Understanding German Aml Regulations 🇩🇪

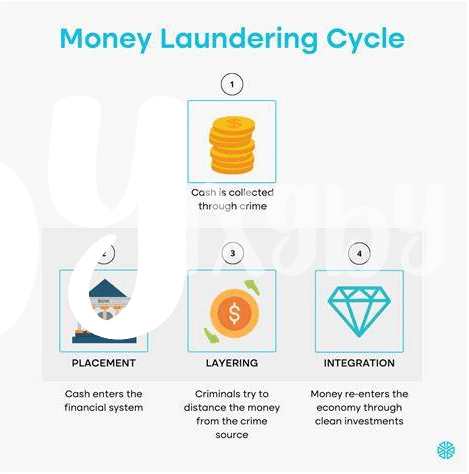

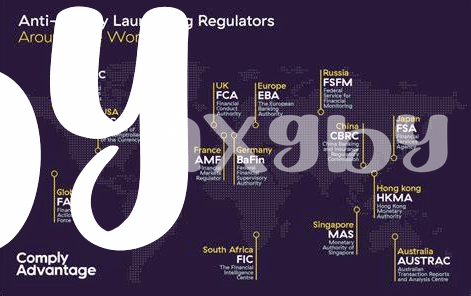

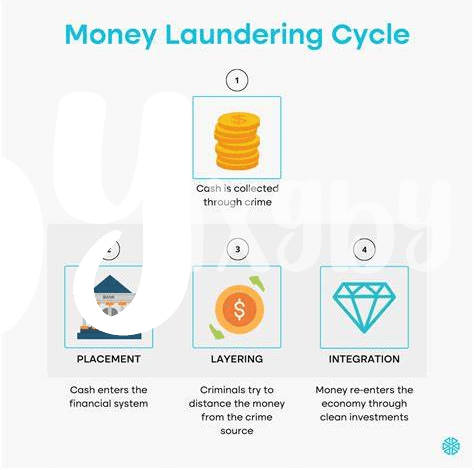

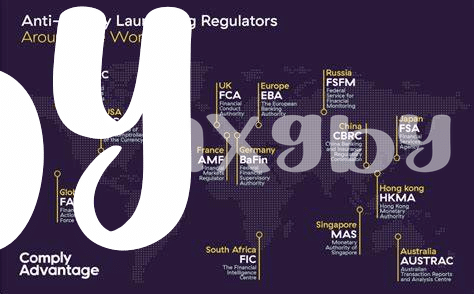

Germany’s Anti-Money Laundering (AML) regulations delve into the intricate framework that governs financial operations within the country. These regulations are designed to combat illicit financial activities, protect the integrity of the financial sector, and uphold transparency standards. Understanding the nuances of German AML regulations is crucial for Bitcoin businesses operating within the country. It involves grasping the legal requirements, reporting obligations, and compliance measures mandated by the regulatory authorities.

Navigating through the German AML regulations requires a comprehensive comprehension of the legal landscape and intricate details embedded within the framework. By familiarizing themselves with these regulations, Bitcoin businesses can proactively align their operations, policies, and procedures to meet the stringent compliance standards set forth by the German regulatory authorities.

Key Compliance Requirements for Bitcoin Businesses 💼

Bitcoin businesses operating in Germany must adhere to strict compliance requirements to ensure they are in line with anti-money laundering regulations. These key requirements encompass various aspects, including thorough customer due diligence procedures, robust transaction monitoring systems, and the implementation of effective Know Your Customer (KYC) practices. By developing and maintaining a comprehensive compliance framework that includes these essential components, Bitcoin businesses can mitigate risks associated with financial crimes and ensure transparency in their operations to regulatory authorities. Regular audits and reporting mechanisms play a crucial role in demonstrating compliance with German AML regulations, showcasing a commitment to upholding regulatory standards and fostering trust within the industry.

Implementing these compliance strategies not only safeguards Bitcoin businesses from potential legal repercussions but also contributes to building a secure and trustworthy environment for users and investors alike. Embracing these key compliance requirements as foundational pillars of their operations empowers businesses to navigate the evolving regulatory landscape with confidence, positioning themselves as responsible and compliant entities within the burgeoning cryptocurrency market. By prioritizing adherence to AML regulations and adopting best practices in compliance management, Bitcoin businesses in Germany can enhance their reputation, strengthen their sustainability, and contribute to the overall legitimacy and acceptance of digital assets in the financial sector.

Developing Effective Kyc Procedures 🛂

Effective Know Your Customer (KYC) procedures are essential for Bitcoin businesses operating under German AML regulations. By implementing thorough KYC processes, businesses can verify the identities of their customers, assess the risks associated with their transactions, and ensure compliance with regulatory requirements. Developing these procedures involves setting clear guidelines for customer identification, verification, and monitoring. By collecting and analyzing relevant information about customers, businesses can mitigate the risks of money laundering and terrorist financing activities. Additionally, automated customer screening tools can streamline the KYC process, enabling businesses to efficiently onboard new customers while maintaining regulatory compliance. Implementing effective KYC procedures not only safeguards businesses against financial crimes but also fosters trust and credibility with customers and regulatory authorities alike.

Implementing Robust Transaction Monitoring Systems 🔄

When it comes to ensuring compliance for Bitcoin businesses under German AML regulations, implementing robust transaction monitoring systems is crucial. These systems act as the eyes and ears of the operation, constantly scanning and analyzing transactions to detect any suspicious activities. By setting up a comprehensive monitoring system, businesses can stay ahead of potential risks and maintain a secure environment for their operations.

For more information on AML requirements and how they apply to Bitcoin users in different countries, you can check out this detailed resource on is bitcoin recognized as legal tender in guinea-bissau?. It provides valuable insights into the regulatory landscape and offers guidance on staying compliant in the ever-evolving cryptocurrency industry.

Ensuring Customer Due Diligence Practices Are in Place 🧾

– Regular audits and reporting to regulatory authorities are crucial components of maintaining compliance for Bitcoin businesses under German AML regulations. By conducting regular audits, businesses can identify any potential gaps or weaknesses in their customer due diligence practices, allowing them to rectify issues promptly. Furthermore, consistent reporting to regulatory authorities demonstrates a commitment to transparency and accountability, fostering trust with both customers and regulators alike. This proactive approach not only helps businesses stay compliant but also reduces the risk of potential penalties or legal repercussions.

Regular Audits and Reporting to Regulatory Authorities 📊

Regular audits and reporting to regulatory authorities are vital components of maintaining compliance for Bitcoin businesses under German AML regulations. By conducting regular audits, businesses can review their internal processes and controls to ensure they are in line with the regulatory requirements. This not only helps in identifying any potential gaps or weaknesses but also demonstrates a commitment to transparency and accountability. Reporting to regulatory authorities involves submitting necessary information and documentation to showcase adherence to AML regulations and to address any concerns or inquiries promptly.

For more information about AML regulations in other countries, such as Gabon and Egypt, you can explore the Bitcoin anti-money laundering (AML) regulations in Gabon and Egypt using the provided link: Bitcoin anti-money laundering (AML) regulations in Egypt