🌍 How Bitcoin Became a Global Payment Powerhouse

Once upon a time, Bitcoin was just a blip on the financial landscape, but oh, how the tables have turned! Its journey to becoming a global powerhouse in payments is nothing short of a digital fairy tale. At its core, Bitcoin offered something completely groundbreaking – a way for people to send and receive money across the globe without the need for traditional banks or currency. This unique feature caught the eye of tech enthusiasts and forward-thinkers who saw the potential for a universal payment system not tied down by borders or government rules. As more people joined in, its popularity skyrocketed. Now, you might wonder, “How did it spread so fast?” Well, it’s all thanks to the internet and the power of word-of-mouth in online communities. People from different corners of the world could easily learn about it and start using it. Plus, its underlying technology, blockchain, ensures that all transactions are secure and transparent, making it a trustworthy way to send and receive money. What started as a niche idea has now transformed into a mainstream solution, offering a glimpse into the future of money as we know it.

| Year | Bitcoin Value Milestone |

|---|---|

| 2009 | First Bitcoin transaction |

| 2017 | Bitcoin’s value hits $19,000 for the first time |

| 2021 | Bitcoin reaches an all-time high of over $60,000 |

⏱️ Breaking down Bitcoin Transaction Speed

When we peel back the layers on how Bitcoin transactions work, it’s like watching a fascinating dance of technology. Imagine sending a letter across the globe, but instead of days, it reaches its destination in minutes or hours. That’s the kind of speed we’re talking about with Bitcoin. Each transaction you make zips through a network of computers, all working together to confirm and secure your transfer. It’s a bit like having an army of messengers at your service, ensuring your money gets where it needs to go, swiftly and safely. But why does this matter? In a world where time is precious, Bitcoin offers a ray of hope for faster global payments, sidestepping the often sluggish pace of traditional banking systems. It’s not instant—taking anywhere from a few minutes to an hour—but it’s a leap towards making our financial systems more in tune with our fast-paced lives. For a deeper dive into how nations are adapting, including legal perspectives on using Bitcoin, check out https://wikicrypto.news/bitcoin-vs-gold-the-future-of-store-value-debate. This exploration not only highlights the speed but also the burgeoning role of digital currencies in reshaping our approach to value storage and global transactions.

💡 Comparing Bitcoin with Traditional Payment Methods

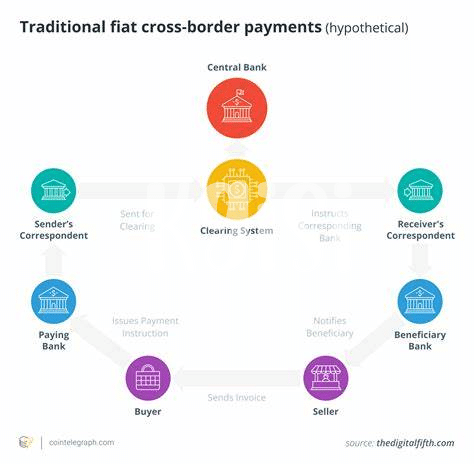

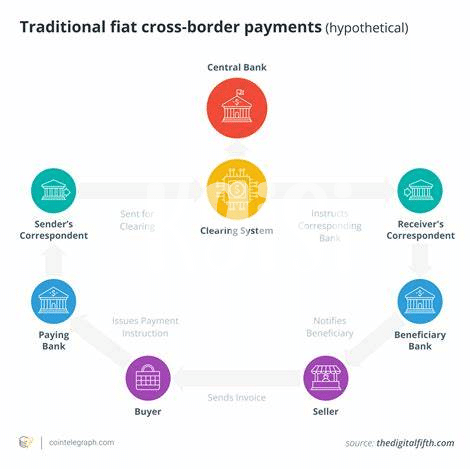

When we look at how we send money to each other, it’s like comparing an instant messaging app with sending a letter through the post. Traditional methods, like bank transfers and even services like Western Union, work well but can feel a bit like waiting for that letter to arrive. It might take days for a transaction to go through, especially if it’s crossing borders. Plus, there are often extra fees for the delivery – just like buying a stamp for your letter.

On the flip side, Bitcoin is like the instant chat of money transfers. Using the internet, it allows you to send cash directly to someone else, no matter where they are in the world, usually within minutes. It’s like sending a message – quick and simple. However, it’s not perfect. Sometimes, when lots of people are sending Bitcoin at the same time, it can get a bit crowded, leading to delays. Just imagine if everyone decided to send a text at once; the network might slow down a bit. But with each update, it’s getting faster and more reliable, aiming to outpace the ‘snail mail’ of traditional banking for good.

🔒 the Role of Blockchain in Speed and Security

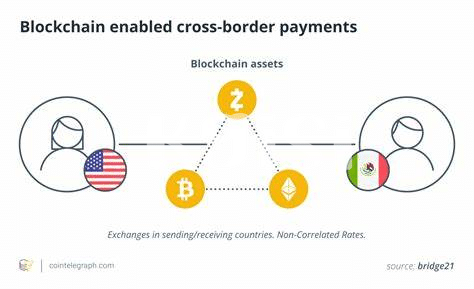

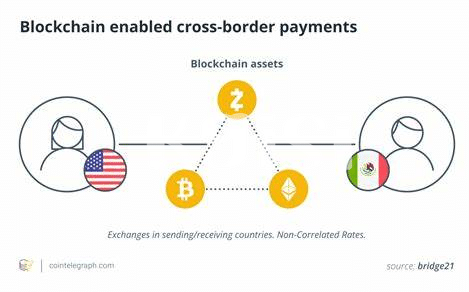

Imagine a world where sending money is as easy as sending an email. This is where blockchain, the technology behind Bitcoin, shines. Think of blockchain like a digital ledger that is not in one place but copied across a network of computers. Every time a Bitcoin transaction happens, it gets recorded on this ledger. What’s cool about it is that it’s secure and tough to tamper with, thanks to some clever cryptography (fancy word for secret codes). So, not only does blockchain make Bitcoin transactions speedy by cutting out the middleman, but it also ensures that your money is safe.

To understand how Bitcoin fits into the bigger picture of global payments, it’s useful to have some context about the rules in different places. For those curious about how Bitcoin is viewed across the globe, taking a peek at bitcoin legality by country suggestions can shed some light. As we look to the future, innovations in blockchain technology are buzzing with potential to make Bitcoin even quicker. Imagine transactions that are almost instant, further solidifying Bitcoin’s role in our everyday financial dealings. This journey from secure to lightning-fast transactions is just beginning, promising an exciting road ahead.

🚀 Future Trends: Making Bitcoin Transactions Faster

Looking into the crystal ball of technology, we see a future where sending Bitcoin is as quick and effortless as sending a text. Innovators are already on the move, working tirelessly on lightning-fast networks and clever upgrades. These advancements promise to make Bitcoin transactions not just faster but also cheaper and more energy-efficient. Imagine being able to pay for your morning coffee with Bitcoin, and the transaction completes before you’ve even had a sip. That future isn’t as far off as it might seem.

In this exhilarating journey towards speed, the spotlight is on two major trends: the rise of the Lightning Network and the development of new protocols that shrink transaction times significantly. The Lightning Network, a second layer on Bitcoin’s blockchain, acts like a speedy highway above the more congested roads, enabling instant, almost free transactions. Meanwhile, developers are experimenting with other protocols that streamline how transactions are verified, reducing the wait time even further. These technological leaps mean that Bitcoin might soon rival, or even surpass, the speed of traditional payment systems.

| Trend | Description |

|---|---|

| Lightning Network | A second layer solution making Bitcoin transactions instant and nearly free. |

| New Protocols | Upcoming technologies aimed at minimizing transaction verification time. |

The race towards making Bitcoin a universally preferred payment method is heating up. With these innovations, the dream of a world where Bitcoin transactions are as simple and swift as sending an email is inching closer to reality.

💬 Real-world Examples: Bitcoin Speed in Action

Imagine a bustling international market, where traders from around the world exchange goods instantly. Now, imagine if transactions in this market could skip the hassle of traditional banking delays and fees. This is where the real-world magic of Bitcoin comes alive. From the vendor selling handmade crafts in a local marketplace to a tech startup securing global investments, Bitcoin has transformed the speed at which they do business. For example, a small business owner in Kenya effortlessly received payment from a client in Canada within minutes, bypassing the typical days-long wait. Similarly, a freelance artist in Brazil was thrilled when her artwork sold to someone in Japan, and the payment, using Bitcoin, was as quick as sending an email.

These stories highlight not just the speed, but the borderless nature of Bitcoin, making it an ever-appealing option for businesses aiming for the global stage. For more insights on how Bitcoin might bolster your business, consider exploring bitcoin and economic theories, which delve into maximizing benefits while navigating the crypto space. Both instances showcase Bitcoin not just as a currency, but a revolutionary tool in achieving instant, secure, and direct transactions, a dream for small and large businesses alike, making economic participation truly global and inclusive.