Rise of Bitcoin as a Global Currency 🌍

In recent years, Bitcoin has steadily gained recognition as a digital currency with global reach. Its decentralized nature and borderless transactions have fueled its rise as a preferred medium of exchange. Bitcoin’s increasing acceptance by merchants and financial institutions around the world underscores its growing importance in the digital economy.

As more people embrace the concept of financial sovereignty and seek alternatives to traditional banking systems, Bitcoin’s role as a global currency becomes more pronounced. Its underlying blockchain technology enhances security and transparency, making it an attractive option for cross-border transactions. The rising acceptance and usability of Bitcoin are reshaping the financial landscape, offering individuals and businesses new possibilities for conducting transactions beyond geographical boundaries.

Regulatory Landscape in Colombia 🇨🇴

The Colombian regulatory landscape concerning cryptocurrency, particularly Bitcoin, has been evolving swiftly in response to the increasing popularity and use of digital currencies. Authorities in Colombia are closely monitoring and adapting regulations to ensure the responsible and secure use of cryptocurrencies within the country. Recognizing the potential benefits and risks associated with this decentralized form of money transfers, the Colombian government is working to strike a balance that fosters innovation while safeguarding against illicit activities. As one of the emerging markets for Bitcoin adoption, Colombia is navigating the complexities of integrating digital currencies into its financial framework to enhance transparency and efficiency in cross-border transactions.

The dynamic nature of cryptocurrency regulation in Colombia underscores the ongoing dialogue between regulators, financial institutions, and cryptocurrency users in shaping the future of digital finance in the country. With a forward-looking approach, Colombia aims to create a regulatory environment that encourages the adoption of innovative financial technologies while addressing potential challenges to ensure a robust and inclusive financial sector.

Benefits of Bitcoin for Money Transfers 💸

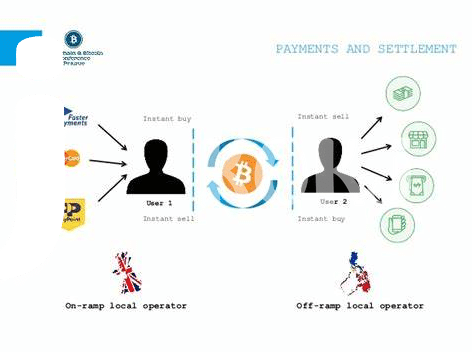

Bitcoin has revolutionized the realm of money transfers with its swift and cost-effective transactions, particularly advantageous for international transfers. One of the key benefits of using Bitcoin for money transfers is its ability to bypass traditional banking systems, reducing the time taken for transactions and overall costs. This decentralized digital currency facilitates peer-to-peer transactions across borders without the need for intermediaries, making it an attractive option for individuals seeking efficient and secure overseas money transfers.

Another advantage of using Bitcoin for money transfers is its near-instantaneous settlement times, especially beneficial for urgent or time-sensitive transactions. Additionally, the transparency and traceability of Bitcoin transactions provide users with a level of security and accountability that is often lacking in traditional banking systems. By leveraging the benefits of Bitcoin, users can experience a streamlined and cost-effective alternative for their international money transfer needs.

Challenges and Risks to Consider ⚠️

Bitcoin’s advent as a global payment solution has opened up new avenues for overseas money transfers. While the technology offers numerous benefits, such as lower transaction fees and faster processing times, there are certain challenges and risks that users need to consider. Factors like price volatility, security vulnerabilities, and regulatory uncertainties can impact the reliability and trustworthiness of Bitcoin transactions. It’s essential for individuals engaging in cross-border money transfers to stay informed and cautious to mitigate these risks effectively. Understanding the regulatory landscape, both globally and locally, is crucial to ensuring compliance and safeguarding funds. Additionally, keeping abreast of developments in the cryptocurrency space can help users navigate potential pitfalls and make informed decisions when leveraging Bitcoin for remittance purposes. For a deeper dive into Bitcoin remittance laws in various regions, check out this insightful article on compliance and regulation in Cabo Verde: bitcoin cross-border money transfer laws in Comoros.

Impact on Overseas Remittances 📈

Bitcoin has revolutionized the landscape of overseas remittances due to its borderless nature and lower transaction fees compared to traditional methods. Through the use of Bitcoin, individuals can now send money across borders quickly and securely, bypassing the lengthy processes and high costs associated with traditional remittance services. This shift to digital currencies has not only facilitated faster and more efficient fund transfers but has also empowered individuals with greater control over their financial transactions. As a result, the impact on overseas remittances has been significant, leading to increased accessibility and financial inclusion for individuals in Colombia and beyond. By leveraging Bitcoin for remittances, recipients can receive funds promptly, contributing to enhanced financial stability and economic empowerment within communities. The ongoing integration of Bitcoin into the remittance ecosystem is poised to continue shaping the future of cross-border money transfers, unlocking new opportunities for individuals seeking seamless and cost-effective financial solutions.

Future Outlook and Potential Developments 🚀

In the rapidly-evolving landscape of global finance, the future outlook for Bitcoin as a tool for overseas money transfers is brimming with potential. As more individuals and businesses recognize the benefits of using Bitcoin for cross-border transactions, we can expect to see increased adoption and innovation in this space. This upward trajectory is not without its challenges, but the resilience and flexibility of Bitcoin as a decentralized currency offer promising prospects for overcoming regulatory hurdles and streamlining international money transfers.

For further insights into the regulatory frameworks surrounding Bitcoin cross-border money transfer laws in Chile and Cabo Verde, check out this resource: Bitcoin Cross-Border Money Transfer Laws in Cabo Verde.