Understanding Cross-border Money Transfer Regulations 🌍

Transfer regulations governing international monetary exchanges can often feel like a labyrinth of rules and requirements, especially in a globalized world where borders can be crossed with the click of a button. Understanding the intricate web of laws and compliance standards that surround cross-border money transfers is crucial for businesses and individuals alike. From anti-money laundering protocols to currency conversion regulations, navigating this landscape demands a blend of vigilance and adaptability. As technology continues to reshape the financial sector, the need for clarity and transparency in cross-border transactions becomes increasingly pronounced, highlighting the importance of staying abreast of evolving regulatory frameworks.

In today’s interconnected economy, grasping the nuances of cross-border money transfer regulations is not merely an exercise in compliance but a strategic imperative. As financial systems undergo rapid digital transformation, the challenge lies not just in adhering to existing rules but also in anticipating and adapting to future regulatory shifts. From the intricacies of data privacy laws to the implications of blockchain technology on cross-border transactions, the regulatory environment is a dynamic space that requires a nuanced understanding to ensure the seamless flow of funds across borders.

Cryptocurrency Adoption Trends in Bosnia 📈

In Bosnia, the adoption of cryptocurrencies is steadily gaining momentum, with more individuals and businesses exploring the potential of digital assets. The increased use of cryptocurrencies is evident in various sectors, showcasing a growing acceptance of this new form of financial technology. This trend reflects a shift towards a more decentralized and efficient financial ecosystem, with cryptocurrencies offering novel solutions for cross-border transactions and financial inclusion.

As more people in Bosnia embrace cryptocurrencies, the landscape is evolving to accommodate these changes. Businesses are increasingly considering accepting cryptocurrency payments, and individuals are exploring investment opportunities in digital assets. This growing interest in cryptocurrencies is not only reshaping the financial landscape but also paving the way for innovative solutions that have the potential to revolutionize traditional payment systems.

Key Challenges Faced by Crypto Users 🛑

Crypto users in Bosnia encounter various challenges, disrupting their seamless transactions. One common hurdle is the lack of clarity and consistency in regulations across different regions, leaving users uncertain about the legality of their activities. Additionally, the volatility of cryptocurrency prices presents a significant challenge, as users face the risk of sudden value fluctuations impacting the worth of their holdings. Security concerns also loom large, with the threat of hacks and scams posing risks to users’ digital assets. These challenges collectively underline the need for robust risk management strategies and heightened security measures to safeguard users’ investments in an increasingly digital financial landscape.

To overcome these obstacles, collaboration between stakeholders, including regulators, financial institutions, and technology experts, is crucial. Educating users about the risks and rewards of crypto transactions can help raise awareness and build confidence in navigating the complexities of the digital asset realm. Furthermore, advancing technological solutions such as secure wallets and robust authentication processes can enhance the overall security of transactions, instilling trust and facilitating smoother cross-border transfers for crypto users in Bosnia and beyond.

Solutions for Seamless Cross-border Transactions 💡

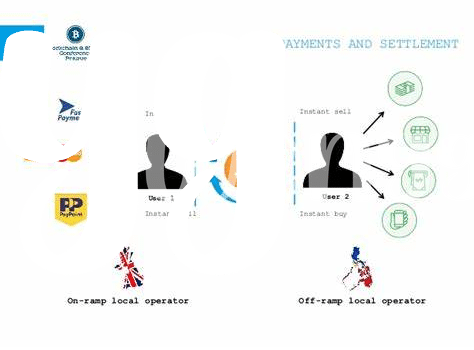

Solutions for Seamless Cross-border Transactions involve leveraging blockchain technology to facilitate swift and secure fund transfers across international borders. By utilizing decentralized networks, individuals can bypass traditional banking systems, reducing transaction fees and processing times. Additionally, the use of smart contracts automates payment processes, ensuring efficiency and transparency in cross-border transactions. Embracing these innovative solutions opens up new avenues for individuals and businesses looking to engage in global commerce, fostering a borderless financial ecosystem.

For further insights on staying compliant with cross-border money transfer laws, particularly in the realm of Bitcoin transactions, check out this informative guide on bitcoin cross-border money transfer laws in Bolivia. This resource offers valuable tips and guidelines to navigate regulatory requirements effectively and securely. By staying informed and adhering to compliance measures, users can confidently engage in cross-border Bitcoin transfers while mitigating risks and ensuring regulatory compliance.

Regulatory Outlook for the Crypto Landscape ⚖️

The regulatory landscape surrounding cryptocurrencies in Bosnia is evolving, with authorities striving to strike a balance between fostering innovation and ensuring consumer protection. As the country grapples with the complexities of cross-border money transfers involving digital assets, the focus is on creating a framework that can adapt to the rapidly changing dynamics of the crypto market. Stakeholders are closely monitoring international developments and exploring ways to enhance regulatory clarity while minimizing risks such as money laundering and fraud. This proactive approach reflects a commitment to embracing the potential benefits of blockchain technology while addressing the unique challenges posed by decentralized currencies. By fostering an open dialogue with industry players and leveraging insights from global best practices, Bosnia aims to position itself as a progressive hub for crypto innovation in the region.

Future Prospects and Emerging Opportunities 🔮

As the crypto landscape in Bosnia continues to evolve, the future prospects hold exciting opportunities for both users and businesses. With advancements in technology and increasing adoption rates, the potential for seamless cross-border transactions is on the rise. Emerging opportunities in the sector are paving the way for innovative solutions to bridge the gap between traditional finance and digital currencies. This shift towards a more interconnected and efficient financial ecosystem bodes well for the future of crypto in Bosnia and sets the stage for further growth and expansion in the digital economy. For those looking to stay informed about the latest developments and opportunities in the crypto space, keeping abreast of regulatory changes and market trends will be key to seizing the potential benefits of this dynamic industry.

Insert the link to bitcoin cross-border money transfer laws in Belgium organically in this post.