🌍 Setting the Scene: Why El Salvador Chose Bitcoin

Imagine a country, not very large, nestled between gorgeous landscapes, with dreams as big as its vibrant culture. El Salvador, in a bold and pioneering step, turned heads worldwide by embracing Bitcoin, a type of digital money that exists only on the internet, not controlled by any single government or company. But why did they decide to take this leap? The answer lies in their pursuit to energize their economy, make it easier for Salvadorans living abroad to send money back home without losing a chunk on high fees, and to include those without access to traditional banking in the economy. Nearly one in four Salvadorans lives in another country, and the money they send home is vital, making up a big portion of the country’s income. By choosing Bitcoin, El Salvador aimed to make these transactions smoother and cheaper, hoping to spark interest and investment from tech-savvy folks and companies worldwide. This move was not just about adopting a new kind of money; it was a vision to transform the nation’s economic landscape and light a path for others to possibly follow.

| Aspect | Description |

|---|---|

| 🌎 Country | El Salvador |

| 💡 Initiative | Making Bitcoin legal tender |

| 🎯 Goal | Boost economy, aid money transfers, increase financial inclusion |

💡 the Big Move: Making Bitcoin Legal Tender

In a bold and surprising move, El Salvador decided to embrace the future of currency head-on by making Bitcoin an official form of money. This step wasn’t just about adopting new technology; it was about opening a new chapter in the country’s economic story. By recognizing Bitcoin as legal tender, El Salvador broke away from traditional financial systems, positioning itself as a pioneer in the global financial landscape. The decision aimed to stimulate economic growth, attract tech-savvy investors, and offer a financial lifeline to the many Salvadorans without access to traditional banking services. This groundbreaking move highlights the country’s effort to harness the power of cutting-edge technology to reshape its economy and empower its people.

However, making Bitcoin legal money isn’t as simple as flipping a switch. It requires a well-thought-out legal framework to ensure that this digital currency can be smoothly integrated into everyday transactions, from buying groceries to paying taxes. For businesses, this means embracing new tools and technologies to handle Bitcoin payments—a journey not without its hurdles but potentially rewarding. The transition also represents a significant learning curve for citizens, necessitating education on Bitcoin’s use and benefits. Amidst this transformation, El Salvador has become a live experiment in the viability of cryptocurrency as an everyday currency, attracting global attention and sparking conversations on the future of money. For those interested in how small businesses can integrate Bitcoin payments, a helpful guide can be found at https://wikicrypto.news/integrating-bitcoin-payments-a-small-business-guide.

📜 Unpacking the Legal Bits: How It Works

When El Salvador decided to make Bitcoin a legal way to pay for things, it wasn’t as simple as saying “let’s do it!” The country had to create a whole set of rules to explain how it would work. Imagine going to a store and paying with a digital coin instead of cash. To make that happen, El Salvador had to ensure that businesses could accept Bitcoin, and people could easily swap between Bitcoin and their usual money, the U.S. dollar. The government also introduced a special app to make using Bitcoin easier for everyone. This move required thinking about how to keep transactions safe, how to manage changes in Bitcoin’s value, and even how to explain all of this to people who had never used digital money before. It’s like playing a brand-new game where everyone is learning the rules together, making sure that this big change helps businesses and people feel confident in using Bitcoin in their daily lives.

🎢 the Ripple Effect: Local and Global Reactions

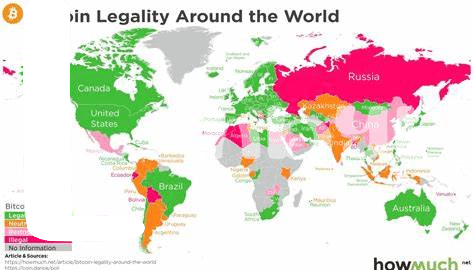

When El Salvador decided to embrace Bitcoin, it sent waves across the globe. Everyone, from coffee shop owners in San Salvador to policy makers in far-off capitals, found themselves talking about this bold move. On the ground, the reception was mixed. While some locals saw this as a chance to be part of a financial revolution, others worried about the volatility of cryptocurrency. Meanwhile, throughout the wider world, governments and financial experts watched eagerly, some cheering on the experiment, hoping it would prove that digital currencies could play a role in mainstream economies. Others, however, raised their eyebrows, concerned about the potential for financial instability and the challenges of regulating an all-digital currency. This mixed bag of reactions has sparked a vibrant debate about the future of money itself. Amidst these discussions, understanding the nuts and bolts of how Bitcoin operates becomes crucial. For those curious about how such a digital currency maintains its security and integrity, the concept of private keys offers a fascinating glimpse into the world of crypto. A deeper dive into bitcoin and economic theories suggestions illuminates the sophisticated architecture beneath El Salvador’s daring gamble, inviting even more scrutiny and speculation about what the future holds for money.

💼 Businesses and Bitcoin: Adapting to Change

In El Salvador, when Bitcoin stepped into the spotlight as a legal form of money, businesses of all sizes faced a whole new world. Imagine a small café in San Salvador that used to accept cash only, and now also sees a digital wallet icon at the cash register. It’s like stepping into the future without leaving the shop. For bigger businesses, it’s about updating their systems to accept Bitcoin – a bit like learning a new language to welcome more customers. Not all was smooth sailing, though. Some businesses worried about Bitcoin’s price jumping up and down like a bouncy ball, which could make planning tough. Despite these challenges, innovation kicked in. New tools and services sprouted up, aimed at making Bitcoin transactions as easy as a tap on a smartphone. Here’s a quick look at how businesses adapted:

| Type of Business | Adaptation Strategy |

|---|---|

| Small cafes and shops | Installed digital wallets and started accepting Bitcoin payments |

| Large retailers | Updated payment systems to process Bitcoin transactions |

| Service providers | Integrated Bitcoin as a payment option in online platforms |

This movement saw a mix of excitement and cautious optimism as the business landscape in El Salvador began to reshape around Bitcoin, carving out a path for the future of digital currency in the real world.

⚖ Balancing Act: Advocates Vs. Critics Debate

In the heart of El Salvador, a groundbreaking experiment is unfolding, sparking passionate debates across the globe. On one side, advocates sing praises, seeing Bitcoin as a beacon of financial freedom, with the potential to empower millions by providing access to global markets and protecting against inflation. They argue that embracing digital currency could put El Salvador on the map as a forward-thinking nation, attracting tech-savvy investors and driving economic growth. On the flip side, critics raise their voices in concern. They worry about the volatility of Bitcoin, its potential for misuse, and the challenges it poses to financial stability and consumer protection. The question they keep asking is, is the risk worth the reward? Amid this heated debate, businesses in El Salvador are finding themselves at the crossroads of innovation and uncertainty. For those curious about how Bitcoin could benefit small enterprises, a closer look at bitcoin paper wallets suggestions might provide some valuable insights into navigating this new digital landscape safely and effectively. As both sides continue to weigh in, El Salvador’s bold move has undeniably turned it into a real-world lab for the future of cryptocurrency.