC procedures, businesses can mitigate risks and ensure transparency in their operations. Collaborating with regulatory bodies, conducting regular audits, and investing in employee training are key components of a successful compliance framework that can safeguard businesses and promote trust within the digital currency ecosystem.

Future Outlook and Potential Changes 🚀

As the landscape of Bitcoin AML regulations continues to evolve, the future outlook for Grenada holds promise for potential changes in compliance requirements. With the global push for heightened regulatory measures, Grenada is expected to align its AML frameworks with international standards, ensuring a more secure environment for cryptocurrency transactions. The implementation of advanced monitoring technologies and increased cooperation between regulatory bodies and businesses are likely to shape the future of Bitcoin AML compliance in the country, paving the way for a more robust and transparent ecosystem. Stay informed about the latest developments in Bitcoin AML regulations in Grenada and beyond. bitcoin anti-money laundering (aml) regulations in germany