Introduction to Aml Rules in Yemen 🌐

In Yemen, AML rules shape the financial landscape, guiding efforts to combat money laundering and terrorist financing. These regulations provide a framework for monitoring financial transactions, ensuring transparency, and safeguarding against illicit activities. As Yemen navigates its economic environment, adherence to AML rules becomes increasingly critical for financial integrity and stability. Understanding the nuances of these rules is essential for all stakeholders, from financial institutions to individuals engaging in transactions within the Yemeni context.

Impact of Bitcoin on Financial Regulations 💰

Bitcoin’s rise has sparked a wave of innovation across financial systems worldwide, challenging traditional regulations and reshaping the landscape of financial transactions. This digital currency has introduced a decentralized approach to financial interactions, transcending borders and traditional banking systems. As Bitcoin gains mainstream acceptance, the impact on financial regulations is profound, prompting governments to reassess existing frameworks in light of this disruptive technology. The transparency and anonymity features of Bitcoin have raised concerns among regulatory bodies, highlighting the need for adaptable and robust AML rules to mitigate potential risks and ensure the integrity of financial systems.

In the dynamic realm of cryptocurrency, the influence of Bitcoin on financial regulations extends beyond local jurisdictions, requiring a cohesive and coordinated approach to address emerging challenges. The evolving nature of digital currencies demands agile frameworks that strike a balance between innovation and compliance, fostering a sustainable and secure financial ecosystem for users worldwide.

Challenges of Enforcing Aml Rules with Bitcoin 🔍

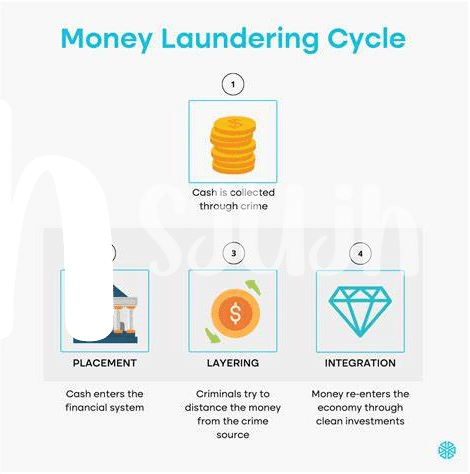

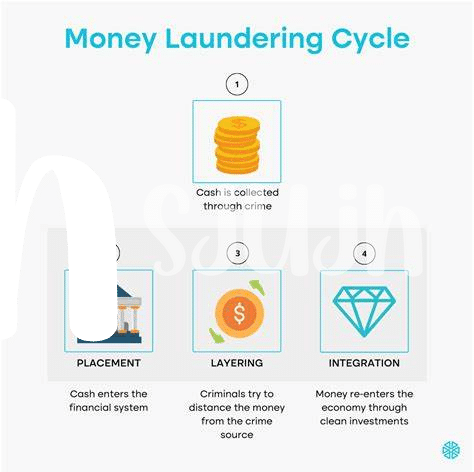

Enforcing Anti-Money Laundering (AML) rules in the realm of Bitcoin presents a unique set of challenges. The pseudonymous nature of Bitcoin transactions can make it difficult for authorities to track and verify the identities of individuals involved in these transactions. Traditional AML mechanisms designed for fiat currencies may not seamlessly translate to the decentralized and borderless nature of cryptocurrencies like Bitcoin. As a result, there is a pressing need for innovative approaches and technological solutions to enhance AML compliance in the digital currency space.

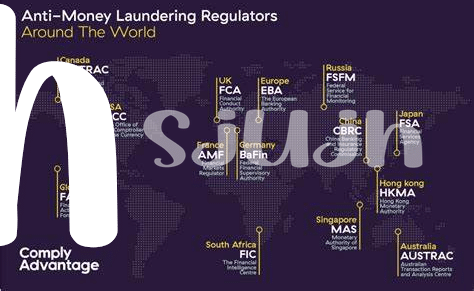

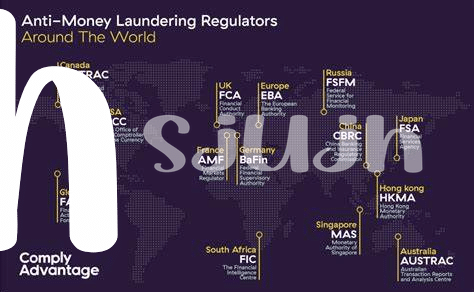

Furthermore, the global and decentralized nature of the Bitcoin network adds another layer of complexity to enforcing AML rules. Coordination among international regulatory bodies becomes crucial to address money laundering risks effectively. Developing standardized frameworks and fostering cross-border collaboration will be essential in combating financial crimes involving Bitcoin.

Technological Solutions for Compliance 🤖

Technological advancements are paving the way for enhanced compliance solutions in the realm of Anti-Money Laundering (AML) regulations. From sophisticated blockchain analytics tools to AI-driven monitoring systems, these innovations are offering a more efficient and effective means of ensuring regulatory compliance within the Bitcoin ecosystem. By harnessing the power of technology, financial institutions and authorities can stay ahead of illicit activities and streamline their AML efforts. These digital tools not only automate tedious processes but also provide real-time insights, empowering compliance teams to proactively address risks and detect suspicious transactions. Embracing these technological solutions is crucial in safeguarding the integrity of the financial system and upholding regulatory standards in the ever-evolving landscape of cryptocurrency transactions.

Please, include this link within the text: bitcoin anti-money laundering (aml) regulations in uzbekistan

Future Outlook and Potential Developments 🚀

The evolving landscape of AML rules for Bitcoin in Yemen points towards a promising future filled with potential developments. As regulatory frameworks adapt to the innovative nature of cryptocurrencies, there is a growing emphasis on enhancing compliance measures and staying ahead of emerging challenges. The future outlook showcases a shift towards more sophisticated technological solutions that streamline AML processes and improve transparency within the cryptocurrency sector. Additionally, the potential developments in AML rules for Bitcoin hint at a more cohesive and globally coordinated approach to combating financial crimes, highlighting the importance of international cooperation and information sharing among jurisdictions. This proactive stance towards regulation sets the stage for a dynamic and secure environment for the utilization of Bitcoin within the financial landscape of Yemen.

Importance of International Cooperation in Aml 🤝

International cooperation in AML efforts is crucial in today’s interconnected world. With the rise of digital currencies like Bitcoin, the need for collaboration between countries becomes even more evident. By working together to establish unified standards and share information, nations can better track and combat money laundering activities involving cryptocurrencies. This exchange of knowledge and resources not only strengthens the global AML framework but also helps in staying ahead of evolving financial crime trends. Establishing strong partnerships and fostering cooperation enhance the effectiveness of AML regulations and contribute to a more secure and transparent financial ecosystem.

insert a link to bitcoin anti-money laundering (aml) regulations in Uruguay