Understanding the Basics of Bitcoin Futures 📊

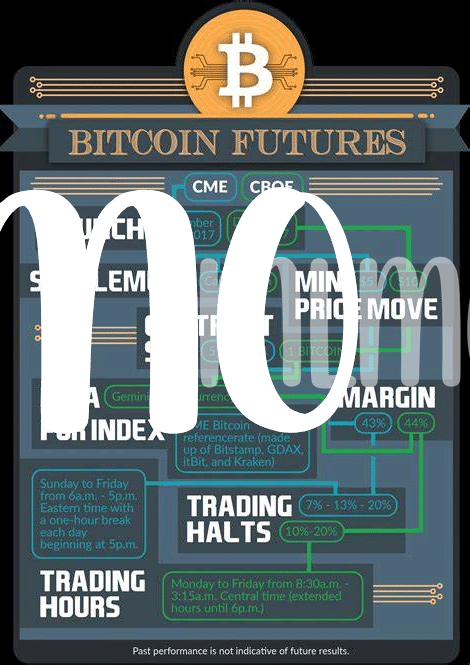

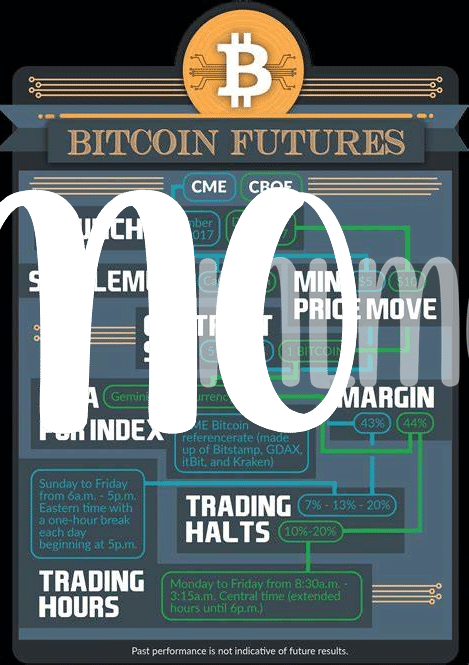

Imagine playing a game where you predict whether the price of Bitcoin will go up or down in the future. If your guess is right, you make money; if it’s wrong, you lose. This game is a real thing, called Bitcoin futures trading. Simply put, it allows you to make a deal today on the price of Bitcoin at a future date. Say, you think Bitcoin’s price will rise, you can “bet” on this by buying a futures contract. If the price goes up, you can sell it for more than you paid. Conversely, if you expect the price to drop, you can “bet” on this decrease. The cool part? You don’t need to own any Bitcoin to do this; you’re essentially dealing with contracts about future prices. It’s a bit like making a reservation for a flight at today’s price, betting that it will either go up or down before you fly.

Here’s a simple table to break down the basics:

| Action | Expectation | Outcome if Correct |

|---|---|---|

| Buy a Bitcoin Futures Contract | Price Will Rise | Sell for More than Paid |

| Sell a Bitcoin Futures Contract | Price Will Drop | Buy Back for Less than Sold |

This imaginative way of trading helps traders from around the globe to participate in the Bitcoin market without needing to hold the actual digital currency. It’s an exciting, albeit risky, avenue to explore the vibrant world of cryptocurrency trading.

Exploring the Volatility of Bitcoin Prices 🔍

Bitcoin’s price rollercoaster can be both exhilarating and nerve-racking. Imagine you’re on a wild ride where one minute you’re at the top, seeing the landscape for miles around, and the next, you’re plunging into a deep valley. This is a lot like tracking the price of Bitcoin – sometimes it shoots up high, and other times, it drops quickly. Why does this happen? A mix of factors like news, investor mood, and even global events can stir up the market. This wild ride isn’t for everyone, but if you’re game, understanding these ups and downs is crucial. It’s a bit like the weather; while we can’t control it, understanding patterns helps us prepare. Just as a wise sailor watches the skies, a smart Bitcoin trader keeps an eye on market trends. For those interested in diving deeper into how cryptocurrency can pave the way for a better future, a visit to https://wikicrypto.news/bitcoin-for-good-how-cryptocurrency-can-change-philanthropy reveals how innovations in Bitcoin not only enhance privacy but also hold the promise to revolutionize philanthropy.

The Impact of Leverage on Your Investments 💸

Leverage is like a double-edged sword when it comes to investing in Bitcoin Futures. Imagine you’re using a small amount of your own money to control a much larger amount in the market. This can make your investment seem like a superhero, capable of delivering big wins with less upfront cash. But, just like in superhero movies, every power comes with its own set of risks. If the market moves against you, the losses can be just as amplified as the gains, making it important to handle this tool with care and understanding.

To navigate the choppy waters of leverage, it’s crucial to wear your life jacket by knowing just how much you can afford to risk. Think of it as setting up a safety net to catch you if you fall. This way, even if the market takes an unexpected turn, your financial health won’t be thrown overboard. By balancing optimism with caution, investors can aim to sail smoothly through the volatile seas of Bitcoin Futures, making the most of leverage’s potential rewards while avoiding its pitfalls. 🚢💰🔍

Strategies to Hedge Your Bitcoin Futures Positions 🛡️

Navigating the unpredictable waters of Bitcoin futures requires a sharp mind and a keen strategy. Think of it as setting up a safety net for your digital coin journey. One effective method is diversification: don’t put all your digital eggs in one basket. Spreading your investments across different financial products can reduce risk since not all investment types move in the same direction at the same time. Another clever move is to set stop-loss orders. This tool acts like a predefined exit strategy for your positions. If the market swings are not in your favor, these orders can help minimize losses by automatically selling at your specified price.

Moreover, constantly updating your strategy with the latest bitcoin software updates suggestions can be a game changer. This way, you’re not just reacting to the market’s ups and downs; you’re staying a step ahead. Also, keeping a close tab on market trends and utilizing both technical and fundamental analysis can refine your hedging strategy. By understanding the market’s underlying currents, you can better anticipate shifts and shield your investments from unexpected storms. While the thrill of bitcoin futures trading has its allure, smart moves and a forward-thinking approach are your best allies in this dynamic arena.

Importance of Staying Informed about Market Trends 📈

Imagine you’re on a big boat, and the way you steer through the big waves—up and down—depends on how well you can predict the weather. Now, think of trading in Bitcoin futures the same way. The better you understand the market’s mood swings, the smoother your journey. Keeping up with market trends isn’t just about watching numbers go up and down. It’s about understanding why they move and how the news, global events, and advancements in technology might affect them. This knowledge is like having a map and compass in the vast sea of digital currency trading.

| Tip | Why It’s Important |

|---|---|

| Read widely | Diverse sources offer a broader view. 📚 |

| Join online communities | You can exchange insights with fellow traders. 💡 |

| Use analytical tools | They help identify trends and patterns. 🔍 |

Many traders have learned the hard way that being in the dark about market shifts can lead to making decisions based on outdated or inaccurate information. This is akin to navigating that big boat in stormy weather without a compass. That’s why it’s critical to stay agile, constantly updating your strategy with the freshest information you can get your hands on. Remember, in the world of Bitcoin futures, knowledge isn’t just power—it’s your lifeline.

Avoiding Common Pitfalls in Bitcoin Futures Trading 🚫

Diving into the world of Bitcoin futures trading 🚫 can be like setting sail in the vast ocean of financial opportunities. It’s a thrilling adventure that promises treasure but also hides lurking dangers beneath the waves. To navigate these waters safely, knowing what mistakes to dodge is like having a map to buried treasure. First off, don’t put all your eggs in one basket. Spreading investments across different opportunities 📊🔍 can soften the blow if the market takes a sudden dive. Another savvy move is to never sail blindly. Setting sail without a clear strategy is like navigating through fog without a compass. Whether it’s a stormy day or smooth sailing, staying calm and not making hasty decisions based on temporary market squalls can save your ship from capsizing. And while on this voyage, there’s a treasure trove of knowledge to be found in educating yourself continuously. The sea of Bitcoin trading is constantly changing, and staying informed about the latest trends 📈 and strategies can make all the difference. For those with a keen interest in making their investment journey impactful, exploring areas like bitcoin and quantum computing suggestions can offer insightful connections between cutting-edge technology and financial growth, steering clear of the common pitfalls requires a mix of wisdom, courage, and a bit of caution. By keeping these guidelines close, your venture into Bitcoin futures can lead to serene harbors rather than stormy seas.