🌍 the Big Picture: Bitcoin’s Role in Global Finance

Imagine the world as a big marketplace, where everyone wants to buy and sell, but not everyone has the money to do so. Enter Bitcoin, a digital form of money that’s like invisible coins. It’s making waves in this big market, especially in how we think about lending money across the globe. Bitcoin is shaking things up by making it possible to send and lend money in a snap, without the hassle of dealing with banks that ask for a lot of paperwork or say no because you live too far away. This is a big deal for people in far-off places who want to grow their businesses or start new ones.

Bitcoin doesn’t care where you are in the world. It travels through the internet, making it a game-changer for entrepreneurs in developing nations. Think of it like a superhero of finance, breaking down barriers and giving everyone a fair shot. Here’s a quick look at how Bitcoin fits into the world of global finance:

| Feature | Description |

|---|---|

| Global Accessibility | Bitcoin can be sent and received anywhere in the world, anytime, without the need for traditional banking systems. |

| Low Transaction Fees | Compared to banks, Bitcoin charges minimal fees, making it cheaper to send money across borders. |

| Digital and Decentralized | There’s no central control, meaning politics or location don’t influence Bitcoin’s operation. |

| Empowers the Unbanked | Gives access to financial services for those without traditional bank accounts, particularly in developing countries. |

In a world where moving money can be slow and expensive, Bitcoin offers a breath of fresh air, especially for those dreaming big in parts of the world where opportunities can be hard to come by.

💡 Spark of Change: What Are Bitcoin Microloans?

Imagine a world where small business owners in far-off places can dream big without the heavy weight of financial constraints. This is where the magic of Bitcoin microloans comes into play. Think of it as offering a helping hand, but instead of traditional money, we’re talking digital currency. It’s a game-changer for hardworking folks in developing countries who have big ideas but lack the resources to bring them to life. By tapping into this innovative approach, they can now access funds quickly and without the daunting hurdles that often come with traditional banking systems.

What makes Bitcoin microloans extraordinary isn’t just the digital currency aspect, though that’s a big part of its charm. It’s how these loans bridge distances and connect people with opportunities that were once out of reach. Entrepreneurs can now ignite their business dreams, thanks to the simplicity and accessibility of Bitcoin. And as these visionary individuals flourish, they not only uplift themselves but also their communities. If you’re curious about how technology is making other aspects of the world better, such as promoting sustainable energy, check out this fascinating article https://wikicrypto.news/smart-contracts-101-simplifying-complex-agreements-on-blockchain. It’s a deep dive into the wonders of blockchain technology and its role in a brighter, more sustainable future.

🚀 Empowering Dreams: Success Stories from Around the World

Imagine a world where dreams don’t have to die because of a lack of resources. That’s exactly what Bitcoin microloans are making a reality for many aspiring entrepreneurs in developing countries. Picture Sarah, in Kenya, who had the brilliant idea of starting a sustainable farming project. Traditional banks turned her away, labeling her venture too risky. Yet, through a Bitcoin microloan, she received the funding needed to begin. Fast forward, and her business now feeds hundreds of families. Over in Bangladesh, Anwar had the skills and passion for creating unique handcrafted goods but no start-up capital. A Bitcoin microloan changed that, enabling him to sell his crafts worldwide, supporting his community in the process. These stories are not just tales of financial success but are testaments to how innovative tools like Bitcoin are breaking down the age-old barriers to economic growth. Entrepreneurs like Sarah and Anwar are now empowered to dream big and achieve even bigger, thanks to the support of global communities united by technology. The ripple effect of their success stories is a stronger local economy and a step towards leveling the global playing field, showcasing just how significant a small gesture like a microloan can be.

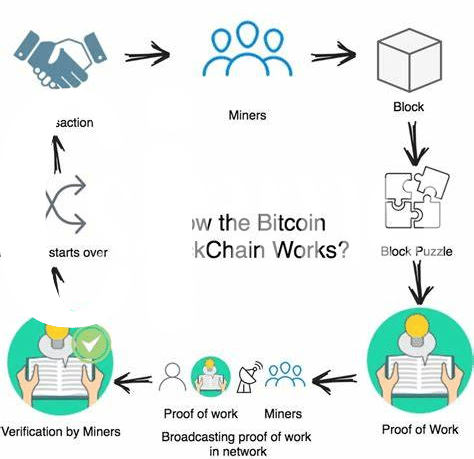

🛠 Tools for Success: How Bitcoin Microloans Work

Imagine sending a little help across the world, turning small dreams into big realities. That’s essentially the magic behind Bitcoin microloans. It starts with people who want to lend a helping hand, using Bitcoin, a digital currency that knows no borders. These lenders offer small amounts of money to entrepreneurs in far-off places, helping them to start or grow their businesses. It’s a simple idea: through an online platform, a person in one country can lend a few bitcoins to a small business owner in another, all without the hassle of traditional banking systems. This means quicker, easier, and often more affordable loans for those who need them most.

The beauty of bitcoin and renewable energy and the blockchain shines through in these transactions, making them secure and transparent. For the entrepreneur, it’s a chance to build their dream with the support of someone across the globe. For the lender, it’s an opportunity to see their bitcoins help someone achieve their goals. This process not only provides the necessary funds but also fosters a global connection, breaking down financial barriers and uniting people with a common purpose. As these microloans are repaid, the funds become available to support other dreams, creating a cycle of empowerment and opportunity.

🤝 Breaking Barriers: Bitcoin Microloans Vs. Traditional Loans

Imagine a world where getting a helping hand to start your business doesn’t require you to jump through hoops or fill out piles of paperwork. This is the reality for entrepreneurs in many developing countries, thanks to Bitcoin microloans. Unlike traditional loans that often come with a long wait times and hefty interest rates, Bitcoin microloans are like a breath of fresh air. They’re quick, they’re digital, and they don’t care about borders. Best of all, these loans are often peer-to-peer, meaning they come from people all over the world who want to help. It’s a bit like getting a boost from a global community, rather than a stern-faced banker. Here’s a simple breakdown of how they stack up:

| Feature | Bitcoin Microloans | Traditional Loans |

|---|---|---|

| Accessibility | High, with internet access | Variable, often requires physical presence |

| Approval Time | Fast, sometimes instant | Can take weeks or even months |

| Interest Rates | Often lower, peer-determined | Generally higher, institution-determined |

| Geographical Barriers | Minimal, globally accessible | Significant, often limited to residents |

In essence, Bitcoin microloans are tearing down the walls that have kept many would-be entrepreneurs just dreaming instead of doing.

🌱 Planting Seeds: the Future of Bitcoin Microloans

As we gaze into the future, Bitcoin microloans shine as a beacon of hope, promising to further revolutionize how entrepreneurs in developing nations find the financial support they need to grow. Imagine communities where access to funds is no longer a roadblock to dreams, but rather, a stepping stone to success. This vision is becoming increasingly tangible, as the adoption of Bitcoin and smart contracts paves the way for more secure, transparent, and inclusive financing models. The beauty of Bitcoin microloans lies not just in their ability to bypass traditional financial systems but in their potential to foster a global network of support and opportunity.

As we continue to plant the seeds of change, the roots of Bitcoin microloans grow deeper, creating a sturdy foundation for the future. With advancements in technology and a growing awareness of the blockchain, the potential for Bitcoin microloans to empower entrepreneurs around the world is boundless. Picture a world where financial barriers are dismantled, and bright, innovative minds have the resources they need to flourish. This is the promise of Bitcoin microloans—a future where dreams are nurtured, and opportunities are as limitless as one’s imagination.