Overview of Bitcoin Remittances in Cabo Verde 🌍

The increasing adoption of Bitcoin remittances in Cabo Verde has brought about a significant shift in the traditional methods of sending and receiving money. This digital currency has provided a more efficient and cost-effective way for individuals to transfer money across borders, especially for the diaspora community. As more people in Cabo Verde embrace this innovative form of remittance, it has the potential to revolutionize the financial landscape of the country, offering greater financial inclusion and access to funds. The ease of transferring funds through Bitcoin has opened up new opportunities for individuals and businesses alike, facilitating faster and cheaper transactions compared to traditional banking systems. With the continued growth of Bitcoin remittances in Cabo Verde, there is a growing need for both regulatory oversight and technological advancements to ensure the security and stability of these transactions.

Importance of Compliance in the Industry 💼

Compliance plays a crucial role in the Bitcoin remittance industry, ensuring that transactions adhere to legal requirements and regulatory standards. By following compliance measures, businesses can build trust with customers and regulators, fostering a secure environment for financial transactions. Compliance not only safeguards against money laundering and fraud but also promotes transparency and accountability within the industry, ultimately strengthening the integrity of Bitcoin remittances globally.

Embracing compliance is not just a regulatory obligation but a strategic advantage for remittance businesses in Cabo Verde. Adhering to compliance standards can open doors to new partnerships, enhance credibility in the marketplace, and mitigate risks associated with non-compliance. In a rapidly evolving regulatory landscape, prioritizing compliance is essential for the long-term sustainability and growth of Bitcoin remittance services in Cabo Verde.

Current Regulations Affecting Bitcoin Transactions 📝

The regulatory landscape surrounding Bitcoin transactions in Cabo Verde is evolving rapidly, with authorities keen on balancing innovation with consumer protection. In recent years, the government has taken steps to clarify the legal status of cryptocurrencies, notably Bitcoin, and ensure that remittance businesses comply with anti-money laundering (AML) and know your customer (KYC) regulations. These regulations aim to prevent illicit activities and enhance the transparency and stability of the financial ecosystem. Embracing these regulations is pivotal for the sustainable growth of Bitcoin remittances in Cabo Verde, offering credibility and trust to both users and regulatory bodies alike. As the industry continues to mature, regulatory clarity and compliance will play a crucial role in shaping the future of Bitcoin transactions in the country.

In addition to local regulations, international compliance standards, such as those set forth by the Financial Action Task Force (FATF), also impact Bitcoin remittances in Cabo Verde. Collaboration between governments, financial institutions, and tech companies is essential to navigate and adapt to the evolving regulatory landscape, fostering a conducive environment for innovation and growth in the digital remittance sector.

Challenges and Opportunities for Remittance Businesses 🤔

Challenges in the remittance business landscape in Cabo Verde arise primarily from navigating the intricate web of compliance requirements. Ensuring adherence to regulations is not only a necessity but also a significant cost burden for companies. On the flip side, embracing compliance can open up opportunities for growth and credibility within the market. Remittance businesses face the challenge of staying updated with ever-evolving regulations while also striving to innovate and offer efficient services to customers. Moreover, competition in the industry is fierce, pushing companies to differentiate themselves through technological advancements and superior customer experiences. As businesses navigate these challenges, they can explore emerging technologies like blockchain to streamline processes and enhance security in transactions. While the landscape poses obstacles, it also presents opportunities for those who can adapt and lead in compliance and innovation. To delve deeper into the legal frameworks impacting bitcoin remittances in Africa, explore the detailed insights on bitcoin cross-border money transfer laws in China.

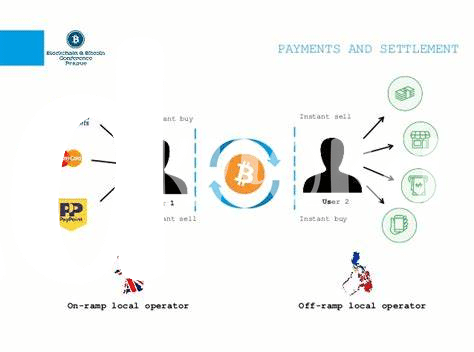

Technological Innovations in Payment Systems 🚀

The rapid advancements in payment systems technology have revolutionized the landscape of remittance services in Cabo Verde. From mobile wallets to blockchain-based solutions, these innovations have streamlined the process of sending and receiving funds, making it faster, more secure, and cost-effective for both individuals and businesses. The integration of biometric authentication, AI-powered fraud detection, and real-time transaction tracking have enhanced the overall user experience, ensuring seamless and efficient cross-border money transfers. Additionally, the adoption of contactless payment options and instant settlement features has further optimized the remittance industry, paving the way for greater financial inclusion and accessibility for the unbanked population in Cabo Verde.

Future Outlook for Bitcoin Remittances in Cabo Verde 🔮

In the ever-evolving landscape of remittances in Cabo Verde, the future outlook for Bitcoin transactions holds promise and potential. As technological innovations continue to shape payment systems, there is a growing opportunity for streamlined and efficient cross-border money transfers. Compliance with regulations not only ensures the security of transactions but also fosters trust among users. The challenges faced by remittance businesses are met with inventive solutions, paving the way for a more seamless experience for senders and recipients alike. Looking ahead, the integration of Bitcoin into the remittance sector in Cabo Verde is poised to further revolutionize the way funds are transferred, offering a glimpse into a more interconnected and digitized future. For more information on Bitcoin cross-border money transfer laws, check out the regulations in bitcoin cross-border money transfer laws in central african republic.