🚀 the Rise of Ethereum: a Historical Journey

Imagine a digital world where a new kind of money exists. This isn’t like any money we’ve used before because it’s made for the internet age. It’s called Ethereum. When it first appeared, many people didn’t know what to make of it. But, as they understood its potential, to do so much more than just buy and sell things, interest began to grow. Ethereum could handle contracts, share information without a hitch, and let creators build their own projects on top of its technology. This wasn’t just another digital currency; it was a whole new platform.

As more folks caught on, the excitement started to bubble. Big news events, like when a famous company said they liked Ethereum, or when it got easier for people to buy and invest in it, made its value jump. But it wasn’t just the good news that drew attention. Sometimes, people worried about new rules that could change how things worked or about the system getting too clogged up. In these early days, Ethereum’s journey was like a rollercoaster, thrilling and full of ups and downs.

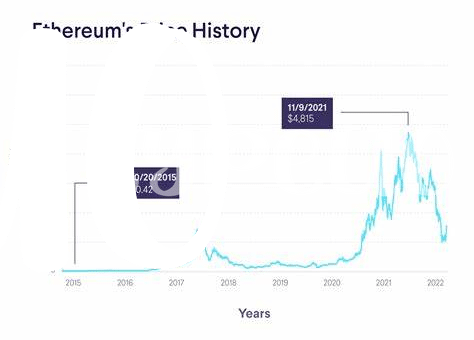

Here’s a simple look at what happened with Ethereum’s value over time with some key highlights:

| Year | Important Events | Value Change |

|---|---|---|

| 2015 | Ethereum Launch | 💹 Start |

| 2016 | Interest from Big Companies | 📈 Rise |

| 2017 | ICO Craze | 🚀 Sky-high |

| 2018 | Market Correction | 📉 Dip |

| 2021 | New Technologies and Upgrades | 📈 Significant Rise |

It’s a story of growth, learning, and adaptation. From just an idea to a groundbreaking technology that keeps on evolving. Every chapter in Ethereum’s history teaches us something new, making us eager to see where this journey leads next.

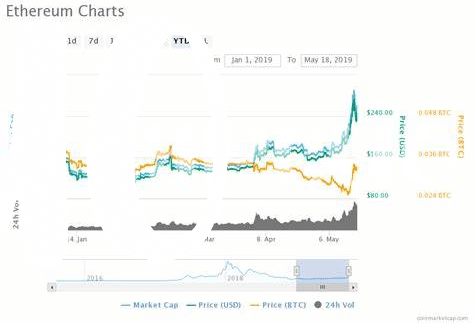

💥 Impact of Major Events on Ethereum’s Value

Ethereum, like a thrilling rollercoaster, has seen its value ebb and flow due to various world events. Imagine a day where the news announces a major company investing in Ethereum, and suddenly, more people want a piece of this digital gold, pushing its value up. On the other hand, laws or regulations tightening around cryptocurrencies in a country can create uncertainty, leading folks to sell off their Ethereum, making its value dip. It’s a dance of supply and demand, influenced by the world’s heartbeat. For those looking to dive into the world of cryptocurrencies, it might be useful to learn how to get started. A helpful guide can be found at https://wikicrypto.news/how-to-buy-bitcoin-a-step-by-step-guide, where beginners can take their first steps securely. Understanding these fluctuations and the reasons behind them isn’t just about watching numbers change; it’s about seeing the bigger picture of how global events play a role in our digital wallets.

📈 Analyzing Peaks: What Sent Prices Sky-high?

Have you ever wondered why sometimes the price of Ethereum, the digital money you might use to buy things online or invest in, suddenly shoots up, making headlines? It’s a bit like a rocket 🚀 taking off, and there are a few key reasons behind these exciting jumps. Sometimes, it’s because a lot of people start believing in the power of Ethereum and want to be part of its journey, thinking it’s going to be very important in the future. Other times, it’s because big companies decide to use Ethereum for their projects, making everyone else see it as valuable. And then there are moments when the rules of the game change, like when the way Ethereum works gets an upgrade, making it faster or more secure.

Understanding these high points isn’t just about cheering from the sidelines. It’s a way to peek into why people and big players in the market think Ethereum is a big deal at certain moments. By looking at the reasons behind the big jumps in price, we can get a sense of what makes Ethereum special to so many people. Whether it’s a new technology that makes it better, or a big endorsement from a famous company, these peaks in price are like clues in a treasure hunt 🕵️♂️, showing us what to look out for if we’re trying to guess where Ethereum might go next.

📉 Understanding the Dips: More Than Just Bad News

When Ethereum’s prices take a dip, it’s easy to think it’s all due to troubling news or a bad vibe in the market. But look closer, and you’ll see there’s more to these downturns than meets the eye. Think of it like a roller coaster – sure, the downs are scary, but they’re just part of the ride. Various factors come into play, from changes in rules around the world that affect how people can buy and sell Ethereum, to the natural ups and downs of any financial market. Sometimes, even a big sale by a single investor can make the price drop. It’s all part of the ebb and flow of the cryptocurrency world.

In understanding these dips, we also come across opportunities. For those looking to manage their digital assets wisely, timing can be everything. Knowing when to hold on tight and when to convert your digital currency can make a big difference in your wallet. For more guidance on safely managing your funds, learn about how to withdraw bitcoins to cash. So, while the dips might seem daunting, they also teach us about resilience and the importance of a good strategy in navigating the crypto seas.

🔍 Predictive Factors: What Moves Ethereum’s Price?

Like a ship on the sea, Ethereum’s price doesn’t just move on its own; it’s pushed by winds and pulled by currents, some you can see and some you can’t. 🌬️🌊 Let’s talk about what steers this ship. First up, we’ve got the big tech updates or changes in “rules” that can make Ethereum more appealing or sometimes more challenging to use. Then there’s the buzz—what people are talking about. This can range from influential folks singing Ethereum’s praises to news spreading fear. And let’s not forget the rollercoaster ride that is the world of cryptocurrencies in general. When other digital coins are having a wild time, Ethereum often joins the ride. Guess what? Even situations completely outside the crypto world, like changes in how much things cost or big decisions made by governments, can make waves big enough to rock Ethereum’s price.

Imagine diving into a pool where each splash affects how high you jump off the diving board. That’s Ethereum’s price for you! To understand and maybe even guess what’s coming next, it helps to keep an eye on a few key things. Here’s a simple table to break it down:

| Factor | Impact on Ethereum’s Price |

|---|---|

| Technology Updates | 📈 Increases with positive changes, 📉 decreases if it gets too complicated |

| Market Sentiment | 📈 Surges with positive buzz, 📉 declines with negative news |

| Global Economy | 🌍 Varies with economic stability or instability |

| Other Cryptocurrencies | 🔗 Often moves in tandem with Bitcoin and others |

By keeping tabs on these factors, we’re a bit like seafarers studying the weather before setting sail—a must for those looking to navigate Ethereum’s choppy waters.

📚 Learning from the Past to Forecast the Future

Just like flipping through an old photo album can tell us stories of the past, tracking Ethereum’s journey offers vital clues for what lies ahead. In the dynamic world of cryptocurrencies, patterns tend to reappear, painting a roadmap for future possibilities. Taking a closer look at the past, we’ve witnessed how certain events, innovations, and market moods have steered Ethereum’s price. 📊 By connecting the dots between past happenings and price movements, we gather a treasure trove of insights. This wisdom is not about predicting the exact price at a future date but understanding the ebb and flow of the market, preparing us for waves before they hit.

Diving into Ethereum’s history, we see a digital currency influenced by massive spikes 🚀 in interest, technological advancements, and shifts in global finance. But it’s not just the highs that teach us; the lows have their lessons too, revealing resilience and areas for growth. To navigate the future, harnessing these learnings is crucial. By analyzing how past events have shaped Ethereum’s value, we can make educated guesses about its future direction. While the crystal ball of cryptocurrency remains cloudy, looking back is akin to shining a flashlight forward in the dark. If you’re curious about diving deeper into the crypto world, especially understanding what is bitcoin, these insights can be your guide, helping you to make informed decisions in an unpredictable market.