Benefits of Bitcoin in Latvia’s Money Transfers 💰

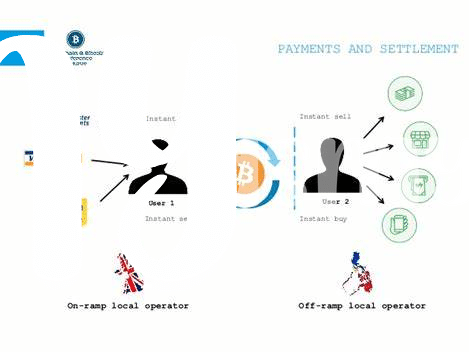

Bitcoin is revolutionizing money transfers in Latvia by offering speed and cost-effectiveness compared to traditional banking channels. With Bitcoin, transactions can be completed within minutes, even across borders, eliminating the need for intermediaries and reducing associated fees. Additionally, the decentralized nature of Bitcoin ensures that transactions are secure and transparent, providing users with greater control over their finances. This newfound efficiency opens up a world of possibilities for individuals and businesses in Latvia, enabling them to participate in global trade and access financial services without the constraints of traditional banking systems.

Challenges and Regulations in Cross-border Transactions 🌍

In the realm of cross-border transactions, navigating the challenges and regulations can be a complex landscape to traverse. From differing regulatory frameworks to varying compliance requirements, ensuring seamless cross-border money transfers poses a significant hurdle. Striking a balance between innovation and adherence to established regulations is essential in this evolving space to foster trust and transparency among stakeholders.

As the digital currency space continues to expand, finding solutions that address regulatory concerns while harnessing the potential of Bitcoin in cross-border transactions is imperative. By overcoming these challenges effectively, the financial ecosystem can embrace the efficiency and global reach that cryptocurrencies offer, paving the way for a more interconnected and streamlined future of money transfers.

Adoption of Cryptocurrency in Latvia 📈

In recent years, Latvia has shown a growing interest in embracing cryptocurrencies as a means of exchange and investment. The adoption of cryptocurrency in Latvia has been fueled by a combination of technological advancements, increasing awareness among the general population, and a desire for financial innovation. As more Latvians become familiar with digital currencies like Bitcoin, the use of cryptocurrency in everyday transactions is gradually gaining traction. This positive trend not only reflects a shift towards modern financial solutions but also signals a potential shift in the traditional banking landscape within the country. With the rising adoption of cryptocurrency in Latvia, there are exciting opportunities on the horizon for individuals and businesses alike to explore the benefits and possibilities offered by this digital asset.

Impact on Traditional Banking Systems 🏦

Bitcoin’s entrance into the financial landscape of Latvia inevitably impacts traditional banking institutions. The traditional banking systems are now faced with the challenge of accommodating and integrating this emerging digital currency into their established frameworks. As more individuals and businesses in Latvia opt for Bitcoin in their cross-border transactions, traditional banks must adapt their services to remain competitive in a rapidly evolving financial market. This shift prompts banks to reassess their fee structures, transaction processing times, and overall customer experience to meet the changing needs of the digital-savvy population. The coexistence of Bitcoin and traditional banking systems in Latvia signifies a pivotal moment in the evolution of the country’s financial sector, leading to an ecosystem where technological innovation and traditional finance intersect to shape the future of money transfers. (Link: Bitcoin cross-border money transfer laws in Kuwait)

Future Trends and Opportunities for Bitcoin 💡

The evolving landscape of digital currency presents a myriad of possibilities for Bitcoin in Latvia. As the world becomes increasingly interconnected, the role of Bitcoin in cross-border transactions is poised for growth. From providing lower transaction fees to offering quicker transfer times, Bitcoin’s potential to streamline international money transfers is becoming more evident. Furthermore, the decentralized nature of Bitcoin ensures greater autonomy and accessibility for individuals looking to move funds across borders. With the continuous advancements in blockchain technology, the future holds promising opportunities for Bitcoin to further revolutionize the way money is transferred globally. Innovations such as the Lightning Network aim to enhance the scalability and efficiency of Bitcoin transactions, paving the way for a more seamless cross-border payment experience. Amidst these developments, the adaptability of traditional banking systems to incorporate cryptocurrency solutions will be crucial in shaping the future landscape of financial transactions.

Building Trust and Security in Transactions 🔒

When it comes to ensuring trust and security in transactions involving Bitcoin, one key aspect lies in the transparency of the blockchain technology that underpins cryptocurrency exchanges. With every transaction being recorded on a public ledger that is immutable and decentralized, the risk of fraud or tampering is significantly reduced. Additionally, the use of smart contracts for executing transactions automatically based on pre-defined conditions adds an extra layer of security. Emphasizing user education on safe practices, such as storing Bitcoin in secure wallets and using reputable exchanges, is crucial in building trust within the cryptocurrency ecosystem. Moreover, regulatory frameworks play a vital role in establishing guidelines for secure transactions, which can help mitigate risks associated with money laundering and other illicit activities. By combining innovative technological solutions with clear regulatory oversight, the path towards building trust and security in Bitcoin transactions becomes clearer for users and businesses alike.

For more insights on bitcoin cross-border money transfer laws, you can refer to the bitcoin cross-border money transfer laws in Kenya and the bitcoin cross-border money transfer laws in Jordan.