Understanding the Importance of Aml Compliance 💡

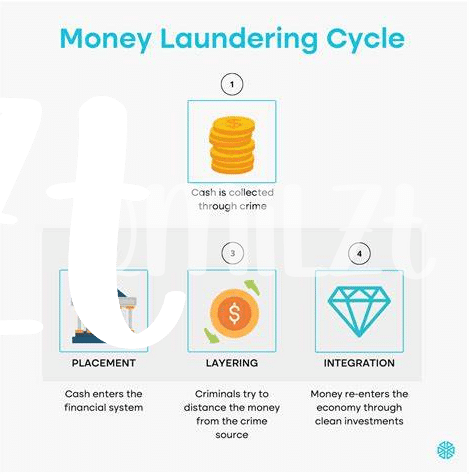

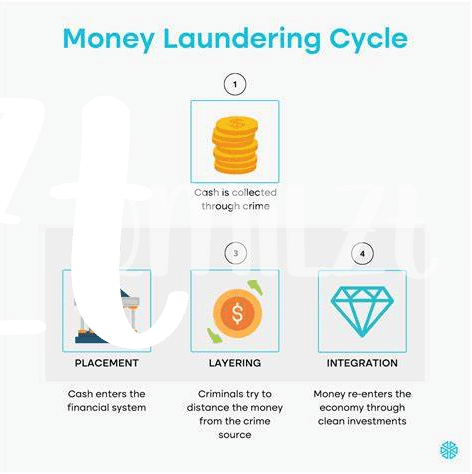

Understanding the importance of AML compliance involves recognizing the critical role it plays in safeguarding financial systems and preventing illicit activities. By adhering to strict compliance measures, businesses can establish trust with regulators, customers, and stakeholders, ultimately enhancing their reputation and credibility in the market. AML compliance not only protects against financial crimes but also fosters a culture of transparency and accountability within the organization. Embracing the significance of AML compliance is essential for upholding integrity and ethical practices, ensuring sustainable growth and long-term success.

Key Regulations and Requirements in Uruguay 📝

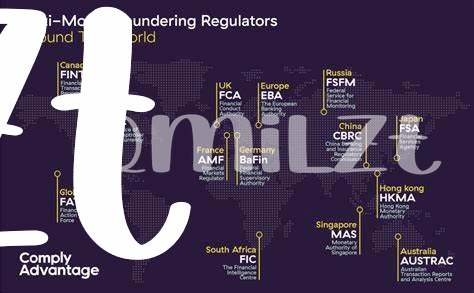

Uruguay has clear regulations in place to ensure compliance with Anti-Money Laundering (AML) requirements. Financial entities engaging in Bitcoin transactions must adhere to strict reporting standards and identification protocols established by the country’s regulatory bodies. Understanding the specific regulations governing AML in Uruguay is crucial for businesses operating within the cryptocurrency space. By familiarizing themselves with these key requirements, companies can proactively implement measures to stay compliant and mitigate potential risks associated with financial crime. Embracing a proactive approach to AML regulation in Uruguay is essential for fostering trust and transparency in the burgeoning cryptocurrency market.

Implementing Effective Compliance Procedures 🛠️

– While ensuring compliance may seem like a daunting task, implementing effective procedures is key to seamlessly integrating AML practices into your Bitcoin operations. By establishing clear guidelines and protocols, you can streamline your compliance efforts and mitigate potential risks. From conducting thorough customer due diligence to implementing robust transaction monitoring systems, each step plays a crucial role in upholding regulatory standards. Moreover, fostering a culture of compliance within your organization ensures that all team members are aligned with the necessary protocols. By embedding compliance procedures into your daily workflows, you can navigate regulatory requirements with confidence and foster a secure environment for Bitcoin transactions.

Leveraging Technology for Enhanced Compliance 📱

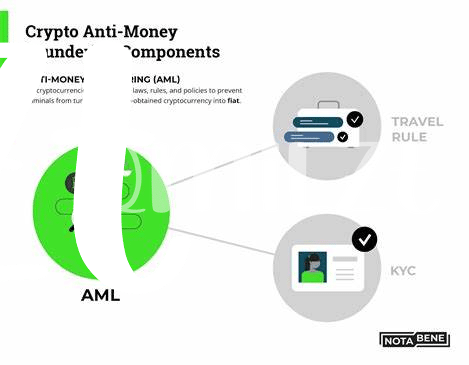

When it comes to enhancing compliance in the realm of Anti-Money Laundering (AML), integrating technology solutions can be a game-changer. By leveraging innovative tools and software, organizations can streamline AML processes, automate manual tasks, and improve the overall efficiency of compliance procedures. From advanced monitoring systems to sophisticated data analysis tools, technology offers a plethora of opportunities to strengthen AML frameworks and stay ahead of regulatory requirements. Embracing digital solutions not only enhances compliance effectiveness but also enables businesses to adapt swiftly to evolving AML landscapes.

Don’t forget to check out valuable insights on bitcoin anti-money laundering (aml) regulations in the United States here: bitcoin anti-money laundering (aml) regulations in United States.

Case Studies and Lessons Learned 📊

When exploring real-world examples and insights from the field, we gain a deeper understanding of AML compliance nuances. By delving into various case studies, we uncover valuable lessons learned and best practices. These real-life scenarios provide a practical perspective on navigating the complexities of compliance requirements. Through analyzing how others have tackled challenges and implemented solutions, we can glean practical tips and strategies for ensuring effective compliance in the realm of Bitcoin transactions in Uruguay.

Continuous Monitoring and Adaptation for Compliance 🔄

In the dynamic landscape of compliance, continuous monitoring and adaptation are crucial for staying ahead of regulatory changes. By regularly reviewing and adjusting compliance procedures, companies can ensure they are meeting the latest requirements and protecting themselves from potential risks. This proactive approach allows businesses to stay agile in response to evolving AML guidelines, ultimately fostering a culture of compliance that is both robust and resilient.

Bitcoin Anti-Money Laundering (AML) regulations in United Kingdom with anchor Bitcoin Anti-Money Laundering (AML) regulations in Tuvalu