🕵️♂️ Understand the Basics of Bitcoin and Cash Conversion

Before we dive into turning bits into bucks, let’s start with the basics. Imagine you’ve got a digital piggy bank called Bitcoin – it’s like invisible money that lives on the internet. Now, you need to turn this invisible money into cash, the kind you can hold in your hand or stash in your real piggy bank. It’s a bit like exchanging foreign money when you come back from a holiday, but instead of visiting a currency exchange, you use special online services.

| Step | Description |

|---|---|

| 1 | Understand Bitcoin: It’s digital currency, a bit like the coins and notes in your wallet, but virtual. |

| 2 | Understand Cash Conversion: Turning your Bitcoin into cash means exchanging your digital coins for physical money. |

Choosing the right moment and place to make this magic happen is crucial. You don’t want to play a guessing game with your hard-earned cash, so getting a little familiar with how it all works is your first mission. Finding a safe and trustworthy service will be your treasure map in this adventure of converting those digital coins back into cold, hard cash. It’s all about taking those first baby steps into understanding this sparkling world of digital currency conversion.

🔒 Choosing a Safe and Trustworthy Conversion Service

In the world of digital money, taking the right steps to safeguard your investments is key. Imagine you’ve ventured into the bitcoin space, excited by its potential. Now, you’re looking to convert some of that digital treasure into cash, but where do you start? The foundation of a smooth conversion process rests on selecting a conversion service that’s as reliable as a vault. This initial choice is more than just ticking boxes; it’s about doing a bit of detective work to ensure your chosen platform is fortified against the digital equivalent of a bank heist. Look for services with sterling reputations, verified by user reviews and recognized in the community. A prime focus should be on their security measures; do they provide two-factor authentication (2FA), and are there safeguards against unauthorized access? Additionally, understanding their fee structure is crucial to avoid any unpleasant surprises. Remember, your peace of mind is priceless, but it shouldn’t cost you an arm and a leg in fees. To further secure your investment journey, consider visiting https://wikicrypto.news/maximizing-security-when-buying-litecoin-online, a resource that dives deeply into maximizing security in online transactions. At the end of the day, your goal is to ensure that the only surprises you encounter are happy ones, like finding an extra chocolate in the box you thought was empty.

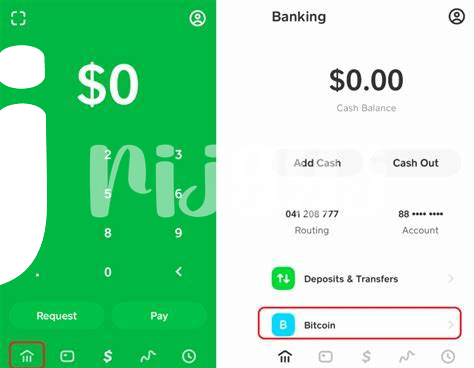

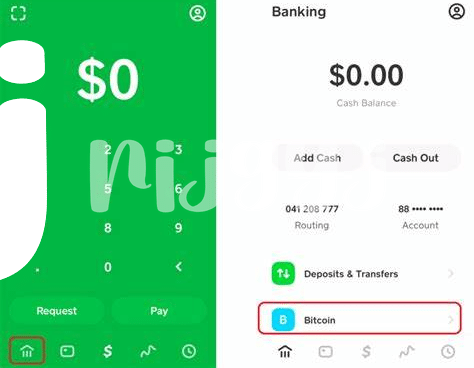

💱 Setting up Your Account for the Conversion Process

Once you pick a spot you feel good about sharing your digital coins with, the next step is like setting up camp, but instead of tents and fires, you’re setting up a spot online where you can swap your bitcoins for good, old-fashioned cash. Imagine opening a new checking account, but online, and specifically for your digital money. First up, you’ll go through a signing-up dance, providing some basic personal info — just like when you create a social media profile, but maybe with a few extra steps to prove you are who you say you are. This might mean snapping a quick selfie or sending over a photo of your ID. 🆔💻 Once you’ve jumped through those hoops, it’s all about making sure your new digital wallet is safe and sound. Think of a super-secret password, one that’s as unique as your favorite pizza topping combo. Then, pop in some security questions, double-check your email, maybe even set up something called two-factor authentication, which is like having a secret handshake with your account. Doing all this might seem like a bunch of steps, but it’s all to ensure that when you’re ready to turn those digital coins into cash, you can do it smoothly, safely, and without any hitches. 🛡️💰

📈 Deciding the Right Moment to Convert Your Bitcoins

Knowing the best time to turn your digital money into real cash can feel a bit like trying to hit a moving target. It’s all about watching and waiting for that perfect moment when the value goes up, so you get more bang for your buck. But here’s the trick: the world of digital currencies, like Bitcoin, is always on the move, changing day by day. This means staying alert and informed is your best tool. Now, you might be wondering, what is bitcoin? It’s essentially digital money that can grow in value over time, just like saving up coins in a piggy bank that gets bigger. However, understanding when to open that piggy bank requires a bit of strategy. Keeping an eye on the market trends is key, as you don’t want to make the swap when values are low. Think of it as selling a toy car from your collection; you wouldn’t want to part with it when it’s not worth much, right? Instead, you wait for the moment when everyone wants it, and its price skyrockets. By doing your homework and staying patient, you can significantly increase your chances of getting a better deal for your digital treasure.

💸 Initiating the Conversion from Bitcoin to Cash

So, you’ve reached the thrilling moment where your digital currency journey meets the real world—you’re ready to turn those virtual coins into actual cash in your pocket. The first move is pretty straightforward; you hop onto your chosen platform and hit the button to start the conversion. But it’s not just about clicking through; you need to enter the amount of Bitcoin you wish to change into dollars, euros, or whatever your local money might be. Imagine it like telling a money exchange booth how much foreign currency you want to sell.

Here’s a friendly table to guide you through:

| Step | Action | Tip |

|---|---|---|

| 1 | Log into your conversion service. | 🔐 Make sure your connection is secure. |

| 2 | Select “Sell” or “Convert.” | 💡 Know your service’s fees. |

| 3 | Enter the Bitcoin amount. | 🧮 Double-check the numbers. |

| 4 | Confirm the transaction. | 📈 Review the conversion rate. |

Once you’ve confirmed everything’s correct and hit that final confirm button, the gears start turning. Your digital coins begin their journey through the digital ether, transforming into a format recognized by your local ATMs and banks. It feels like magic, but it’s really just technology working to bridge the gap between the future of currency and the familiar comfort of cold, hard cash.

🏦 Withdrawing Your Cash Safely from the Service

Once you’ve made the leap and converted your hard-earned bitcoins into cash, the final step is getting that cash safely into your hands. Think of this part as the last mile in a marathon; you’ve come this far, and now it’s all about crossing the finish line without any hiccups. Start by selecting the withdrawal method that feels safest and most convenient for you. This could be transferring the money directly to your bank account, using a wire transfer, or even opting for a check, if the service offers it. Pay close attention to the processing times and any fees that might eat into your cash. Security is paramount here, so ensure all your details are correct to avoid delays. Remember, it’s your money on the line, so double-checking doesn’t hurt. If you’re also keen on exploring other cryptos with potential, like turning your hand at mining, peep at this seamless way to dive in: how mine litecoin. Just like withdrawing cash, venturing into new cryptocurrencies should be done with care and thought, ensuring you’re setting yourself up for success without facing unnecessary risks.