Current State 🔍

At present, Crypto banking in Eritrea operates within a limited framework, with minimal usage and acceptance among the population. The infrastructure for widespread adoption is in its nascent stages, with a lack of regulatory clarity posing hurdles. Despite the potential advantages offered by crypto banking, such as enhanced security and efficiency, its current state in Eritrea reflects a cautious approach among the financial community and consumers. This cautious stance is influenced by factors like unfamiliarity with digital currencies and apprehensions about volatility in the market.

Potential Benefits 💡

In the realm of cryptocurrency banking, the potential benefits are vast and transformative. From increased financial inclusion for underserved populations to enhanced security and efficiency in transactions, the adoption of crypto banking holds promise for revolutionizing the traditional banking landscape. Additionally, it opens up avenues for seamless cross-border transactions and reduced costs associated with traditional banking services. The potential benefits of crypto banking are poised to reshape the financial sector in Eritrea and beyond.

Technology Integration 🖥️

Cryptocurrency banking in Eritrea is set to revolutionize traditional financial services through innovative technology solutions. The seamless integration of blockchain technology will enhance security, transparency, and efficiency in transactions. This advancement paves the way for a more accessible and inclusive banking system, allowing individuals to access financial services remotely and conveniently. The potential for borderless transactions and reduced fees through technology integration opens up new opportunities for financial empowerment and economic growth in Eritrea.

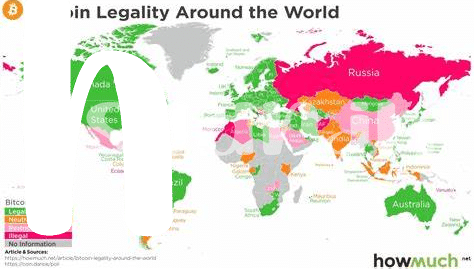

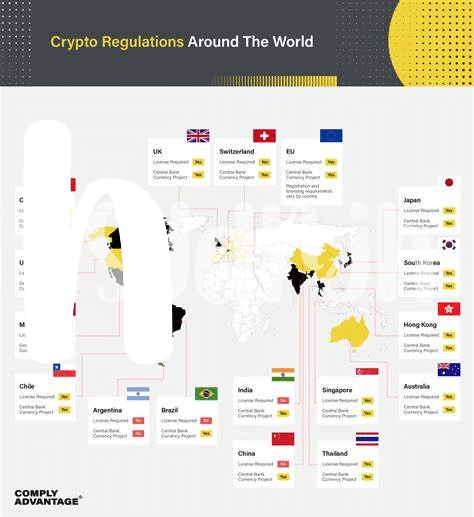

Regulatory Challenges ⚖️

Understanding and navigating regulatory challenges in the crypto banking sphere can be a complex journey. Regulations, aimed at enhancing security and stability, often pose hurdles for innovative financial solutions to thrive seamlessly. It’s vital for Eritrea to strike a balance that fosters innovation while ensuring consumer protection. Dive deeper into Bitcoin banking services regulations in Egypt to gain insights into potential pathways for regulatory adaptation and evolution. bitcoin banking services regulations in Egypt

Adoption by the Masses 🌐

With the growing accessibility to digital platforms, the potential for crypto banking in Eritrea to be adopted by the masses is promising. The convenience of conducting financial transactions securely and swiftly through digital currencies can appeal to a tech-savvy population. Simplifying the process of managing funds and enabling quick transfers can attract a wide range of users, including those seeking more efficient banking options. Educating the public about the advantages and safety measures of crypto banking could further encourage its widespread acceptance.

Future Possibilities 🚀

In the realm of crypto banking, the future holds exciting potential for innovative financial services tailored to the needs of individuals and businesses. As technology continues to advance, we can anticipate a seamless integration of blockchain and digital assets, providing greater accessibility and efficiency in financial transactions. The evolution of crypto banking in Eritrea could transform the traditional banking landscape, offering new avenues for financial empowerment and inclusion.