The Rise of Bitcoin in Bangladesh 🚀

In recent years, the adoption of digital currencies like Bitcoin has been steadily increasing in Bangladesh. The tech-savvy population, coupled with growing interest in alternative financial systems, has contributed to the rise of Bitcoin transactions within the country. Despite initial skepticism, more individuals and businesses are exploring the potential benefits and convenience that Bitcoin offers in a rapidly digitizing economy. As awareness and acceptance continue to expand, Bitcoin is poised to play a significant role in reshaping the financial landscape of Bangladesh.

Impact of Aml Regulations on Bitcoin 💼

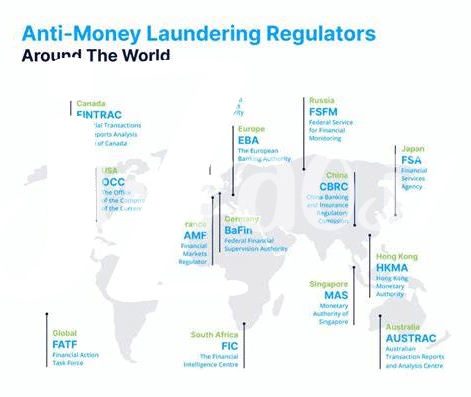

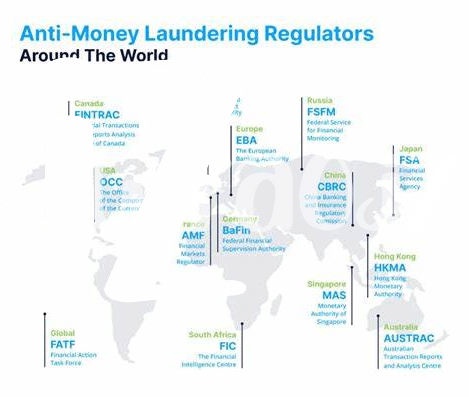

The regulatory landscape surrounding Bitcoin in Bangladesh has undergone significant transformations due to the implementation of AML regulations. These regulations have brought about a notable impact on how Bitcoin is used and perceived within the country. Financial institutions are now required to adhere to stricter compliance measures, affecting the accessibility and ease of conducting Bitcoin-related transactions. While these regulations aim to curb illicit activities and promote transparency, they have posed challenges for both users and businesses operating in the cryptocurrency space. Adapting to these regulatory changes is crucial for the sustainable growth and acceptance of Bitcoin in Bangladesh.

Challenges Faced by Bitcoin Users 💔

Challenges Faced by Bitcoin Users in Bangladesh often stem from the lack of clear regulatory guidelines, leading to uncertainty and potential risks in transactions. Additionally, the fluctuating value of Bitcoin poses a challenge for users seeking to store wealth effectively. Limited acceptance of Bitcoin for goods and services in the country further complicates its practical use. Moreover, security concerns related to hacking and fraud also contribute to the challenges faced by Bitcoin users in Bangladesh. These hurdles make it essential for users to adopt stringent security measures and stay informed about the evolving landscape of Bitcoin regulations to navigate these obstacles effectively.

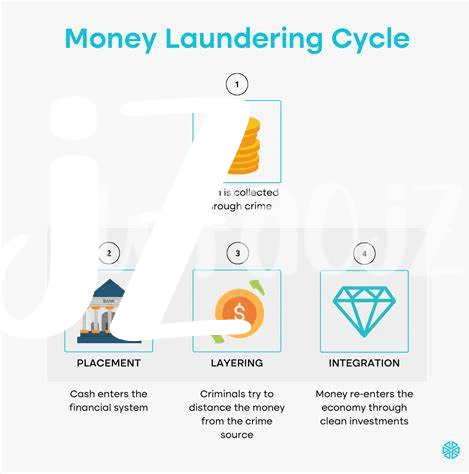

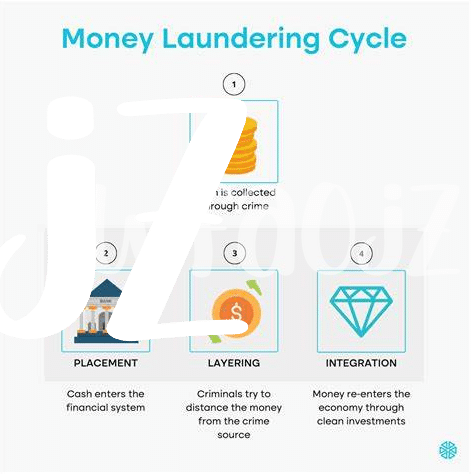

Regulatory Solutions to Combat Money Laundering 🛡️

Regulatory Solutions to Combat Money Laundering in the realm of Bitcoin are essential for ensuring the integrity of financial transactions. By implementing robust measures such as enhanced due diligence, transaction monitoring, and Know Your Customer (KYC) protocols, authorities can effectively track and deter illicit activities within the cryptocurrency space. These proactive steps play a crucial role in safeguarding the legitimacy of Bitcoin transactions and fostering a secure environment for users and investors. To delve deeper into the impact of AML laws on Bitcoin in Bangladesh, explore the insights provided in this comprehensive article on the **[bitcoin anti-money laundering (AML) regulations in Belize](https://wikicrypto.news/impact-of-aml-laws-on-bitcoin-transactions-in-bahamas)**.

Implementing Effective Enforcement Strategies 🔍

Enforcement Strategies are key in ensuring that AML regulations are upheld effectively. To achieve this, a multi-faceted approach is essential, involving collaboration between regulatory bodies, financial institutions, and Bitcoin platforms. Establishing clear guidelines and robust monitoring systems can help in identifying suspicious activities promptly. Additionally, leveraging technology such as blockchain analytics and artificial intelligence can enhance the efficiency of enforcement efforts. Continuous training and capacity-building programs are also crucial to ensure that all stakeholders are equipped with the necessary knowledge and tools to combat money laundering effectively. By implementing these comprehensive enforcement strategies, Bangladesh can strengthen its regulatory framework and mitigate the risks associated with Bitcoin transactions.

Future Outlook for Bitcoin Amid Regulations 🌐

As the regulatory landscape continues to evolve, the future outlook for Bitcoin amid regulations in Bangladesh is a topic of keen interest. With ongoing developments in AML regulations, there is a growing need for stakeholders to adapt and engage proactively in compliance measures. The intersection of innovation and regulation presents both challenges and opportunities for the cryptocurrency space, shaping how Bitcoin is perceived and utilized in the country.

For a deeper dive into Bitcoin AML regulations in different jurisdictions, such as Belarus and Bahamas, you can explore the intricacies here: Bitcoin Anti-Money Laundering (AML) Regulations in Belarus and Bitcoin Anti-Money Laundering (AML) Regulations in Bahamas.