Regulatory Landscape 🌍

The regulatory landscape surrounding Bitcoin transactions across borders in Brunei is evolving to address the challenges presented by this digital currency. Governments and regulatory bodies are continuously monitoring and updating their policies to ensure compliance with international standards and regulations. This includes ensuring transparency, preventing money laundering, and combating the financing of terrorism. By understanding and adhering to the regulatory requirements in place, businesses and individuals engaging in cross-border Bitcoin transactions can navigate this complex landscape with confidence and integrity. As the digital economy continues to grow, staying abreast of these regulatory developments is crucial to fostering a secure and compliant environment for all stakeholders involved.

Cross-border Compliance 🔒

Cross-border compliance in Bitcoin transactions entails navigating a complex web of regulations and requirements to ensure seamless cross-border transfers. Understanding the legal frameworks in both the origin and destination countries is crucial for compliance and mitigating the risks associated with international transactions. Compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations is paramount, requiring robust mechanisms to verify the identities of parties involved while maintaining transaction transparency and traceability.

To stay on the right side of the law, businesses must implement stringent compliance measures that align with international standards and local regulations. Leveraging technology and automation can streamline compliance processes, enhancing efficiency and accuracy in cross-border Bitcoin transactions. By proactively addressing compliance challenges and staying abreast of regulatory developments, businesses can navigate cross-border transactions securely and effectively.

Reporting Requirements 📋

Reporting requirements are a crucial aspect of ensuring transparency and accountability in Bitcoin transactions. Compliance with reporting guidelines helps regulators keep track of cross-border financial activities, ultimately contributing to the prevention of illicit transactions. By adhering to these requirements, businesses can demonstrate their commitment to upholding regulatory standards and combatting money laundering and other financial crimes. Clear and timely reporting not only satisfies legal obligations but also builds trust with authorities and promotes a healthy and secure financial ecosystem. In a rapidly evolving digital landscape, effective reporting mechanisms serve as a fundamental pillar in upholding the integrity of cryptocurrency transactions globally.

Risk Assessment Strategies 🛡️

Risk assessment strategies in the realm of Bitcoin transactions across borders play a pivotal role in ensuring compliance and minimizing potential risks. These strategies involve thorough analysis of the involved parties, transaction history, and the overall context of the cross-border transfer. By implementing robust risk assessment protocols, businesses can identify and address potential red flags early on, safeguarding against illicit activities and ensuring adherence to regulatory requirements.

Understanding the evolving nature of the crypto landscape is essential for formulating effective risk assessment strategies. By staying informed about new trends and regulatory developments, businesses can adapt their risk assessment methodologies to effectively navigate the complexities of cross-border Bitcoin transactions. Embracing a proactive approach to risk assessment not only enhances compliance but also positions businesses to anticipate and mitigate emerging challenges effectively. For further insights, you can explore Bitcoin cross-border money transfer laws in Brazil at bitcoin cross-border money transfer laws in Brazil.

Customer Due Diligence 🕵️♂️

Customer due diligence is a crucial aspect of ensuring the integrity and security of Bitcoin transactions across borders in Brunei. By verifying the identities of individuals involved in these transactions and assessing the risks associated with their activities, companies can mitigate potential fraudulent activities and comply with regulatory requirements. This process not only safeguards against money laundering and terrorist financing but also builds trust with customers by demonstrating a commitment to transparency and accountability. Implementing robust customer due diligence practices not only strengthens the overall compliance framework but also contributes to a more secure and sustainable Bitcoin ecosystem for all stakeholders involved.

Future Trends and Challenges 🔮

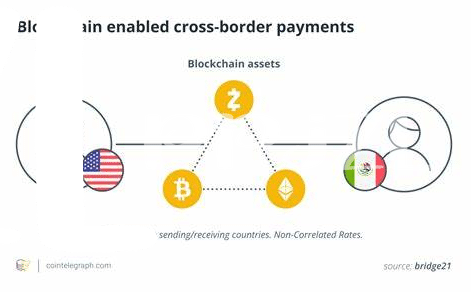

Bitcoin transactions across borders continue to evolve, presenting both opportunities and challenges for compliance. As the digital landscape expands, future trends suggest a shift towards more stringent regulations to ensure transparency and security in cross-border transactions. One key challenge is the need for enhanced measures to prevent money laundering and the financing of illicit activities. Additionally, technological advancements, including blockchain technology, are expected to play a crucial role in improving the efficiency and security of cross-border transactions. However, with innovation comes the challenge of balancing regulatory compliance with the need for innovation and financial inclusion. Keeping pace with these dynamic trends while addressing emerging risks will be essential for stakeholders in the Bitcoin ecosystem. Stay informed about the latest developments in Bitcoin cross-border money transfer laws in Botswana and navigate the regulatory landscape effectively. Bitcoin cross-border money transfer laws in Bosnia and Herzegovina.