Current State of Money Transfers 💸

The Maldives currently relies heavily on traditional methods for money transfers, which can be time-consuming and costly. Residents often face challenges with high fees and long processing times when sending or receiving funds domestically or internationally. This outdated system can be frustrating for individuals and businesses alike, leading to delays and inefficiencies in financial transactions. The lack of innovation in the current state of money transfers highlights the need for alternative solutions that can offer more efficiency and lower costs. As the global landscape of financial technology evolves, exploring the potential of digital currencies like Bitcoin could present a promising opportunity to revolutionize the way money is transferred in the Maldives, making transactions quicker, more secure, and cost-effective for all parties involved.

Benefits of Bitcoin in Maldives 🌴

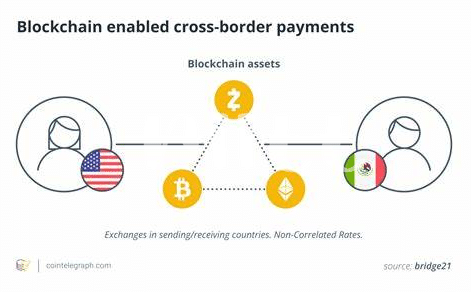

Bitcoin offers a transformative solution for financial transactions in the Maldives. With its decentralized nature, transactions can be conducted swiftly and securely, catering to the needs of a population dispersed across islands. The efficiency of Bitcoin transfers eliminates the need for intermediaries, reducing associated fees and processing times. Additionally, the transparency of blockchain technology ensures that transactions can be traced, enhancing trust among users. By leveraging Bitcoin, individuals in the Maldives can access financial services without the constraints of traditional banking systems, empowering financial inclusion and economic growth within the region. The decentralized nature of Bitcoin also provides a hedge against inflation and currency fluctuations, offering stability in an uncertain economic landscape. Ultimately, the benefits of Bitcoin in the Maldives lie in its ability to revolutionize the financial sector, providing greater access and efficiency in money transfers.

Challenges to Adoption 🤔

Bitcoin adoption in Maldives faces several challenges, from limited awareness and understanding among the general population to regulatory uncertainties surrounding cryptocurrency transactions. One key hurdle is the lack of infrastructure supporting Bitcoin usage, such as the availability of exchanges and wallet services in the region. Additionally, concerns about the volatile nature of cryptocurrencies and their susceptibility to hacking and fraud deter many from embracing digital assets for their financial transactions. Overcoming these obstacles will require concerted efforts from both the government and the private sector to educate and reassure Maldivians about the benefits and security measures of using Bitcoin for money transfers. By addressing these challenges, the path towards widespread adoption of Bitcoin as a mode of financial exchange in Maldives can be navigated more smoothly.

Regulatory Environment for Cryptocurrency 📜

To learn more about the regulatory environment for cryptocurrency in Maldives, it is essential to consider the current laws and guidelines in place that govern the use of digital assets. Understanding the legal framework surrounding cryptocurrencies is crucial for individuals and businesses looking to engage in Bitcoin transactions within the country. By familiarizing oneself with the regulatory landscape, stakeholders can navigate the requirements and compliance measures necessary to operate securely and legally. For detailed insights into simplifying compliance with Bitcoin laws for cross-border transfers in Malawi, you can refer to the resource provided here: bitcoin cross-border money transfer laws in Malawi.

Impact on Traditional Banking 🏦

Traditional banking institutions in Maldives are beginning to feel the ripples of Bitcoin’s growing influence. As more individuals and businesses turn to cryptocurrency for their financial needs, traditional banks are adapting to stay relevant in this evolving landscape. While some banks are exploring ways to integrate blockchain technology into their operations, others are monitoring the situation closely to understand the potential impact on customer behavior and the overall financial ecosystem. The competition from Bitcoin and other cryptocurrencies is prompting traditional banks to reevaluate their services and fees, aiming to provide a more competitive and efficient experience for their customers. This shift in the financial sector is fostering innovation and driving banks to explore new ways to meet the changing needs of their clientele.

Future Outlook and Potential Growth 📈

The future of bitcoin money transfers in Maldives holds immense potential for transforming the way financial transactions are conducted in the region. As digital currencies continue to gain traction globally, the Maldivian market is ripe for embracing the benefits of using bitcoin for seamless cross-border transfers. With the evolving technological landscape and growing acceptance of cryptocurrencies, the outlook for bitcoin money transfers in Maldives points towards substantial growth and increased efficiency in financial transactions. The potential for expanding the use of bitcoin in the country is promising, paving the way for a more streamlined and cost-effective approach to money transfers. As regulators grapple with the intricacies of integrating cryptocurrency into the financial ecosystem, the future of bitcoin money transfers in Maldives is poised to revolutionize the traditional methods of cross-border transactions. The anticipated growth in adoption and integration of bitcoin reflects a shift towards a more digital and borderless financial system.

To learn more about bitcoin cross-border money transfer laws in Madagascar, visit bitcoin cross-border money transfer laws in Malaysia.