Overview 🌏

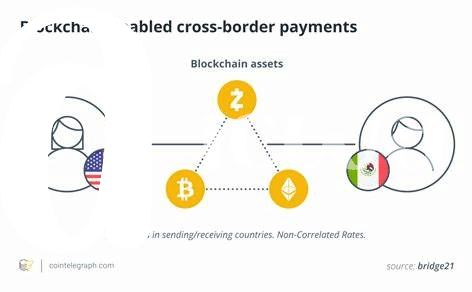

Bitcoin’s increasing prominence in global finance fuels the need to examine its implications in cross-border money transfers within Kiribati. Delving into the legal landscape surrounding this decentralized currency serves as a key step in understanding its potential ramifications. By exploring the regulatory frameworks and obstacles in place, we can grasp the complexities that govern Bitcoin transactions across borders. This overview provides a foundational understanding of the intricate interplay between digital assets and traditional financial regulations, shedding light on the evolving nature of cross-border money transfers.

Current Regulations 📜

In Kiribati, the laws surrounding Bitcoin cross-border money transfers are evolving, impacting how businesses navigate the digital financial landscape. Understanding the current regulations is crucial for compliance, as regulators seek to balance innovation with consumer protection. Stay updated on the latest developments to ensure smooth operations and mitigate any potential risks. By proactively addressing compliance requirements, businesses can position themselves for long-term success in the dynamic realm of cross-border money transfers involving Bitcoin. Keeping a close eye on regulatory updates and adjusting strategies accordingly will be key in navigating the evolving legal framework while fostering growth and sustainability in the industry.

Potential Challenges ⚖️

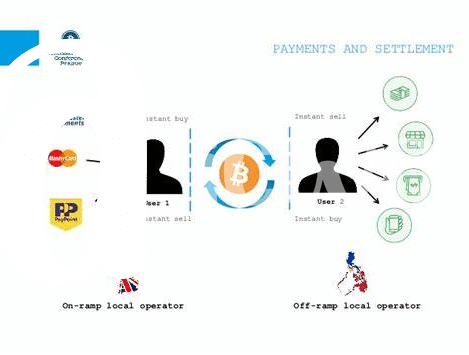

Bitcoin cross-border money transfers in Kiribati present a unique set of challenges that stem from the evolving regulatory landscape. The decentralized nature of cryptocurrencies, such as Bitcoin, raises questions about compliance requirements and the potential risks associated with money laundering and terrorism financing. As Kiribati navigates the legal complexities of cross-border transactions involving Bitcoin, one of the key challenges lies in balancing innovation with regulatory oversight to ensure financial integrity and consumer protection.

Furthermore, the lack of clear guidelines and inconsistent regulatory approaches across jurisdictions can create uncertainty for businesses seeking to leverage Bitcoin for international money transfers. This dynamic environment requires proactive measures to address compliance gaps and mitigate operational risks. Developing a robust framework that addresses the potential challenges of cross-border Bitcoin transactions is crucial for fostering a trustworthy and sustainable ecosystem in Kiribati’s financial landscape.

Impact on Businesses 💼

Businesses in Kiribati are navigating an evolving landscape influenced by cross-border money transfer regulations. With the rise of Bitcoin as a potential disruptor, companies are carefully assessing the implications on their operations. The ability to swiftly and securely conduct international transactions can streamline processes and reduce costs for businesses engaging in global trade. However, the regulatory uncertainties surrounding digital currencies pose challenges for enterprises seeking to integrate Bitcoin into their financial strategies. Adapting to these legal developments requires thorough compliance measures to mitigate risks and ensure operational continuity. As businesses evaluate the impact of Bitcoin on cross-border money transfers in Kiribati, strategic foresight and proactive regulatory engagement will be vital in safeguarding their financial interests and sustaining growth in an increasingly interconnected global economy. For an in-depth exploration of Bitcoin’s potential in cross-border money transfers, including insights from different jurisdictions such as Laos, visit bitcoin cross-border money transfer laws in Laos.

Future Outlook 🔮

In examining the intersection of Bitcoin cross-border money transfers and Kiribati’s legal framework, it becomes evident that the future outlook is poised for evolution. As advancements in technology continue to reshape the global financial landscape, policymakers in Kiribati may need to consider adapting regulations to accommodate the growing prevalence of digital currencies. With the increasing acceptance and integration of blockchain technology, the potential for innovative payment solutions and streamlined cross-border transactions is on the horizon. This shifting paradigm presents both opportunities and challenges for Kiribati, requiring a forward-thinking approach to ensure alignment with the changing dynamics of the digital economy.

Recommendations for Compliance 📊

When it comes to adhering to the legal framework for Bitcoin cross-border money transfers, businesses in Kiribati must prioritize compliance to ensure seamless operations. Understanding and staying updated with the current regulations is crucial, as the cryptocurrency landscape is ever-evolving. Emphasizing transparency in transactions, implementing robust security measures, and conducting regular audits can significantly aid in compliance efforts. Apart from local laws, businesses should also consider the global implications by aligning with international standards such as the Financial Action Task Force guidelines for virtual assets and virtual asset service providers.

Furthermore, establishing strong partnerships with institutions that specialize in blockchain technology and compliance can offer valuable insights and expertise in navigating the regulatory environment. By proactively engaging with regulatory bodies and fostering a culture of compliance within their organizations, businesses can not only mitigate risks but also build trust among stakeholders in the burgeoning digital economy. To delve deeper into specific nuances of Bitcoin cross-border money transfer laws, exploring cases such as bitcoin cross-border money transfer laws in Japan and bitcoin cross-border money transfer laws in Latvia can provide valuable comparative insights for businesses operating in Kiribati.