Implement Robust Kyc Procedures for All Transactions 🛡️

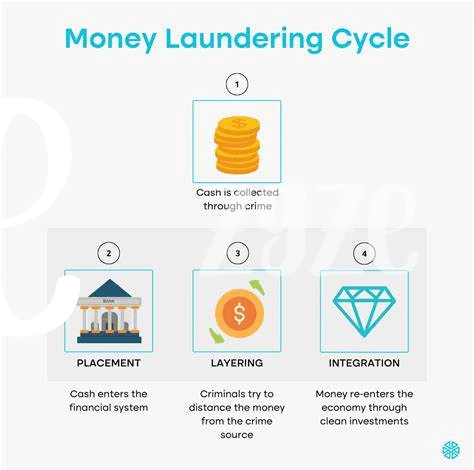

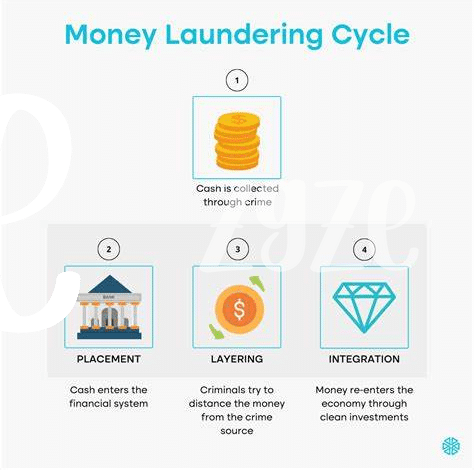

To ensure compliance and security in the Barbados Bitcoin sector, implementing robust KYC procedures for all transactions is crucial. By verifying the identity of customers and monitoring their transactions, businesses can mitigate the risk of illegal activities such as money laundering or terrorist financing. KYC procedures provide a layer of protection for both the company and its clients, fostering trust and transparency within the industry. This step not only helps in meeting regulatory requirements but also strengthens the overall resilience of the business against financial crimes.

Train Staff on Aml Regulations and Reporting Requirements 📚

At the core of every successful AML compliance program lies the crucial step of educating staff members about AML regulations and reporting requirements. By providing comprehensive training sessions, employees gain the necessary knowledge and skills to identify suspicious activities, understand compliance protocols, and adhere to reporting guidelines. Through interactive workshops and real-world case studies, staff members can grasp the importance of their role in preventing money laundering and terrorist financing within the Bitcoin sector, fostering a culture of vigilance and regulatory adherence. Continuous education ensures that all team members remain up-to-date with the evolving landscape of AML regulations, empowering them to make informed decisions and uphold the integrity of the organization.

Conduct Regular Risk Assessments and Audits 🔍

To effectively ensure AML compliance in the Barbados Bitcoin sector, conducting regular risk assessments and audits plays a crucial role. By consistently evaluating potential vulnerabilities and identifying areas of improvement, businesses can proactively address any compliance gaps and mitigate risks. These assessments provide valuable insights into the operations, helping organizations stay ahead of evolving regulatory requirements and industry trends. By integrating audits into regular compliance practices, companies can maintain transparency, uphold integrity, and demonstrate a commitment to robust AML protocols.

Utilize Advanced Transaction Monitoring Tools 📈

When it comes to maintaining compliance in the Barbados Bitcoin sector, one crucial aspect is the effective utilization of cutting-edge transaction monitoring tools. These advanced tools play a vital role in flagging any suspicious activities or transactions that may potentially involve money laundering or other illicit activities, helping companies stay ahead of potential risks and comply with regulations. By harnessing the power of sophisticated monitoring tools, businesses can enhance their ability to detect and prevent financial crimes, safeguarding their operations and reputation in the rapidly evolving digital landscape.

For further insights on navigating the challenges and solutions related to Bitcoin anti-money laundering (AML) regulations, particularly in Barbados, you can explore this comprehensive resource on bitcoin AML regulations in Bolivia offered by Wikicrypto.news.

Collaborate with Local Regulators for Compliance Updates 🤝

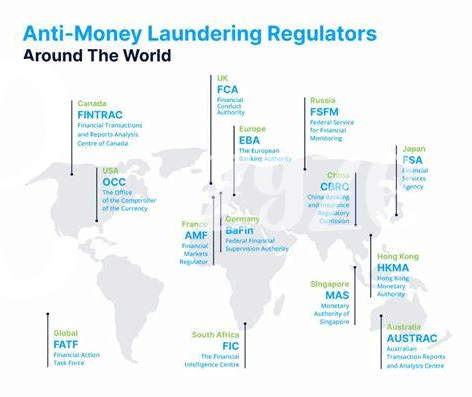

Collaborating closely with local regulators is paramount in ensuring compliance updates are promptly integrated into operational practices. By maintaining open lines of communication and a proactive approach to regulatory changes, businesses in the Bitcoin sector can stay ahead of evolving AML requirements. This partnership not only safeguards against potential violations but also fosters a culture of transparency and trust within the industry. Establishing a collaborative relationship with regulators demonstrates a commitment to upholding the highest standards of compliance, ultimately benefiting both the business and the regulatory authorities.

Stay Informed on Global Aml Best Practices 🌎

Staying informed on global AML best practices is crucial for maintaining compliance in the ever-evolving regulatory landscape. By keeping abreast of emerging trends and regulatory changes worldwide, businesses in the Barbados Bitcoin sector can proactively adapt their AML policies and procedures to meet international standards. This proactive approach not only enhances compliance efforts but also demonstrates a commitment to combating money laundering and terrorist financing on a global scale. In a rapidly changing environment, continuous education and awareness of best practices are key to safeguarding the integrity of financial systems and protecting against illicit activities.

Bitcoin Anti-Money Laundering (AML) Regulations in Bangladesh