Central Banks: the Big Players in Money Game 🌍

Imagine a game where the biggest players have the power to set the rules, control the flow, and sometimes, shake the entire playground with a single decision. These big players are known as central banks, and they hold the keys to the kingdom when it comes to the world’s money. Think of it like being at the steering wheel of a colossal, global economy car. With tools like interest rates and money printing, they can speed up or slow down economic activity. If they sense things are getting too slow, a little more gas (money) gets things moving. But if things are speeding too fast, leading to higher prices for just about everything (what we call inflation), they might hit the brakes by making borrowing more expensive.

This immense power is not without its challenges, especially in our digital age. As guardians of traditional money, or fiat, central banks are at a crossroads. The digital revolution, where everything, including money, is going online, poses new questions. How much money should be in circulation? How to manage this without stifling growth or causing inflation? It’s a delicate balancing act, underscored by the arrival of digital currencies like Bitcoin, which operate outside the traditional money circle but have begun to play a significant role in the financial landscape.

| Central Bank Tools | Description | Impact |

|---|---|---|

| Interest Rates | Price of borrowing money | Controls economic speed |

| Money Printing | Increasing money supply | Boosts spending and investment |

| Inflation Management | Keeping price rises in check | Preserves currency value |

Bitcoin: the Rebel Sparking Digital Gold Fever 🔥

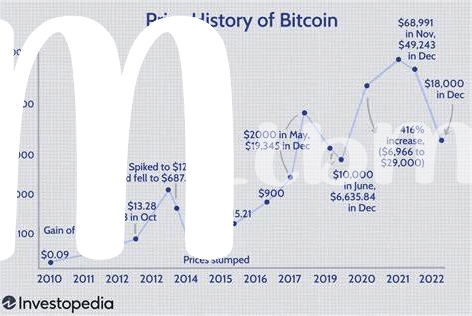

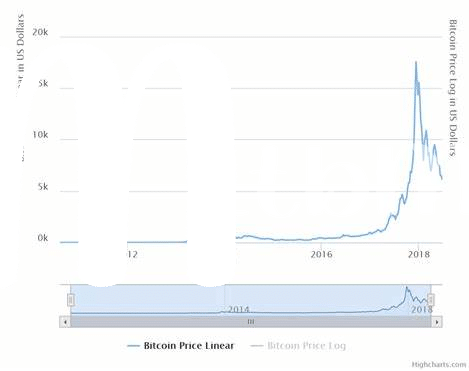

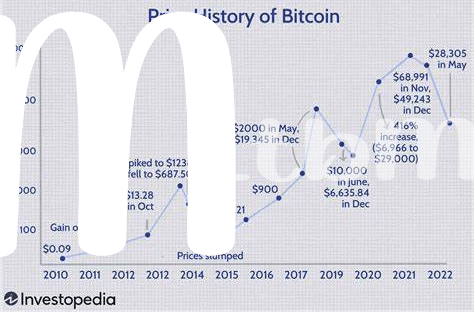

Imagine a world where the shiny glow of gold is replaced by the flicker of computer screens, showcasing rows of digital coins. This world isn’t just a fantasy; it’s the reality that Bitcoin brings into the financial realm. Emerging from the shadows of the 2008 financial crisis, Bitcoin presented itself as a beacon of hope for those disillusioned by traditional banking systems. Its allure isn’t just in its novelty, but in the promise of freedom from the control of big central banks. This digital treasure, often likened to gold, has sparked a feverish excitement among investors, tech enthusiasts, and dreamers seeking a new kind of wealth.

Transcending mere curiosity, Bitcoin’s journey paints a vivid picture of an underdog challenging the status quo. People worldwide are drawn to its potential for high returns and its role as a hedge against inflation – two facets that central banks often grapple with. Amidst this excitement, it’s crucial to navigate the evolving landscape of digital currency with a clear understanding. For those intrigued by how Bitcoin is rewriting the rules of currency, diving deeper into its evolution offers insightful perspectives. A compelling resource to explore such transitions is https://wikicrypto.news/the-evolution-of-currency-from-fiat-to-bitcoin, shedding light on how digital currencies are shaping the future of finance.

The Chess Match: Rate Decisions Vs. Bitcoin’s Mood 📉📈

Imagine a world where two giants battle it out, not with swords and shields, but with economic strategies and digital innovation. In one corner, we have central banks, the traditional powerhouses controlling the flow of money, making decisions on interest rates like master chess players, aiming to keep economies stable 🌍. In the opposing corner stands Bitcoin, the digital maverick, whose value swings with the mood of investors and the whispers of online forums, rather than the strict rules of economic policy 🔥. This ongoing game is intricate and fascinating. As central banks adjust rates to either encourage spending or save for a rainy day, Bitcoin reacts in its unique way, sometimes soaring as if celebrating the newfound freedom from traditional constraints, other times dipping as if in cautious anticipation of the next move. This delicate dance between decentralized digital currency and centralized financial policy highlights a broader discussion about the future of money itself — a narrative punctuated by surprising twists and turns, driven by innovation, and fueled by the ever-evolving landscape of trust and technology 💪⚖️.

Inflation Tales: Central Banks’ Nightmare, Bitcoin’s Daydream 🌜🌞

When we talk about inflation, it’s like watching a horror movie for central banks around the world but a dreamy fairy tale for Bitcoin enthusiasts 💸🌈. Imagine, central banks are like captains trying to steer their ships through stormy seas, doing everything they can to keep the water (inflation) from rising too high and capsizing their economies. On the other hand, Bitcoin is like a surfer, riding the waves of these economic storms, often finding its value boosted when traditional money loses its purchasing power. It’s a complex dance, where central banks adjust interest rates to try and control inflation, but Bitcoin operates on its own beat, independent of these traditional moves. This fascinating dynamic has people looking at Bitcoin not just as a digital asset, but as a potential safe haven, much like gold, when inflation hits. It raises big questions about money, value, and how we protect our purchasing power in uncertain times. If you’re diving deeper into how these forces interact, especially with the evolving landscape of Bitcoin mining and regulations, looking at insights such as those found in navigating bitcoin taxation: a global perspective regulatory outlook can provide valuable context and a deeper understanding of the ongoing economic chess match.

Regulation Rumbles: Striking Balance or Stirring Conflict? ⚖️

Imagine a seesaw in a playground. On one side, you have the big institutions that make rules about money, trying to keep everything in order, and on the other side, there’s Bitcoin, the cool kid that plays by its own rules. These institutions, known as regulators, are always trying to find the perfect balance. They want to protect people from money’s ups and downs while ensuring that innovations like Bitcoin can grow without causing trouble. It’s a tough job, and sometimes, they might tip the seesaw too much, causing a bit of a stir in the digital currency world.

| Aspect | Impact on Bitcoin | Impact on Regulation |

|---|---|---|

| New Rules | 📉 Can cause value dips or surges | ⚖️ Aims for stability and investor protection |

| Public Opinion | 🔥 Can boost trust and value | 💬 Influences policy adjustments |

At the heart of it all, everyone’s trying to make the financial world a better place – safer, more reliable, yet still exciting. The dance between regulations and Bitcoin continues as both try to lead. Sometimes they step on each other’s toes, but every now and then, they find a rhythm that works, showing us that maybe, just maybe, striking a balance isn’t a far-off dream. It’s a delicate operation, watching this interplay unfold, but one that holds the promise of shaping the future of money for everyone involved.

People Power: Consumer Trust in Bitcoin Vs. Fiat 💪

In the bustling arena of finance, the dynamics of trust and power are dramatically reshaped by the emergence of Bitcoin and its clash with traditional fiat money. The heart of this transformation lies in the hands of everyday folks – their confidence and preference between the digital pioneer and conventional cash are forming the frontline of this financial evolution. Bitcoin, with its decentralized charm, offers a sense of control and transparency that strikes a chord with those disillusioned by the opaque maneuvers of traditional banking systems. On the other hand, fiat currency, backed by centuries of trust and a regulatory framework, still holds a strong allure for those seeking stability and predictability in their transactions. This tug-of-war for consumer trust is not just a reflection of personal finance preferences but a signal towards a broader shift in the global financial landscape. As individuals navigate through their financial journey, their choices fuel the ongoing debate on reliability, security, and the future of money. Whether leaning towards the revolutionary ethos of Bitcoin or the established order of fiat, the power ultimately rests with the people, shaping the course of currency in the digital age. For in-depth insights into how Bitcoin stands up against traditional fiat currencies and the implications of regulatory policies, take a look at what you need to know about bitcoin halving events regulatory outlook.