Understanding Tuvalu’s Aml Regulations 🌴

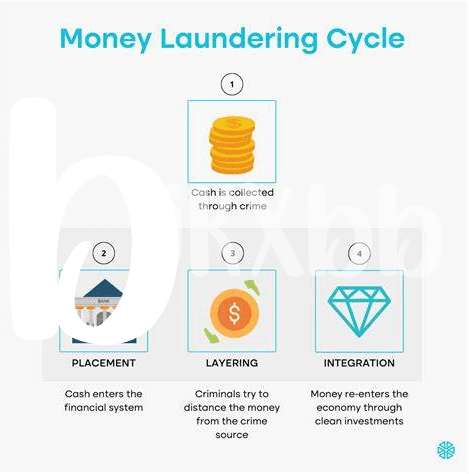

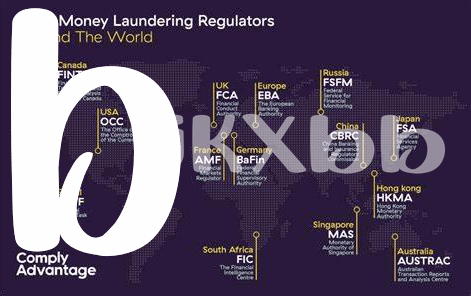

Tuvalu’s Aml regulations play a crucial role in shaping the financial landscape of this Pacific island nation. Enacted to combat money laundering and terrorism financing, these regulations set the framework for financial institutions and businesses to adhere to stringent compliance requirements. Understanding Tuvalu’s Aml regulations is essential for businesses operating in the country to ensure they are in line with the legal framework and avoid potential penalties.

By delving into the specifics of Tuvalu’s Aml regulations, businesses can navigate the regulatory landscape with confidence and integrity. With a clear understanding of the requirements, companies can establish robust compliance programs that not only meet regulatory standards but also contribute to a culture of transparency and accountability within the financial sector. Moreover, staying abreast of any updates or changes to the regulations will enable businesses to adapt proactively and effectively to ensure ongoing compliance.

The Impact of Compliance on Privacy 🔐

When talking about compliance and privacy in Tuvalu, it’s essential to consider how regulations impact the protection of personal information. Striking a balance between meeting Anti-Money Laundering (AML) requirements while safeguarding privacy can be a delicate task. Compliance measures often involve collecting and storing significant amounts of data, raising concerns about the confidentiality and security of individuals’ information. The challenge lies in upholding regulatory standards without infringing on the privacy rights of Bitcoin users, highlighting the need for innovative solutions to navigate this intricate landscape.

In the digital age, the intersection of compliance and privacy underscores the importance of proactive strategies to address potential vulnerabilities. As technology continues to advance, there are opportunities to leverage innovative tools and methods that enhance both compliance with regulations and the protection of privacy. By staying abreast of developments in compliance technology and embracing proactive approaches to data security, Tuvalu and its Bitcoin users can strive towards a harmonious coexistence between regulatory requirements and privacy considerations, paving the way for a more secure and transparent financial ecosystem.

Challenges Faced by Bitcoin Users in Tuvalu 💰

Bitcoin users in Tuvalu often encounter hurdles related to the limited access to traditional banking services, which makes it challenging to convert their digital assets into local currency. Additionally, navigating the complex landscape of regulatory compliance can be a daunting task for individuals who are not well-versed in the intricacies of Anti-Money Laundering (AML) requirements. Despite the decentralized nature of cryptocurrencies, users in Tuvalu may struggle to find compliant avenues for trading and utilizing Bitcoin within the country’s regulatory framework. These challenges highlight the need for user-friendly solutions that strike a balance between maintaining privacy in financial transactions and adhering to AML protocols to ensure a secure and transparent ecosystem for cryptocurrency activities in Tuvalu.

Opportunities for Balancing Privacy and Compliance 🤝

Balancing privacy and compliance in Tuvalu presents a dynamic landscape of challenges and opportunities. As digital transactions continue to evolve, finding the sweet spot between safeguarding user privacy and adhering to regulatory requirements is crucial for the sustainable growth of the cryptocurrency ecosystem. Embracing innovative solutions and leveraging cutting-edge compliance technology can pave the way for a harmonious coexistence of privacy protection and regulatory compliance. By exploring new avenues for collaboration and dialogue between stakeholders, Tuvalu has the potential to lead the way in setting a global standard for balancing privacy and compliance in the realm of cryptocurrency.

For a comprehensive understanding of how jurisdictions worldwide are navigating the intricacies of AML regulations in the realm of cryptocurrencies, including Tuvalu, and to delve deeper into the regulatory landscape, delve into the detailed guide on bitcoin anti-money laundering (AML) regulations in Ukraine provided here: bitcoin anti-money laundering (AML) regulations in Ukraine.

Innovations in Compliance Technology 🔍

In recent years, advancements in technology have greatly impacted the field of compliance, particularly in the realm of Anti-Money Laundering (AML). The introduction of innovative tools and solutions has revolutionized the way organizations approach compliance, making processes more efficient and effective. These technologies, ranging from AI-powered software to blockchain analytics, are enabling companies to stay ahead of evolving regulatory requirements and navigate complexities with ease. By leveraging these cutting-edge tools, firms can not only enhance their compliance efforts but also strengthen their overall risk management strategies. The incorporation of such innovations in compliance technology is key to achieving a harmonious balance between regulatory obligations and operational efficiency.

Future Trends in Aml for Cryptocurrencies 💡

The landscape for anti-money laundering (AML) in cryptocurrencies is rapidly evolving, with future trends pointing towards increased integration of advanced technologies such as artificial intelligence and blockchain analytics. These innovations aim to enhance the efficiency and effectiveness of AML processes, enabling better tracking of transactions and identification of suspicious activities in real-time. Moreover, collaborative efforts between regulators and industry stakeholders are paving the way for standardized AML practices across different jurisdictions, promoting a more cohesive approach to combating financial crimes in the digital asset space. As regulatory frameworks continue to adapt to the dynamic nature of cryptocurrencies, staying abreast of these developments will be crucial for businesses and individuals navigating the intersection of privacy and compliance in the evolving financial ecosystem.

Insert link: bitcoin anti-money laundering (AML) regulations in United Arab Emirates