Understanding Bitcoin Laws in Cross-border Transfers 🌍

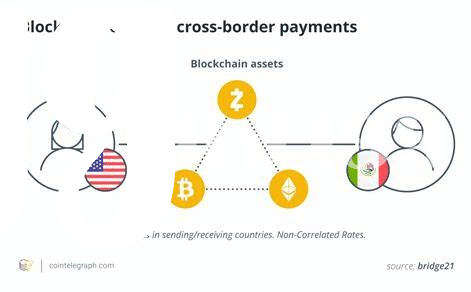

Cryptocurrency regulations in the realm of cross-border transfers can be a maze of legalities and requirements that can bewilder even seasoned professionals. The evolving landscape of Bitcoin laws across different jurisdictions introduces layers of complexity to the compliance process. Understanding the intricacies of these laws is crucial for businesses engaging in cross-border Bitcoin transactions to ensure smooth operations and avoid potential legal pitfalls. By delving into the specifics of each region’s regulations, businesses can navigate the compliance requirements effectively and foster trust with their customers and partners.

The global nature of Bitcoin transactions necessitates a comprehensive grasp of the legal frameworks in each country involved. From reporting obligations to anti-money laundering measures, compliance with Bitcoin laws is essential for maintaining integrity in cross-border transfers. Staying informed about the latest developments in regulatory requirements and seeking expert guidance can empower businesses to streamline their operations and uphold the standards of compliance expected in the dynamic world of digital finance.

Key Compliance Regulations for Bitcoin Transactions 📝

Understanding and abiding by the compliance regulations for Bitcoin transactions is paramount in the realm of cross-border transfers. In Malaysia, these regulations serve as the framework for ensuring the legality and security of such transactions. Regulations typically cover areas such as Know Your Customer (KYC) procedures, anti-money laundering (AML) policies, and reporting requirements. By adhering to these key compliance regulations, individuals and entities engaging in Bitcoin transactions can safeguard themselves against potential risks and legal repercussions. Furthermore, compliance fosters trust and transparency within the financial ecosystem, contributing to the overall legitimacy and acceptance of Bitcoin in cross-border transfers.

When navigating the landscape of compliance regulations for Bitcoin transactions, it is essential to stay informed and proactive. Implementing robust compliance measures not only demonstrates a commitment to regulatory standards but also mitigates the potential impact of non-compliance. By staying abreast of regulatory updates and best practices, stakeholders can adapt their strategies accordingly and continue to operate within the parameters of the law. Embracing a culture of compliance is not merely a box-ticking exercise; it is a strategic imperative that underpins the integrity and sustainability of Bitcoin transactions in the cross-border context.

Navigating the Complexities of Cross-border Transfers 🧭

Navigating the complexities of cross-border Bitcoin transfers requires a deep understanding of regulations in different jurisdictions, coupled with strategic planning to ensure seamless transactions. It involves staying updated on changing laws, compliance requirements, and potential risks that may arise during international transfers. By developing clear protocols and leveraging technology solutions, businesses can streamline cross-border transactions while adhering to regulatory standards. Building strong relationships with regulatory authorities and industry peers also plays a crucial role in navigating the intricate landscape of cross-border Bitcoin transfers. Furthermore, conducting thorough due diligence on counterparties and implementing robust risk management practices are essential steps in mitigating compliance challenges.

Implementing Effective Compliance Measures ✅

In order to ensure compliance with Bitcoin laws for cross-border transfers, it is essential to implement effective measures that address the specific regulatory requirements of each jurisdiction involved. This involves thorough due diligence processes to verify the legitimacy of transactions, as well as the implementation of robust Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. Additionally, utilizing reputable third-party compliance solutions and regularly updating internal policies can further enhance the effectiveness of compliance measures. By staying proactive and vigilant in upholding regulatory standards, businesses can navigate the complexities of cross-border Bitcoin transfers with confidence and transparency. To delve deeper into the intricate landscape of compliance in Bitcoin transactions, check out this comprehensive guide on bitcoin cross-border money transfer laws in Liberia.

Challenges and Solutions in Bitcoin Law Compliance ⚖️

Navigating the landscape of Bitcoin law compliance can present various hurdles and roadblocks for businesses engaged in cross-border transfers. One common challenge is the lack of standardized regulations across different jurisdictions, leading to uncertainty and potential legal risks. Additionally, the decentralized nature of cryptocurrencies like Bitcoin can make it challenging to track and monitor transactions effectively, raising concerns about compliance with anti-money laundering (AML) and know-your-customer (KYC) requirements.

To address these challenges, businesses can implement robust compliance programs that incorporate risk assessment, due diligence processes, and ongoing monitoring mechanisms. Collaborating with legal experts and regulatory authorities can also provide valuable insights and guidance on navigating the complexities of Bitcoin law compliance. Embracing technological solutions such as blockchain analytics tools and smart contracts can offer innovative ways to enhance transparency and traceability in cross-border transactions, ultimately strengthening compliance efforts and mitigating risks associated with regulatory non-compliance.

Future Trends and Innovations in Compliance Practices 🔮

In exploring the future trends and innovations in compliance practices, it’s crucial to anticipate the evolving landscape of regulatory requirements and technologies. As the global financial sector continues to adapt to the increasing prominence of virtual currencies like Bitcoin, authorities and businesses alike are likely to witness a shift towards more sophisticated monitoring tools and automated compliance solutions. Enhanced transparency measures, real-time monitoring capabilities, and decentralized verification mechanisms are expected to play a pivotal role in streamlining compliance processes for cross-border Bitcoin transfers.

For more insights into Bitcoin cross-border money transfer laws in Luxembourg, refer to the Bitcoin Cross-border Money Transfer Laws in Liechtenstein.