Regulations Impact Bitcoin Transfers 🌍

Regulations play a crucial role in shaping the landscape of Bitcoin transfers globally. In Libya, regulatory frameworks impact the ease and legality of cryptocurrency transactions, influencing the accessibility and adoption of Bitcoin within the country. These regulations dictate how individuals can engage in transferring Bitcoin, imposing constraints or requirements that can either facilitate or hinder the process. Understanding the intricate relationship between regulations and Bitcoin transfers is essential for navigating the evolving financial ecosystem in Libya and beyond.

By analyzing the impact of regulations on Bitcoin transfers, individuals and entities can strategize and adapt to comply with legal standards while maximizing the benefits of cryptocurrency transactions. As regulatory environments continue to evolve, staying informed and proactive in addressing compliance challenges becomes increasingly vital for sustaining a thriving crypto economy in Libya and fostering a secure environment for digital financial interactions.

Challenges Faced by Individuals in Libya 🌐

In Libya, individuals face various challenges when engaging in Bitcoin transfers. The lack of clear regulatory guidelines and infrastructure poses hurdles for seamless transactions. Limited access to reliable internet and technological resources further complicates the process for those looking to participate in the crypto market. Moreover, concerns around security and potential legal repercussions deter many from fully embracing Bitcoin transactions. These challenges create barriers to financial inclusion and innovation within the Libyan crypto community. Despite these obstacles, there is a growing interest in exploring alternative solutions and educating individuals on navigating the evolving regulatory landscape to empower them in the digital financial space.

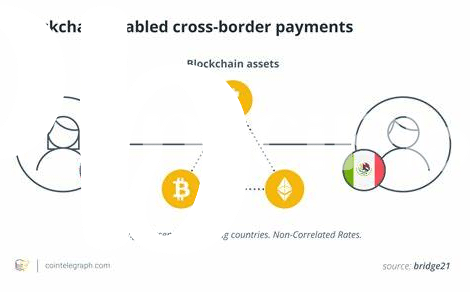

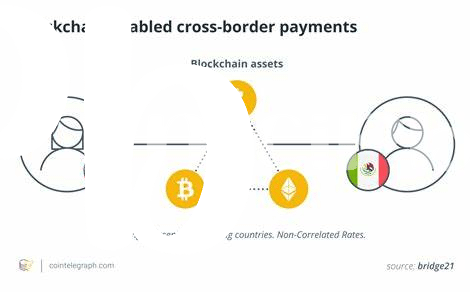

Emerging Trends in Crypto Transactions 📈

The crypto landscape is constantly evolving, with new trends shaping the way transactions are conducted. From the rise of decentralized finance (DeFi) to the increasing integration of blockchain technology in various sectors, the world of crypto transactions is becoming more diverse and dynamic. One notable trend is the growing acceptance of cryptocurrencies as a legitimate form of payment, with more businesses and individuals embracing digital assets. Additionally, innovations such as non-fungible tokens (NFTs) are revolutionizing the concept of ownership and digital representation. These emerging trends are not only changing the way we think about money and assets but also opening up new opportunities for financial inclusion and innovation. As the crypto market continues to expand and evolve, staying informed about these trends is crucial for anyone looking to navigate this rapidly changing landscape.

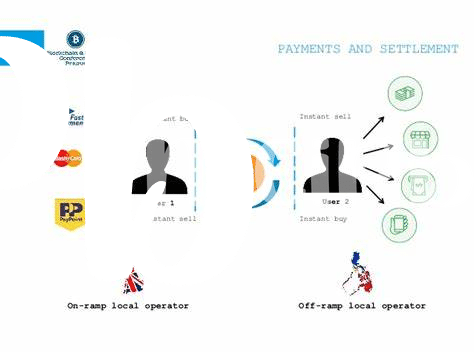

Solutions for Navigating Regulatory Hurdles 🔍

Navigating regulatory hurdles in the realm of Bitcoin transfers requires a strategic approach that embraces compliance while fostering innovation. In Libya, where regulations around cryptocurrency transactions are still evolving, individuals seeking to engage in Bitcoin transfers must stay informed and adapt to the changing landscape. One effective solution lies in fostering dialogue between the crypto community and regulatory bodies to establish clear guidelines that ensure transparency and security. This collaborative effort can help build trust and legitimacy in the use of Bitcoin for transfers within the country. Additionally, education plays a pivotal role in empowering individuals to understand the regulatory requirements and implement best practices for compliant Bitcoin transactions. By equipping the community with the knowledge and tools needed to navigate regulatory challenges, Libya can create a more conducive environment for the growth of Bitcoin adoption and utilization. Through proactive engagement and education, stakeholders can work towards a harmonious integration of cryptocurrency transfers in the country’s financial ecosystem.

Future Outlook for Bitcoin in Libya 💭

– The future outlook for Bitcoin in Libya shows promise amidst evolving regulatory landscapes and increasing adoption of cryptocurrency. As the global financial system continues to adapt to digital currencies, Libya stands at a crucial juncture in embracing the potential of Bitcoin for financial inclusion and economic growth. With a growing interest in decentralized finance and blockchain technology, there is a growing momentum towards integrating Bitcoin into mainstream financial services in Libya. The evolving regulatory framework presents both challenges and opportunities, shaping the trajectory of Bitcoin within the country’s economic landscape, ultimately influencing its future outlook for adoption and innovation.

– As more individuals and businesses in Libya explore the benefits of Bitcoin and blockchain technology, the future outlook holds potential for transforming traditional financial systems and promoting a more inclusive economy. By fostering a supportive regulatory environment and enhancing financial literacy around cryptocurrency, Libya has the opportunity to position itself as a hub for digital innovation and financial empowerment. The future of Bitcoin in Libya hinges on navigating regulatory hurdles, fostering community engagement, and embracing the transformative potential of blockchain technology to drive sustainable growth and development in the region.

Empowering the Crypto Community through Education 🎓

In the ever-evolving realm of cryptocurrencies, education plays a pivotal role in fostering understanding and adoption within the community. By empowering individuals with knowledge about blockchain technology, smart contracts, and the intricacies of Bitcoin transfers, we equip them to make informed decisions and navigate regulatory landscapes confidently. Educational initiatives can range from workshops and online courses to community discussions and informational resources, all aimed at demystifying the complexities of the cryptocurrency world. As individuals become more proficient in navigating these nuances, they are better positioned to contribute meaningfully to the crypto ecosystem and drive innovation forward.

For further insights into cross-border money transfer laws related to Bitcoin, particularly in Kyrgyzstan, explore the regulations outlined here: bitcoin cross-border money transfer laws in kiribati. This link provides detailed information on the legal framework surrounding Bitcoin transactions in the region, offering valuable guidance for those engaging in cross-border crypto transfers.