🌍 Understanding Global Remittance: a Brief Overview

Imagine sending money to your family across the sea, to a place where every dollar is a lifeline. This is the essence of global remittance 🌏💸 – a vital support system for families worldwide. People working far from their homeland often send money back to support their loved ones. However, this isn’t as simple as handing over cash. Traditional methods involve banks or services that charge fees, sometimes eating into the hard-earned money that could have been more helpful at home. It’s a process familiar to many, connecting hearts across distances through the lifeline of financial support. To understand its impact, consider that millions depend on these funds for daily living, education, and healthcare. Remittances aren’t just transactions; they’re bonds that stretch across borders, binding the globe in a web of shared responsibility and care.

| Important Component | Description |

|---|---|

| Global Remittance | The process of sending money from one country to another, often by migrants to support family back home. |

| Traditional Methods | Using banks or specific money transfer services, which often include high fees. |

💸 the High Cost of Traditional Money Transfers

When people move to different countries to work, they often need to send money back home. Until recently, this process was pricey and slow. Traditional ways of sending money across borders involve banks or services that charge a lot. These costs can really add up, especially for those earning modest wages. Just imagine setting aside some of your hard-earned money to help your family back home, only to see a chunk of it disappear in fees.

What’s more, it’s not just the high fees that are a pain. The waiting game adds to the frustration. Sometimes, it takes days for the money to reach loved ones in need. And for families living in remote areas, getting access to the transferred money can be another hurdle. It’s clear that the traditional system has its flaws, making every penny and every second count for people working far from home.

🌐 Introduction to Bitcoin: a Digital Currency Revolution

Imagine a kind of money that isn’t bound by borders or banks, that you can send to anyone, anywhere, with just a tap on your phone. That’s what we’re talking about when we mention Bitcoin. Born from the digital world, it allows us to send value directly to one another, without any intermediaries charging extra fees or causing delays. This isn’t just an idea anymore; it’s a currency that lives on the internet, ready to be used by anyone with access to it.

The beauty of Bitcoin lies in its simplicity and its revolutionary approach to money. You can think of it as digital cash that doesn’t need a wallet, but rather, a digital one. Moving money becomes as easy as sending an email, breaking down financial barriers and giving power back to the people, especially those working far from home. With Bitcoin, the control shifts from big financial institutions to individuals, making it a tool not just for investment, but for daily transactions and savings.

💡 How Bitcoin Changes the Game for Migrants

For people moving to new countries for work, sending money home has always been a pricey puzzle. Traditional methods are not just slow but also gulp down a good chunk of hard-earned money in fees. Enter Bitcoin, a digital currency that’s like a breath of fresh air for migrants. It cuts out the middleman, making it cheaper and faster to send money across borders. Imagine being able to support your family back home without losing money on high fees or waiting days for the transfer. With Bitcoin, this has turned into reality for many. What’s more, learning about bitcoin trading strategies and the blockchain can also open up new ways for migrants to invest and grow their savings, further securing their financial future. This shift towards Bitcoin is not just about saving on fees; it’s about empowerment, giving control back to the individuals who work tirelessly away from their homelands. Through real-life success stories, we see a growing confidence among migrants in managing their finances in a more secure, efficient way. This isn’t just a trend; it’s a movement towards financial independence and security for migrants worldwide.

🚀 Real-life Success Stories: Migrants Embracing Bitcoin

Across the globe, countless migrants have found a new ally in Bitcoin, a digital currency that’s breaking down financial barriers. Imagine Maria from Venezuela, who sends her earnings back home without the hefty fees that used to eat into her hard-earned money. Then there’s Amit in Dubai, who uses Bitcoin to ensure his family receives more of what he sends, faster than ever before. Their stories are not just inspiring; they spotlight a growing trend where Bitcoin is not just an investment but a lifeline, allowing migrants to support their families back home in ways previously unimagined. With the power of the internet and a smartphone, they’re bypassing traditional banks, keeping more of their money, and sending it home securely. These real-life examples shed light on how Bitcoin is transforming remittances, offering a glimpse of hope and financial empowerment for many.

| Name | Location | Benefit |

|---|---|---|

| Maria | Venezuela | Lower Fees |

| Amit | Dubai | Faster Transfers |

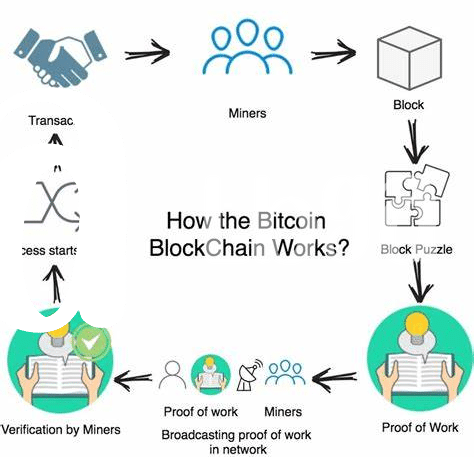

🛠 Tips for Safe and Smart Bitcoin Remittances

Sending money across borders using Bitcoin can be a game-changer for those looking to support their families back home. However, it’s crucial to navigate this dynamic world with caution. Start by doing your homework. Read up on how Bitcoin and blockchain technology work. It’s like understanding the rules of the road before you start driving in a new country. This knowledge will serve as your map, guiding you away from common pitfalls and towards more secure transactions. You’ll find plenty of resources explaining bitcoin in emerging markets and the blockchain to give you a solid grounding in how this digital currency can aid financial inclusion.

On your journey, remember to protect your digital wallet like your physical one. Use strong, unique passwords, and consider extra layers of security like two-factor authentication. It’s also wise to transfer small amounts first to test the waters before making larger remittances. Just as you wouldn’t carry all your savings in your back pocket while traveling, don’t store large sums of Bitcoin in a single transaction or wallet. By keeping these tips in mind, migrants can tap into the power of Bitcoin, not just as a means of sending money home, but as a stepping stone towards greater financial empowerment and independence.