Cuba’s Evolving Approach Towards Cryptocurrency Regulation 🌍

Cuba has been gradually shifting its approach towards regulating cryptocurrency, reflecting a growing recognition of the potential impact of digital assets in the modern financial landscape. This evolving stance signals a willingness to explore the opportunities presented by blockchain technology while also addressing the associated challenges and risks. By adapting its regulatory framework to accommodate the emergence of cryptocurrencies, Cuba is positioning itself to navigate the complexities of this rapidly evolving landscape.

The strategic adjustments in Cuba’s approach towards cryptocurrency regulation demonstrate a forward-thinking mentality that acknowledges the importance of staying abreast with global financial trends. As the country continues to assess the implications of digital currencies, it is paving the way for potential advancements in its financial infrastructure and fostering a climate conducive to innovation and economic development.

Impacts of Bitcoin on Cuba’s Traditional Financial System 💰

Bitcoin’s presence in Cuba is reshaping the landscape of the country’s traditional financial system. As digital currency continues to gain traction, Cuban financial institutions are grappling with the disruption it poses to their conventional practices. The influx of Bitcoin transactions has prompted a reconsideration of established norms, challenging the status quo while offering new avenues for financial inclusion and innovation. Amidst this shift, Cuban policymakers are faced with the task of navigating the complexities of integrating cryptocurrency into their monetary framework, balancing the potential benefits of economic growth with the imperative of safeguarding against illicit activities.

The evolving dynamics between Bitcoin and Cuba’s financial sector underscore a significant paradigm shift, creating a ripple effect that touches upon various facets of the economy. As the adoption of digital currencies accelerates, traditional financial actors are compelled to adapt their strategies to remain relevant in a swiftly changing landscape. This transformation not only necessitates a reevaluation of existing regulatory frameworks but also underscores the importance of fostering a conducive environment for financial modernization. By exploring the impacts of Bitcoin on Cuba’s financial ecosystem, it becomes evident that the path toward sustainable development lies in embracing the opportunities presented by digital innovation while mitigating associated risks through prudent regulatory oversight.

Key Challenges in Implementing Aml Policies in Cuba 🚫

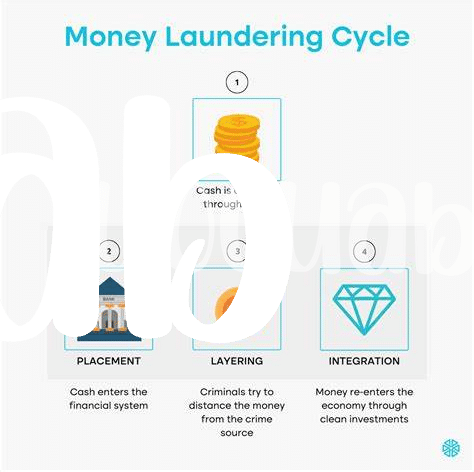

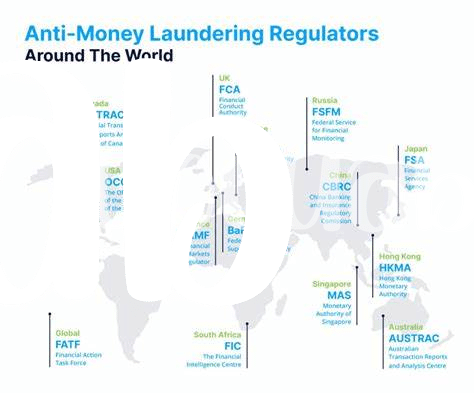

Cuba faces unique challenges in implementing Anti-Money Laundering (AML) policies in relation to Bitcoin. The decentralized nature of cryptocurrencies poses a hurdle in surveillance and control. Lack of proper infrastructure and expertise further complicates the monitoring of digital transactions. Moreover, the absence of clear guidelines increases the risk of potential misuse and illegal activities within the cryptocurrency space.

As Cuba navigates through the complexities of integrating AML policies with the digital landscape, there is a pressing need for collaboration with international agencies and experts. Building robust frameworks and enhancing technological capabilities are pivotal in addressing the challenges posed by Bitcoin transactions. Public education and awareness campaigns can also play a significant role in fostering a culture of compliance and transparency in the evolving financial ecosystem.

Public Sentiment and Awareness of Bitcoin in Cuba 🧐

When it comes to public sentiment and awareness of Bitcoin in Cuba, the landscape is intriguing. Amidst traditional financial constraints, more Cubans are starting to explore the possibilities that Bitcoin offers. Despite regulatory challenges, the curiosity and interest in cryptocurrencies are visibly growing among the Cuban population. This shift in perception hints at a potential transformation in how Cubans perceive and interact with financial systems. For more insights on Bitcoin anti-money laundering (AML) regulations in Comoros, check out this detailed guide on bitcoin anti-money laundering (AML) regulations in Comoros.

Comparison of Cuba’s Stance with Other Countries on Bitcoin 🌏

Cuba’s approach to Bitcoin stands apart from many other countries. While some nations embrace cryptocurrency with open arms, Cuba treads cautiously, considering its unique economic and political landscape. Unlike countries like El Salvador, which adopted Bitcoin as legal tender, Cuba maintains a more reserved stance. The comparison sheds light on how different regulatory frameworks, societal attitudes, and economic conditions influence a country’s approach to Bitcoin. Understanding these variations can offer valuable insights into the potential trajectories of cryptocurrency adoption globally.

Future Outlook for Bitcoin Adoption in Cuba 🚀

Cuba stands on the brink of a new era in financial technology. As the nation continues to navigate the complexities of integrating Bitcoin into its economy, the future outlook for adoption appears promising. With gradual steps towards regulatory clarity and increasing awareness among the public, the potential for widespread acceptance of Bitcoin in Cuba is on the rise. This shift not only signals a departure from traditional financial norms but also paves the way for innovative solutions to address existing economic challenges, propelling the nation towards a more interconnected and tech-savvy future.

To delve deeper into Bitcoin anti-money laundering (AML) regulations in other regions, like Congo, you can explore the specifics of their framework using the bitcoin anti-money laundering (AML) regulations in Colombia.