💰 the Timeless Charm of Gold

Gold has always sparkled in the human imagination, capturing hearts and minds as the epitome of value and beauty. For centuries, it has stood as a beacon of wealth, serving not just as currency but as a symbol of power and status. Nations have hoarded it, individuals have adorned themselves with it, and today, despite the emergence of digital currencies, its allure remains undiminished. Its tangible nature offers a sense of security and permanence in a world increasingly dominated by the ephemeral. Unlike digital assets that can seem abstract, gold’s physical presence provides a comforting assurance of its value. Moreover, its scarcity ensures that it retains worth over time, making it not just a thing of beauty but a reliable store of value. While new forms of investment come and go, gold’s enduring appeal is a testament to its unshakeable position in the world of wealth and finance.

| Attribute | Gold |

|---|---|

| Value Retention | High |

| Tangibility | Physical |

| Historical Significance | Centuries-old |

| Symbolism | Wealth, Power, Beauty |

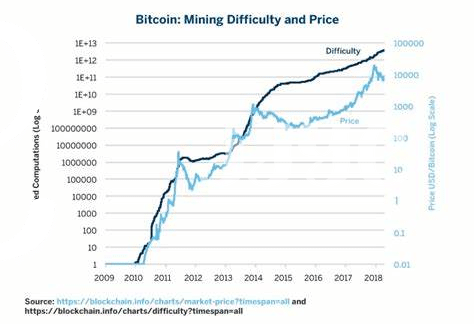

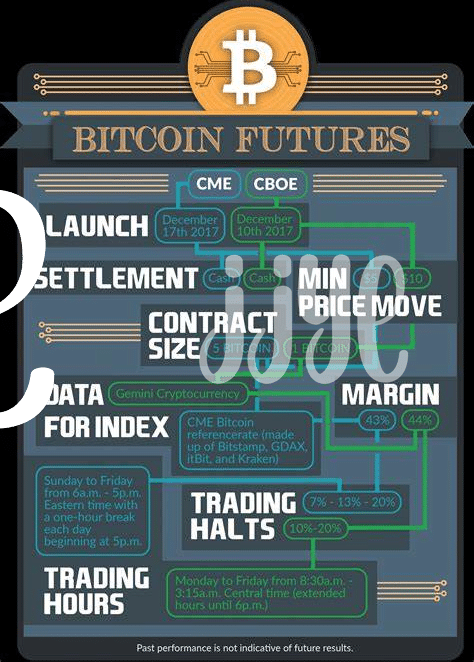

📈 Bitcoin’s Meteoric Rise and Volatility

Bitcoin, a digital currency that appeared seemingly out of the blue, has taken the world by storm. Its journey from an obscure internet invention to a valuable asset is nothing short of remarkable. Along the way, those who took a chance on Bitcoin early have seen their faith rewarded with astonishing returns. However, this road to riches has been anything but smooth. The value of Bitcoin can swing wildly from one day to the next, making it as thrilling as it is unpredictable. This characteristic volatility is a double-edged sword; it creates opportunities for high gains but also poses a risk of abrupt losses.

Within this fast-paced world of digital currency, understanding the mechanics behind it, like the significance of private keys in maintaining the security of your assets, is crucial. For anyone diving into this arena, a solid grasp on these fundamentals can make all the difference. This is true whether you’re investing or incorporating crypto into your business. To get up to speed, consider exploring resources like https://wikicrypto.news/understanding-private-keys-the-foundation-of-bitcoin-paper-wallets which offer guidance on navigating these waters. As we continue to compare Bitcoin’s attributes with those of traditional store values like gold, such insights can be invaluable.

💡 Comparing Liquidity: Bitcoin Vs. Gold

When it’s time to talk about turning assets into cash quickly, we’re diving into a world where Bitcoin and gold sparkle for different reasons. Imagine you have a treasure chest: gold is like the sturdy, reliable coins inside that people have trusted for centuries, always ready to be traded. Then there’s Bitcoin, the new star on the block, digital and fast-moving. It’s like having a magical key that can instantly turn your assets into cash, as long as someone on the other end wants to buy. But, just like in a bustling market, the ease of trading these treasures can vary day by day.

🌊 The big waves in Bitcoin’s sea can mean that its value changes rapidly, making it sometimes a wild ride when you want to switch it for cash. Gold, on the other hand, moves more like a gentle stream, with less sudden ups and downs. This steadiness makes gold a go-to for many when they want something less risky. Yet, in our digital world, pressing a button to sell Bitcoin can be quicker than finding someone to hand over physical gold bars. The key is finding the right balance for you, in a treasure chest that brings confidence and smiles.

🌍 Global Acceptance: Traditional Vs. Digital

When we look at how the world sees and uses gold versus Bitcoin, it’s like comparing a well-loved book to a brand-new e-reader. Gold, with its centuries-old allure, has a solid foothold in various cultures and economies around the globe. Its value understood and accepted widely, serving as a trusty anchor in turbulent financial seas. On the digital side of the fence stands Bitcoin, a relative newcomer that has taken the world by storm. Its acceptance is growing daily, with more businesses and individuals opening their doors to this digital currency. However, it’s important to note that while Bitcoin makes waves, its universal acceptance isn’t quite at gold’s level yet. Many people and places are still warming up to the idea of digital currency, making its global footprint smaller. For small businesses looking to navigate this new terrain, finding balanced information is key. An excellent resource is bitcoin for small businesses suggestions, which provides valuable insights into how Bitcoin is changing the corporate world. As the world evolves, so does the way we see value, making the debate between the traditional and the digital more fascinating than ever.

🛡 Security Concerns: Hacks Vs. Heists

When you hold something valuable, whether it’s a shiny gold bar or digital coins, keeping it safe becomes a big deal. With gold, the old-fashioned worry is about physical theft – think of movie-style heists with masked robbers. It’s tangible, so if you can touch it, you can take it, but guarding it usually means big vaults and complex security systems. On the flip side, Bitcoin faces modern threats like hacking. Since it exists only in the digital world, clever computer criminals try to break into virtual vaults. Both require strong protection strategies, but the enemies and tools are worlds apart.

Concerning safety measures, it’s a game of physical locks against digital keys. Here’s a quick look at how they stack up:

| Aspect | Gold | Bitcoin |

|---|---|---|

| Security Threat | Heists | Hacks |

| Protection Method | Physical Vaults | Encryption & Secure Wallets |

| Recovery Possibility | Depends on Insurance/Recovery Ops | Often Irrecoverable |

In the end, whether you’re worried about a traditional snatch-and-grab or a high-tech cyber theft, knowing the risks and how to shield your treasures is crucial in today’s world, where both gold and Bitcoin present tempting targets for thieves of all types.

🌱 Environmental Impact: Mining Vs. Mining

Imagine two worlds – on one side, the age-old process of digging deep into the Earth chasing after gold, a pursuit as old as civilization itself; on the other, the high-tech world of Bitcoin, where “mining” involves solving complex puzzles with powerful computers. Each of these quests for value leaves a mark on our planet, but in very different ways. Extracting gold from the ground is not just about adventure; it’s a heavy industry that moves mountains, literally, and uses chemicals that can be tough on our environment. Then there’s Bitcoin, a digital miner’s dream that doesn’t disturb the soil but consumes a lot of electricity, which often comes from sources that aren’t too kind to the Earth either. Both are seeking treasure, but the tools and the trails they leave behind raise important questions about sustainability. As we embrace the future of money, whether shiny metal or digital code, understanding their environmental footprints helps us navigate the best path forward. For those keen on securing their digital gold, exploring bitcoin paper wallets might offer a neat solution. At the same time, folks looking at smart ways to bring Bitcoin into businesses might find corporate adoption suggestions particularly insightful.