Bitcoin Regulations in Liechtenstein: 🌍

In Liechtenstein, the regulatory landscape surrounding Bitcoin is evolving to accommodate the burgeoning cryptocurrency market. The country has positioned itself as a progressive jurisdiction by implementing clear guidelines and frameworks for the use of Bitcoin and other digital assets. This proactive approach not only enhances investor confidence but also fosters innovation within the financial sector. By establishing a conducive environment for Bitcoin-related activities, Liechtenstein aims to attract businesses seeking a favorable regulatory climate. The government’s willingness to adapt to the changing dynamics of the digital economy reflects a forward-thinking mindset that positions the country as a leader in blockchain technology. As global interest in cryptocurrencies continues to grow, Liechtenstein’s commitment to fostering a compliant and transparent ecosystem sets a positive example for other nations to follow.

Understanding Cross-border Compliance Requirements: 🚦

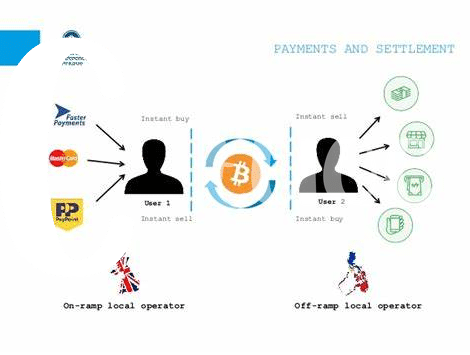

Navigating the maze of cross-border compliance requirements in the world of Bitcoin can feel like deciphering an intricate puzzle. From ensuring adherence to international laws to grasping the nuances of each jurisdiction’s regulations, the journey can be daunting. Fostering a comprehensive understanding of these intricate compliance demands is crucial for seamless cross-border transactions. By staying attuned to the evolving legal landscape, individuals and businesses can navigate the complexities with greater ease and confidence. As the digital currency terrain continues to expand, a proactive approach to compliance not only ensures regulatory alignment but also cultivates trust and credibility in the global marketplace. Through diligence and vigilance, the path to cross-border compliance can be illuminated, propelling the Bitcoin ecosystem towards a more secure and compliant future.

Impact of International Laws on Bitcoin Transactions: ⚖️

The global landscape of international laws impacts Bitcoin transactions in various ways. As cryptocurrencies transcend physical borders, they operate in a complex legal environment shaped by different jurisdictions. International laws can influence how digital assets are traded, taxed, and regulated across countries. This interconnected web of regulations can affect the ease and speed of cross-border Bitcoin transactions, adding layers of compliance requirements for individuals and businesses involved in the cryptocurrency space. Understanding and navigating these international laws is crucial for ensuring the legality and legitimacy of Bitcoin transactions on a global scale. Staying informed about changing regulations can help stakeholders anticipate potential challenges and adapt to the evolving regulatory framework.

Compliance Challenges in the Digital Currency Landscape: 🧩

Navigating the digital currency landscape poses various challenges, especially in terms of compliance. The evolving nature of regulations and the decentralized structure of cryptocurrencies create a complex environment for businesses and individuals alike. From ensuring anti-money laundering compliance to tackling issues of data privacy and security, the compliance hurdles in the digital currency realm are multifaceted. Staying abreast of these challenges is crucial for entities engaging in Bitcoin transactions to mitigate risks and maintain regulatory adherence. Embracing transparency and accountability is key to overcoming these compliance obstacles and fostering a trusted and compliant ecosystem within the digital currency space.

For more insights on the impact of regulations on Bitcoin transfers in Liechtenstein, check out this comprehensive guide on bitcoin cross-border money transfer laws in Lithuania: bitcoin cross-border money transfer laws in Lithuania.

Importance of Staying Updated with Legal Developments: 📰

Staying informed with the latest legal developments is vital for anyone involved in Bitcoin transactions. With the constantly evolving regulatory landscape, keeping up-to-date ensures compliance and minimizes risks. Changes in laws and regulations can have a significant impact on how Bitcoin is used across borders, making it crucial to stay ahead of the curve. By being proactive and monitoring legal updates, individuals and businesses can adapt their practices to meet the requirements set forth by authorities. This not only helps in avoiding potential legal pitfalls but also fosters a more secure and sustainable environment for engaging in cross-border Bitcoin activities.

Navigating the Complex Regulatory Framework: 🌐

Navigating the complex regulatory framework in the realm of Bitcoin cross-border transactions involves a meticulous understanding of both local regulations and international laws. Entrusted with the task of ensuring compliance, individuals and entities operating within this landscape must stay abreast of evolving legislations and regulatory requirements. Each jurisdiction presents its own set of challenges and nuances, making it imperative for stakeholders to adopt a proactive approach in interpreting and adhering to the applicable rules. In Liechtenstein, where the Bitcoin regulatory landscape is continuously evolving, the need for a comprehensive understanding of the legal framework is more crucial than ever.

Keeping pace with the dynamic nature of regulatory requirements not only demands constant vigilance but also necessitates a strategic approach to navigating the intricate web of laws governing cross-border Bitcoin transactions. Harmonizing compliance efforts with the overarching objectives of transparency and accountability is paramount, as deviations from regulatory mandates can have significant repercussions. By fostering a culture of compliance and embracing a forward-looking mindset, stakeholders can effectively navigate the complexities of the regulatory framework and foster a sustainable ecosystem for Bitcoin transactions.

Bitcoin cross-border money transfer laws in Libya can offer valuable insights into the diverse regulatory landscapes governing such transactions, providing a comparative perspective that enriches compliance strategies and operational practices.