What Is Inflation? an Easy Explanation 💸

Imagine going to your favorite store with a $10 bill in your hand, ready to buy a big chocolate bar that you’ve been craving. But when you get there, you find out that the price has jumped to $12 overnight! This is a simple way to understand inflation. It’s when the money in your pocket buys less than it did before because the prices of things go up. Inflation is like a sneaky cookie monster for your savings; it slowly eats away the value of your money over time.

To really see how inflation works, let’s break it down with a table:

| Year | Price of Chocolate Bar | Value of $10 |

|---|---|---|

| 2021 | $10 | 1 Chocolate Bar |

| 2022 | $12 | Less than 1 Chocolate Bar |

So, even though you still have the same $10 bill, it can’t buy as much as it used to. This is what happens to your money over time with inflation. Prices for things like food, rent, and clothes keep going up, and if your money doesn’t grow too, you’ll be able to buy less and less. It’s like being on a treadmill trying to catch up to a chocolate bar that keeps moving farther away.

Introduction to Bitcoin: Your Digital Gold 🌐

Imagine having a treasure chest, but instead of gold coins, it’s filled with digital coins, each one shining with potential. That’s Bitcoin for you—a modern-day form of gold, but without the heavy lifting. Born in 2009 from the clever minds of tech whizzes, Bitcoin set out on a journey to become a new form of money, one that doesn’t rely on governments or banks. It’s like having a secret handshake with the digital world, allowing you to send and receive money across the globe without asking permission from the big bosses in suits.

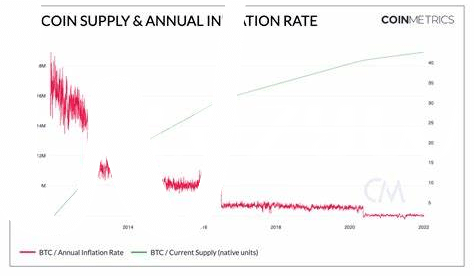

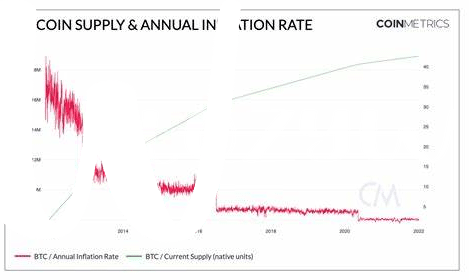

What makes Bitcoin stand out isn’t just its shiny, digital nature; it’s the technology behind it, keeping it safe and secure—much like a vault. With only a limited number available, just like rare gold pieces, it makes sure that inflation, the big scary monster that eats away at the value of traditional money, doesn’t lay its hands on your savings. This digital gold promises a future where you’re in control of your treasure, away from the prying eyes of those looking to pinch a penny from your pocket. For those who wish to dive deeper into navigating the seas of Bitcoin transactions amidst the current economic climate, a visit to https://wikicrypto.news/navigating-bitcoin-transactions-amidst-global-economic-sanctions might just arm you with the map you need.

How Inflation Affects Your Pocket and Savings 📉

Imagine going to your favorite store with money in your hand, ready to buy things you love, only to find out prices have gone 📈sky-high! That’s inflation for you, eating away the value of your money over time. It’s like a silent thief, sneaking into your savings, making each dollar worth a little less tomorrow than it is today. Whether it’s groceries, gas, or gadgets, everything starts to cost more, but somehow, your paycheck doesn’t seem to keep up. This squeeze on your budget can make it harder to save for the future or even cover daily expenses.

Now, think about saving money in a piggy bank or a bank account, hoping it’ll grow over the years. Instead, inflation acts like ice under the sun, slowly melting away the purchasing power of your saved cash 💸. The $100 you save today might not buy you the same amount of goods or services a few years from now. This constant battle means you have to run faster just to stay in the same place, making it essential to find smarter ways to protect and grow your money against the relentless tide of inflation.

Bitcoin Vs. Traditional Safe Havens 🔒

When we think about keeping our money safe and sound, traditionally, we’d turn to things like gold or real estate 💼. These are called “safe havens” because they are meant to protect our money when times get tough, like when prices go up unexpectedly 📈. Now, enter Bitcoin. It’s like the digital version of gold but with a twist. While those old-school havens are pretty straightforward, investing in Bitcoin can feel like riding a very exciting, sometimes bumpy, rollercoaster 🎢. For one, Bitcoin operates in its own world. It’s not tied to any specific country’s economy. This means, while the rest of the world might be dealing with prices going up (inflation), Bitcoin can be on a totally different path. But remember, with great potential comes great responsibility. Jumping into Bitcoin without learning the ropes can be risky. For those looking to smartly navigate these waters, bitcoin educational resources suggestions can provide invaluable insights and tips. This way, you can make better decisions, blending the innovation of Bitcoin with the wisdom of traditional safe havens to safeguard your investments.

Real Stories: People Beating Inflation with Bitcoin 📈

Imagine someone like Maria from Venezuela 🇻🇪 or Alex from Zimbabwe 🇿🇼, two countries experiencing sky-high inflation, seeing their hard-earned savings lose value day by day. Feeling trapped and desperate, they turned to Bitcoin, a decision that transformed their financial landscape. Maria started converting her monthly earnings to Bitcoin, protecting her wealth from the ever-rising prices back home. Meanwhile, Alex, who saw his family’s savings nearly wiped out due to hyperinflation, began investing small amounts into Bitcoin. Despite the ups and downs, both found that over time, their Bitcoin holdings not only preserved their wealth but also grew significantly, outpacing the inflation that threatened to consume their savings.

Their stories are not unique. Around the globe, many have turned to Bitcoin as a lifeline 🔗, finding in it a shield against the erosion of their money’s value. Below is a snapshot of individuals from various countries who have seen significant benefits from incorporating Bitcoin into their financial defense strategy against inflation.

| Country | Name | Result |

|---|---|---|

| Venezuela | Maria | Protected savings from hyperinflation |

| Zimbabwe | Alex | Wealth preservation & growth |

| Argentina | Luis | Secured value against currency devaluation |

| Turkey | Elif | Hedged against inflation & currency crisis |

These individuals represent the face of financial resilience, showing that it’s possible to turn the tide on inflation by strategically embracing digital currencies like Bitcoin.

Managing Risks: the Smart Way to Invest in Bitcoin ⚖️

Dipping your toes into the Bitcoin pool might sound like diving into uncharted waters, but navigating these waves safely isn’t as daunting as it seems. Think of Bitcoin investment like a seesaw; on one end, you have the potential for high returns, and on the other, the risk of unpredictable market swings. 📊 The key to maintaining balance? Start with understanding that investing more than you can afford to lose is like walking on a tightrope without a safety net. Diversify your portfolio; don’t put all your eggs in one basket. 🧺 This means spreading your investments across different assets, not just in Bitcoin or cryptocurrencies. Regularly keeping an eye on the market trends can also give you insights into when to hold tight and when it might be a good time to trade. For those looking to delve deeper into strategizing their Bitcoin investments, considering bitcoin futures trading suggestions can offer a more structured approach to managing potential risks and rewards. Remember, the goal is to make informed decisions that align with your financial goals and risk tolerance, turning the volatility of Bitcoin into a calculated risk rather than a wild gamble. ⚖️