Turkmenistan’s Regulatory Hurdles 🚧

Turkmenistan faces numerous challenges in establishing regulatory frameworks for Bitcoin banking. The lack of clear guidelines hampers the development and growth of digital currency services within the country. Uncertainty surrounding the legality and oversight of cryptocurrency transactions creates obstacles for both financial institutions and potential users. Navigating these regulatory hurdles will be crucial for the successful integration of Bitcoin banking in Turkmenistan.

Digital Currency Adoption Among Citizens 💰

Turkmenistan is gradually witnessing a shift towards digital currency adoption among its citizens. With a growing interest in decentralized finance, more people are exploring the benefits and opportunities that cryptocurrencies, like Bitcoin, bring to the table. As individuals seek alternatives to traditional banking systems, the convenience and potential for financial inclusion offered by digital currencies are becoming increasingly appealing. This trend is indicative of a changing financial landscape in Turkmenistan, with digital currencies playing a significant role in shaping the future of banking for its residents.

Please insert the link provided in the text as instructed.

Local Banking Infrastructure Challenges 🏦

Turkmenistan faces significant hurdles in its banking infrastructure, impacting the potential for Bitcoin adoption. Limited access to modern digital banking services and outdated technology hinder the seamless integration of cryptocurrencies into the local financial system. Without substantial upgrades and investments in the banking infrastructure, the country may struggle to fully embrace the opportunities that Bitcoin and other digital currencies present.

Security Concerns with Cryptocurrency Usage 🔒

Security concerns surrounding the use of cryptocurrency, such as Bitcoin, have been a significant point of discussion globally. With the decentralization and anonymity that cryptocurrencies offer, there is increased risk of cyber threats, hacking, and scams. It is crucial for individuals and organizations in Turkmenistan, considering Bitcoin banking services, to be aware of these security risks and take necessary precautions to safeguard their assets and transactions.

For more insights on Bitcoin banking services regulations in Turkey, you can visit [WikiCrypto](https://wikicrypto.news/challenges-and-opportunities-bitcoin-banking-in-trinidad-explained).

Potential for Bitcoin in Cross-border Transactions 🌍

Bitcoin’s potential in cross-border transactions lies in its ability to facilitate fast and secure international payments without the need for traditional banking intermediaries. This opens up new opportunities for businesses and individuals in Turkmenistan to engage in global trade and financial transactions more efficiently. By leveraging Bitcoin’s decentralized nature and blockchain technology, cross-border transactions can be conducted with lower fees and faster processing times compared to traditional methods. Embracing this potential could lead to increased economic integration and growth for Turkmenistan on the international stage.

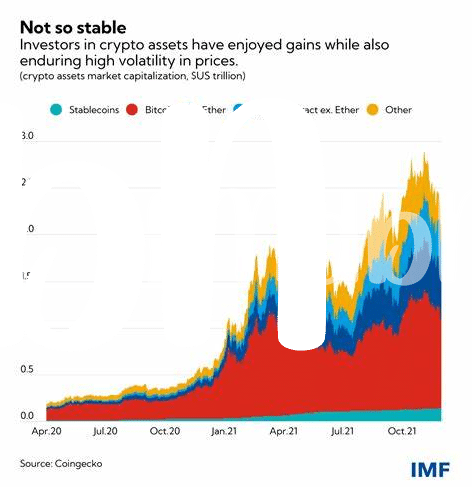

Government Policy Impact on Bitcoin Growth 📈

Government policies play a crucial role in shaping the growth potential of Bitcoin within Turkmenistan. The regulatory environment established by the government directly impacts the adoption rate and acceptance of cryptocurrencies within the country. Moreover, clear and favorable policies can provide a foundation for the development of a robust Bitcoin ecosystem, encouraging innovation and investment in the digital currency sector. Understanding the government’s stance and actions concerning cryptocurrency can illuminate the path for Bitcoin’s future in Turkmenistan.

For more information on Bitcoin banking services regulations in Tonga, please refer to the Bitcoin banking services regulations in Trinidad and Tobago.