🤔 Unraveling the Mystery: What Is Liquidity?

Imagine you walk into a huge shopping mall with tons of stores, all offering cool gadgets and trendy clothes. Now, think of how easy it is for you to buy what you want or sell something you no longer need. That ease, that smoothness of buying and selling, is what we call liquidity. It’s like being at a water park with slides that have a constant flow of water allowing you to glide down without getting stuck. In the world of finance, and more specifically within Bitcoin lending platforms and Ethereum accounts, liquidity means how simple it is to convert your digital assets into cash or other assets without causing a big change in their price. It’s crucial because it affects how quickly and efficiently you can move in and out of your investments without losing value. Just like at the water park, you want a good flow; in the digital finance world, that good flow means having the ability to act fast and effectively.

| Aspect | Importance in Digital Finance |

|---|---|

| Quick Transactions | Allows for fast buying/selling without significant delays. |

| Stable Prices | Ensures that assets can be exchanged without big price drops. |

| Efficiency | Makes investing seamless and user-friendly. |

💸 Bitcoin Lending Platforms: the Basics

Imagine diving into the world of digital money, where Bitcoin lending platforms shine as bustling marketplaces. These platforms act like pioneering explorers, providing a space where people can lend their Bitcoin to others. It’s a bit like lending a book to a friend, but in this case, you lend digital money, and in return, you get some extra money back as a ‘thank you’ – that extra is called interest. The idea sounds simple, right? But it’s a revolutionary step in how we think about managing and growing our digital wallets.

These lending platforms make it easier for folks who have Bitcoin lying around to put it to work. Instead of letting their digital coins collect virtual dust, they can lend them out and earn interest. It’s a win-win: borrowers get access to Bitcoin they need for their projects or investments, and lenders get a little extra Bitcoin without having to buy more or mine it. This concept isn’t just about making money; it’s about creating a fluid, or ‘liquid’, environment where Bitcoin can flow freely, helping the digital economy grow and thrive.

🌐 Ethereum Accounts: a Different Approach

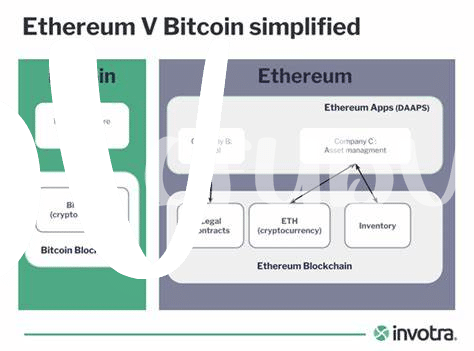

Ethereum takes a unique spin on the digital finance world, with accounts that offer a different kind of playground for your money. Imagine Ethereum like a giant LEGO set, where each piece can be built and rebuilt into whatever financial product you desire. Here, liquidity isn’t just about how quickly you can turn your assets into cash. It’s also about flexibility and the ability to morph your investments into new shapes. Through smart contracts – think of them as self-executing contracts with the terms directly written into code – Ethereum allows for a more dynamic and programmable financial environment. This not only opens up doors for innovative financial products but also makes it easier for folks to tailor their financial strategy to fit their needs perfectly. As we dive into this futuristic finance landscape, remember, it’s not just about speed; it’s about making your money work for you in new and exciting ways.

🔄 Comparing Liquidity: Bitcoin Platforms Vs Ethereum

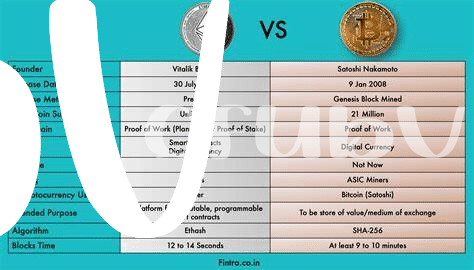

Diving into the heart of the matter, when we examine Bitcoin and Ethereum in the realm of liquidity, it’s like comparing apples and oranges because of their distinct landscapes. Bitcoin lending platforms are rather straightforward; think of them like traditional banks, but for Bitcoin. Users lend their Bitcoins and, in return, get interest payments. It’s a relatively simple concept with a clear liquidity path – your Bitcoins are locked up for a while, and you get more Bitcoin back. On the other hand, Ethereum takes a bit of a different approach, opening up a world of decentralized finance (DeFi) where liquidity isn’t just about lending and earning interest. It’s about participating in a vast network where Ethereum acts as fuel for a variety of financial activities, from lending to creating complex financial products. This difference in approach means that liquidity can sometimes feel more fluid in Ethereum’s ecosystem because it’s not just about lending; it’s about being part of an expansive financial system. However, this also introduces a level of complexity and, sometimes, unpredictability. In truth, both platforms offer unique opportunities and challenges for liquidity. For those curious about how Ethereum extends its benefits beyond mere transactions, bitcoin as a modern-day store of value versus ethereum sheds light on its broader utility. The divergent paths of Bitcoin and Ethereum illustrate the evolving landscape of digital finance, showcasing how different approaches to liquidity can coexist, each catering to diverse needs and expectations within the cryptocurrency world.

🔍 the Risks: What You Need to Know

Venturing into the world of Bitcoin lending platforms and Ethereum accounts feels like diving into a sea with hidden currents. The promise of high returns has many swimming towards these options, yet, like any vast ocean, there are risks lurking beneath the surface that could pull any unwary investor under. One of the most significant hazards is the market’s volatility; prices can skyrocket or plummet within hours, making it a double-edged sword for liquidity. Furthermore, there’s the issue of security. Despite the robust tech foundations, these platforms are not immune to cyberattacks, which could see individuals losing access to their digital wallets or, worse, their entire investments. Regulatory changes also pose a formidable tide to navigate. Governments and financial bodies worldwide are still debating how to handle cryptocurrencies, leading to uncertain regulations that could impact their use and value. It’s like setting sail without knowing if the wind will be in your favor or if you’ll be caught in a storm.

| Risk Factor | Impact on Investors |

|---|---|

| Market Volatility | High risk of loss from rapid price changes |

| Security Vulnerabilities | Potential loss of investment from cyberattacks |

| Regulatory Changes | Uncertainty and potential restrictions for users |

Understanding these risks doesn’t mean steering clear of Bitcoin lending platforms or Ethereum accounts but rather navigating these waters with a compass of knowledge and caution.

🚀 Future Predictions: Where Are We Heading?

Looking ahead, the buzz around Bitcoin lending platforms and Ethereum accounts is only going to grow louder. These digital finance tools are charting a course towards an innovative future where anyone, anywhere, can access funds or invest with just a click. As we delve deeper, it becomes clear that the flexibility and efficiency offered might well set the new standard for personal and business finance. But what’s truly exciting is the potential for these platforms to revolutionize how we think about money itself. With advancements in technology and a growing acceptance of cryptocurrencies in mainstream finance, we could see a world where transactions are faster, cheaper, and more secure. This journey, however, is not without its bumps. Major concerns such as regulatory challenges and market volatility remain. Yet, the promise of a more inclusive financial system keeps the momentum going. For those considering leveraging bitcoin for cross-border payments: benefits and challenges versus ethereum or adopting bitcoin payment solutions for small businesses versus ethereum, the future is bright, but it pays to stay informed and cautious. As we advance, keeping a close eye on these developments will be key to navigating the exciting world of digital finance.