Overview of Bitcoin Regulation in Uganda 🌍

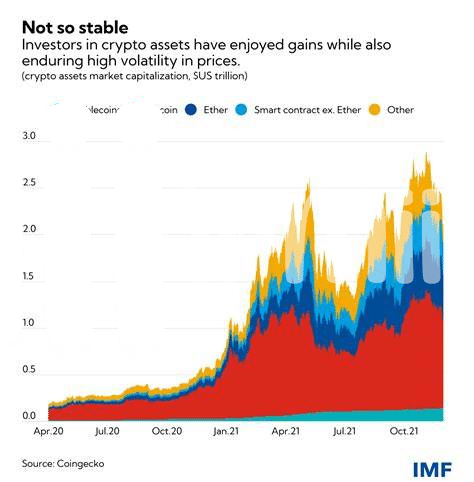

Bitcoin is gaining momentum in Uganda, with regulators keen on establishing clear guidelines for its operation. The country is witnessing a proactive approach towards shaping a regulatory framework that addresses the unique characteristics of this digital currency. As the interest in Bitcoin grows, stakeholders are working towards fostering an environment that balances innovation with compliance, paving the way for a burgeoning cryptocurrency ecosystem in Uganda.

Impact of Compliance on Innovation 🚀

Regulations play a crucial role in shaping the landscape for Bitcoin innovation. By ensuring compliance, businesses can operate within a secure framework, fostering trust and legitimacy in the market. However, overly restrictive regulations can stifle creativity and hinder the development of new ideas and technologies. Striking a balance between compliance and innovation is key to driving the Bitcoin sector forward in Uganda, allowing for growth and exploration of new possibilities in the digital currency space.

In a rapidly evolving industry like Bitcoin, compliance measures can either facilitate or impede innovation. Embracing a regulatory environment that encourages creativity and entrepreneurial spirit while maintaining integrity and consumer protection is vital for the sustainable growth of the sector. As Uganda navigates the intersection of compliance and innovation, finding a harmonious middle ground will be essential for unlocking the full potential of Bitcoin in the country.

Challenges Faced in Regulating Bitcoin 💡

Challenges faced in regulating Bitcoin in Uganda are multifaceted and require careful navigation. One key issue revolves around striking a balance between fostering innovation in the sector and ensuring compliance with existing regulations. Additionally, concerns about potential risks such as fraud, money laundering, and consumer protection underscore the need for robust regulatory frameworks. Overcoming these challenges will be essential in creating a sustainable and secure environment for Bitcoin operations in the country.

Opportunities for Growth in the Sector 💼

Opportunities for growth in the sector abound as more players enter the market, sparking innovation and competition. The increasing acceptance of Bitcoin as a legitimate form of payment opens doors for businesses to expand their customer base and reach new markets. With the right strategies and compliance measures in place, the Bitcoin sector in Uganda is poised for substantial growth and development.

For a deeper dive into the challenges and opportunities in Bitcoin banking services regulations, check out this informative article on bitcoin banking services regulations in united arab emirates.

Collaboration between Government and Industry 🤝

Government and industry collaboration is pivotal for shaping the future of Bitcoin regulation in Uganda. By working hand in hand, both parties can bring together the expertise and resources needed to create a robust regulatory framework that fosters innovation while ensuring compliance. This partnership can lead to a better understanding of the industry’s needs and challenges, enabling the government to tailor regulations that support growth and protect consumers. Ultimately, collaboration between government and industry can pave the way for a thriving Bitcoin sector in Uganda, benefiting the economy and its participants alike.

Future Outlook for Bitcoin Regulation in Uganda 🔮

In Uganda, the future of Bitcoin regulation holds promise for both investors and consumers. As the regulatory landscape continues to evolve, there is a growing focus on balancing compliance with fostering innovation in the cryptocurrency market. Stakeholders are optimistic that a clear regulatory framework will instill confidence in the sector, paving the way for sustainable growth and increased adoption. Collaboration between the government and industry players is key to ensuring that regulations are tailored to address emerging challenges and opportunities. Looking ahead, stakeholders are eagerly anticipating a more mature and robust regulatory environment that will nurture the burgeoning Bitcoin ecosystem in Uganda.

For more information on regulatory frameworks in different countries, you can explore Bitcoin banking services regulations in Ukraine by following this link: