🌐 a Quick Dive into Ethereum and Bitcoin Basics

In the world of digital money, two names stand tall above the rest: Ethereum and Bitcoin. Imagine them as two superheroes in the vast universe of cryptocurrencies, each with their own special powers. Bitcoin, the first of its kind, is like the gold standard of digital currency. It’s like having a virtual treasure chest, designed for you to keep your digital gold safe and sound. Ethereum, on the other hand, is like a wizard with a magic wand. It does more than just store value; it allows you to create and power up various digital contracts and applications on its network.

| Feature | Bitcoin | Ethereum |

|---|---|---|

| Launch Year | 2009 | 2015 |

| Main Purpose | Digital Currency | Smart Contracts & DApps |

| Block Time | ~10 minutes | ~13 seconds |

| Supply Limit | 21 million | No limit |

The magic of these digital wonders doesn’t just stop at what they are today; it’s about the possibilities they open for tomorrow. Whether it’s about sending money across the globe without hefty fees or creating decentralized applications, these two are laying the groundwork for a future where our financial and digital lives are more in our control.

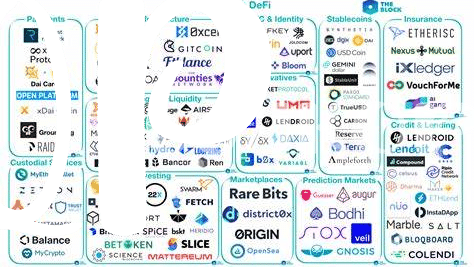

💰 How They Fuel the World of Defi

Imagine a world where you can lend, borrow, and save without ever walking into a bank. That’s the magic Ethereum and Bitcoin are bringing to finance, sparking a revolution known as decentralized finance, or DeFi for short. Ethereum, with its versatile platform, enables developers to create intricate financial services that can do almost anything banks can do, but without the middleman. On the other hand, Bitcoin, often seen as digital gold, is making its mark by allowing secure, peer-to-peer transactions worldwide. While Bitcoin laid the groundwork for this financial upheaval, Ethereum is taking it to the next level with its capability to program money and contracts that execute automatically under certain conditions. This dynamic duo is fueling a shift towards a more open, transparent, and accessible financial system. For a deeper dive into how Ethereum might be reshaping the concept of wealth storage and offering innovative solutions compared to Bitcoin, check out https://wikicrypto.news/innovative-wealth-storage-is-ethereum-the-new-bitcoin. Here, the threshold of innovation in DeFi is just the beginning, inviting everyone to be a part of the financial world’s future.

🏃♂️ Speed and Efficiency Showdown: Ethereum Vs. Bitcoin

When we put Ethereum and Bitcoin side by side, it’s like comparing a speedy gazelle to a sturdy tortoise. Ethereum aims to process transactions quicker, aiming for more actions packed into a shorter time. Imagine sending a letter that reaches in hours versus days – that’s Ethereum pushing the envelope. On the other hand, Bitcoin, the first of its kind, moves with more caution, emphasizing reliability over speed. It’s the old friend you can always count on, but might not always be the first to show up.

🔧🚀 However, being fast isn’t just about bragging rights. It matters a lot when you’re trying to do more in the bustling world of digital finance, or DeFi as it’s known. Ethereum’s approach lets users trade, lend, and borrow in the blink of an eye. 💨 But, it’s not just about speed. Efficiency matters, too. Think of it as trying to run a marathon. It’s not just about how fast you can go, but how smoothly you can maintain your pace without tiring out. Ethereum is working hard on this, making sure every step in the race counts, while Bitcoin continues to prove that taking your time can sometimes be just as impactful.

💡 Innovations and Upgrades: Ethereum’s Ace Card?

In the fast-evolving world of digital currencies, Ethereum seems to be playing a game of chess, constantly introducing innovations and upgrades that could very well be its ace card against Bitcoin. While Bitcoin laid the groundwork for the crypto revolution, Ethereum has taken it a step further with its smart contract capabilities, fundamentally changing how applications are built on the blockchain. This has not only opened the door to a myriad of decentralized applications but has also positioned Ethereum as the go-to platform for developers looking to push the boundaries of what’s possible in the digital space.

For those curious about the specifics of how Ethereum’s smart contracts pave the way for more intricate financial services, including the realm of Decentralized Finance (DeFi), a detailed comparison can be illuminating. By evaluating bitcoin lending platforms and interest accounts versus ethereum, one can grasp the sheer extent of Ethereum’s adaptability and potential for innovation. This continuous stream of upgrades and the active developer community not only make Ethereum a formidable player in terms of speed and efficiency but also highlight its commitment to security and decentralization, essential aspects for long-term supremacy in the DeFi space.

🛡️ Security and Decentralization: Who Wins?

When we talk about keeping our digital treasures safe and ensuring everyone plays by the same rules, Ethereum and Bitcoin both step up to the plate. Think of them like two superheroes, each with their own strengths. Ethereum, with its ever-evolving tech and smart contracts, feels like it’s constantly donning new gadgets to better protect and serve. On the other hand, Bitcoin sticks to its guns, relying on its tried-and-tested blockchain to keep things secure and decentralized. It’s like the wise, seasoned hero that knows its strength lies in its simplicity and reliability.

Yet, when we peek under the hood, the differences start to shimmer. Ethereum aims to be a platform where apps can run without the risk of downtime, fraud, or interference. It’s beefing up its security and decentralization game with the shift to Proof of Stake (PoS) through Ethereum 2.0. Bitcoin, meanwhile, prides itself on being the original blockchain, offering a level of security and decentralization that’s been battle-tested for years. It’s like a robust vault that’s been keeping its contents safe longer than anyone else in the game.

| Feature | Ethereum | Bitcoin |

|---|---|---|

| Security Enhancements | Upgrading to Ethereum 2.0 with PoS | Staying with Proof of Work (PoW) |

| Decentralization Level | High with plans to increase through sharding | Very High, with widespread mining distribution |

| Smart Contracts | Yes, facilitating complex agreements | No, primarily a peer-to-peer cash system |

| Network Upgrades | Frequent, to improve functionality and security | Less frequent, focusing on stability and security |

The real question might not be about who wins but how each plays a unique role in the vast and evolving landscape of digital currencies.

🚀 Future Predictions: the Race for Defi Supremacy

Peering into the crystal ball of decentralized finance (DeFi), we foresee an epic competition between Ethereum and Bitcoin. Ethereum, with its smart contracts and robust ecosystem for building DeFi apps, seems to be sprinting ahead. It’s like Ethereum is the versatile athlete, always finding new ways to perform. On the other hand, Bitcoin, often called digital gold, excels in its simplicity and security, offering a solid foundation as a leveraging bitcoin for cross-border payments: benefits and challenges versus ethereum. This unique dynamic sets the stage for a fascinating race, where each has its strengths playing to different facets of the DeFi realm.

As we move forward, Ethereum’s continuous innovations and scalability solutions might give it the edge in attracting developers and projects. Yet, Bitcoin’s unmatched security and growing adoption as a store of value cannot be ignored. The outcome might not boil down to a simple win-lose scenario. Instead, we might see a DeFi ecosystem where both Ethereum and Bitcoin hold supremacy in their unique domains, complementing rather than competing against each other. With each development in the space, we’re getting a clearer picture of how these two giants could shape the future of finance.