🌎 Understanding Global Bitcoin Taxation Basics

Imagine you’ve ventured into the exciting world of Bitcoin, where digital currencies cross borders as easily as emails. But there’s a twist in this adventure – the world of taxes. Each country sees Bitcoin through its own lens, making the rules around taxes as diverse as the countries themselves. In some places, Bitcoin is treated like gold, a valuable asset that you need to pay taxes on when you sell it for more profit than you bought it. In other places, it’s seen more like money, where different rules apply. For instance, the USA might ask you to report your Bitcoin earnings as capital gains, while over in Germany, if you hold onto your Bitcoin for more than a year, you don’t have to pay tax on the profit you make selling it. It’s a global patchwork quilt of regulations, where keeping track is crucial but challenging. Here’s a simple table breaking down how two countries approach Bitcoin taxation:

| Country | Asset Classification | Tax Treatment |

|---|---|---|

| USA | Property | Capital gains tax on profits |

| Germany | Currency/Asset | No tax on selling after holding for 1 year |

Navigating this landscape requires a compass tuned to the nuances of local regulations, turning the complex world of Bitcoin taxation into a journey rather than an obstacle course.

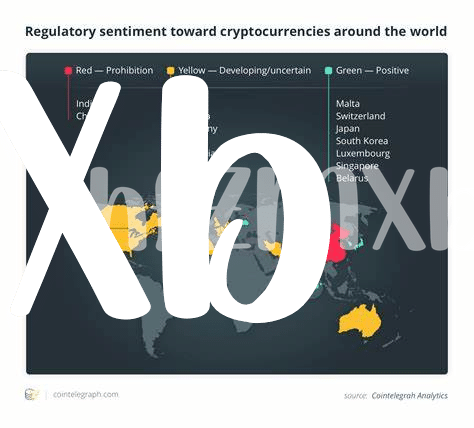

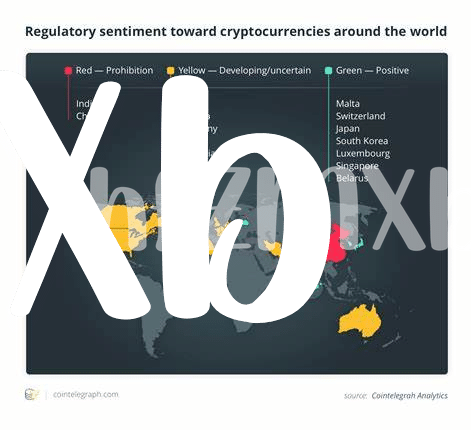

🚧 Identifying Common Tax Hurdles in Multiple Countries

When it comes to dealing with Bitcoin taxes across different countries, one quickly learns it’s like navigating through a maze blindfolded. Every country has its own set of rules, turning what should be a straightforward process into a complex puzzle. For example, some countries view Bitcoin as a form of currency, while others classify it as a property, significantly impacting how it’s taxed. This difference alone can create a massive headache for anyone trying to stay compliant while engaging in cross-border transactions. Moreover, the rate at which countries are rolling out new regulations means what worked yesterday might not work tomorrow, adding another layer of complexity to an already challenging task.

To better understand how these challenges are evolving and how they impact Bitcoin as both a currency and an asset, it’s essential to stay informed with reliable sources. A great starting point is https://wikicrypto.news/decoding-the-impact-of-bitcoin-halving-on-mining-ecosystem, which offers in-depth insights. Equipping oneself with up-to-date information is vital in navigating the tricky waters of Bitcoin taxation, ensuring one remains compliant while optimizing tax liabilities across borders. Within this ever-changing landscape, being informed isn’t just beneficial; it’s essential for anyone looking to engage with Bitcoin on a global scale.

🛠 Tools and Apps for Simplifying Bitcoin Taxes

Keeping track of your Bitcoin investments and their tax implications doesn’t have to be a headache. Imagine having a personal assistant who understands the complexities of international tax laws and can organize your crypto transactions with the tap of a finger. This isn’t just a dream! Today, several digital tools and mobile applications are designed to make your life easier. They automatically track your buying, selling, trading, and even spending of Bitcoin, converting all those movements into easy-to-understand tax reports. These apps consider the specific tax rules of different countries, ensuring your reports are accurate no matter where you are.

Moreover, these innovative solutions offer peace of mind by securely storing records of your transactions, often with cloud backup options so you won’t lose your data. They also provide valuable insights into how different transactions may impact your tax obligations, helping you to make smarter financial decisions throughout the year. Whether you’re a seasoned investor or new to the world of cryptocurrencies, leveraging these tools can streamline your tax preparation process, giving you more time to focus on your investments and less time worrying about the tax season.

💡 Tips for Accurate Record-keeping and Reporting

When venturing into the world of Bitcoin, keeping a clear and comprehensive record of all your transactions can be as crucial as the investments themselves. Imagine each transaction as a piece of a puzzle. Without keeping each piece safe and well-documented, completing the puzzle becomes a challenge, especially when taxes come into play. This is where the magic of meticulous record-keeping shines, transforming a potentially overwhelming tax season into a smooth sail. By maintaining detailed logs of when you bought or sold your Bitcoin, along with the amounts and values in your local currency, you’re essentially building a roadmap that guides you through the complexities of tax reporting.

Moreover, reporting these transactions accurately is key to staying on the right side of the law and avoiding penalties. Tools designed to ease the Bitcoin tax filing process rely heavily on the accuracy and completeness of your records. Whether it’s leveraging software or consulting with tax professionals, the groundwork lies in the records you’ve kept. It’s fascinating to see how these records become essential pieces of evidence, demonstrating your tax compliance. If you’re curious about how Bitcoin measures up against traditional currencies and what regulatory outlooks look like, this article on bitcoin versus traditional fiat currencies: a comprehensive comparison regulatory outlook offers compelling insights, navigating through the tumultuous waters of Bitcoin volatility with ease. Remember, in the world of Bitcoin taxation, your records are your best ally.

🤝 Leveraging Expert Advice for Cross-border Tax Planning

Imagine navigating a maze, where each turn brings a new challenge: that’s what dealing with cross-border Bitcoin taxation can feel like. Different countries have their own rules, sometimes as varied and unique as their cultures. This is where bringing in an expert, like a guide with a map, can make all the difference. They know the shortcuts, the dead ends, and most importantly, the legal pathways to ensure you stay compliant and make the most out of your Bitcoin investments. An expert doesn’t just keep up with the current rules; they stay ahead, predicting changes and advising you accordingly. They can tailor a strategy that fits not just your financial situation but also aligns with your future goals and the ever-evolving landscape of cryptocurrency taxation.

| Advantages | How It Helps |

|---|---|

| Personalized Strategy | Addresses your unique financial situation and goals |

| Staying Ahead | Keeps you informed about upcoming changes and opportunities |

| Legal Compliance | Ensures you follow the rules of each country effectively, avoiding penalties |

| Peace of Mind | Gives you confidence in your cross-border investment decisions |

By investing in expert advice, you’re not just paying for their knowledge; you’re securing peace of mind and potentially, better financial outcomes in the complex world of Bitcoin taxation across borders.

📈 Future Trends in Bitcoin Tax Regulation and Compliance

As digital currencies continue to evolve, navigating the waters of cross-border Bitcoin taxation becomes increasingly complex. Governments around the world are paying closer attention to cryptocurrencies, aiming to incorporate them into existing tax frameworks while also crafting new regulations to address their unique nature. This signals a shift towards more standardized global tax policies in the near future, influencing how individuals and companies manage their digital assets. Alongside these changes, we’re likely to see enhanced cooperation between countries to streamline tax processes and close loopholes that allow tax evasion. Key to staying ahead in this transforming landscape are tools and resources that provide clarity on the implications of these changes. For those keen on understanding the finer points of how regulatory shifts could affect market dynamics, a deep dive into analyzing bitcoin price volatility and its causes regulatory outlook may offer valuable insights. As technology advances, leveraging automated tools for tracking and reporting transactions in real-time will become the norm, ensuring compliance and simplifying the intricacies of cross-border Bitcoin taxation.