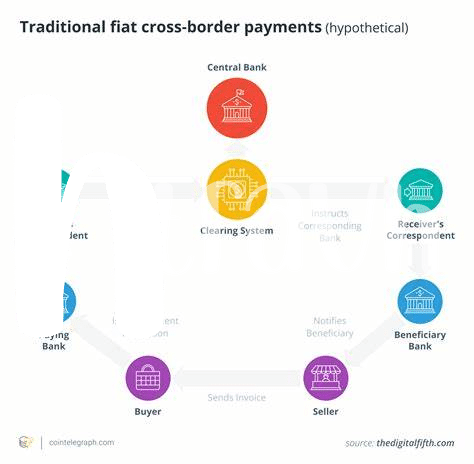

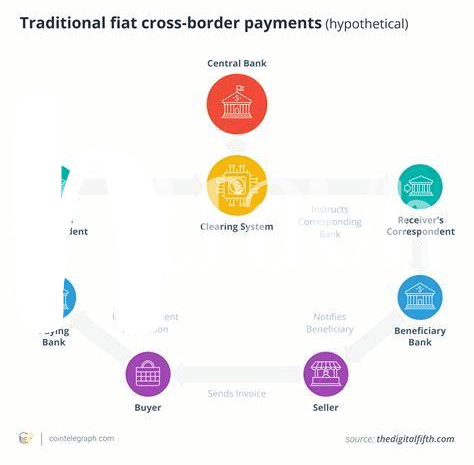

🌍 the High Cost of Traditional Money Transfers

Sending money across borders the old-fashioned way comes with a hefty price tag. Imagine working far from home to support your family, and when you send money back, a big chunk of it disappears just in the transfer process. Banks and traditional transfer services charge a lot, including flat fees and a percentage of the amount you’re sending. It’s like going to a store to buy milk and being told you need to pay an extra fee just for walking through the door! Now add to that, the poorer the country you are sending money to, often, the higher the fees get.

Here’s a simple breakdown of what it might cost you to send money traditionally:

| Service Type | Flat Fee | Percentage Fee |

|---|---|---|

| Bank Transfer | $25 | 1-3% |

| Money Transfer Service | $5-$50 | Up to 10% |

With these costs, sending $200 could easily eat up $10 to $20, or even more, just in fees. That’s money that could have gone towards your family’s needs, just evaporating into thin air. It’s easy to see why people are looking for better ways to send their hard-earned money home.

💸 Understanding How Bitcoin Works

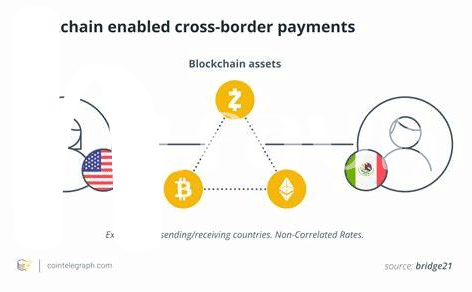

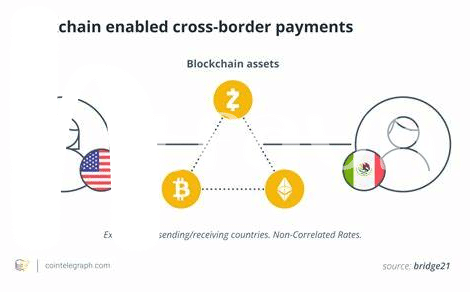

Imagine you’re sending a virtual postcard online instead of mailing a letter. Bitcoin operates on a similar principle but with money. It’s like a digital form of cash that lives on the internet, used by people around the world to buy things or send money to family and friends. Powered by a technology called blockchain, think of it as a huge book where every transaction with Bitcoin is recorded. This book is open for everyone to see, making it tough for anyone to be dishonest about where the money is going.

Now, sending money with Bitcoin is like passing a ball directly to a friend in a game of catch, without anyone standing in between to intercept. This direct approach means no banks or money transfer services get to take a slice of your cash as fees, making it cheaper and faster than traditional methods. It’s no wonder why more and more folks find Bitcoin a handy tool for sending money back home. If you’re curious about more ways Bitcoin is changing the world, take a look here.

💡 Bitcoin Vs. Traditional Banking: a Cost Comparison

Imagine you’re sending money to a friend in another country. With a traditional bank, you might find yourself tangled in a web of fees, waiting periods, and paperwork. On the flip side, enter Bitcoin, the digital challenger that’s shaking up how we think about sending money across borders. Unlike banks, Bitcoin operates on a public ledger, accessible to anyone, anywhere, without the need for intermediaries. This means when you send Bitcoin, you’re essentially zipping funds directly to your recipient, bypassing those pesky bank fees and long processing times. 🌍💸 Imagine this: sending $1000 through a bank might see you paying upwards of $50 in fees, and it could take days for the transaction to clear. With Bitcoin, the cost could be a fraction of that, and the transfer almost instantaneous. This stark cost difference is why so many people are turning their gazes towards Bitcoin for their remittance needs. It’s a modern take on money transfers, offering a glimmer of hope for cheaper, faster, and more accessible financial transactions for everyone, everywhere. 🚀🌐

🚀 the Power of Peer-to-peer: Cutting Out the Middleman

Imagine a world where sending money to family and friends across the globe is as simple as sending a text message. This is the promise of Bitcoin’s peer-to-peer system, a groundbreaking method that eliminates the need for traditional banks or financial intermediaries. By cutting out these middlemen, the process becomes faster, cheaper, and more straightforward. Transaction fees are significantly reduced, and the hassle of dealing with banking hours or paperwork is eliminated. This shift towards a more direct form of money transfer is not just a concept; it’s a reality for millions of people worldwide, transforming the way we think about sending money abroad.

For an in-depth exploration of how Bitcoin is making waves beyond just the financial industry, check out bitcoin in popular culture explained. This liberating approach to managing and transferring funds is fostering a new era of financial independence and inclusivity. By empowering individuals to handle their transactions directly with one another, Bitcoin is not just reducing costs; it’s also enabling a more connected world. Stories of people leveraging Bitcoin to support their families back home, invest in their futures, or even start businesses are becoming increasingly common, illustrating the profound impact of this peer-to-peer revolution.

🌐 Real-life Success Stories: Bitcoin in Action

Imagine a world where sending money to your family across the globe is as easy as sending a text message. That’s what happened for Maria in the Philippines 🇵🇭 when she started receiving Bitcoin from her brother in Canada 🍁. Instead of waiting days for her money and losing a chunk of it to high fees, she now gets more of what her brother sends, faster. It’s not just Maria; many people have turned to Bitcoin to make remittances simpler and more cost-effective. By doing so, they’ve bypassed the traditional banking system and its hefty fees, directly benefiting from technology’s promise to make life easier.

This isn’t a lone success story. In countries like Venezuela 🇻🇪, where the economy faces challenges, Bitcoin has become a lifeline. Pedro, for example, uses Bitcoin to receive funds from his daughter in the US. Instead of navigating a complex web of exchange rates and bank charges, he simply receives Bitcoin directly into his digital wallet. This method not only saves money but also time, offering a glimmer of hope and financial stability in tough times. Stories like those of Maria and Pedro showcase the real impact Bitcoin is having on people’s lives, proving that this digital currency is more than just an investment; it’s a way to bring financial services into the 21st century, helping those who need it the most.

| Location | Problems Faced | Solution with Bitcoin |

|---|---|---|

| Philippines 🇵🇭 | High remittance fees, slow transfer times | Lower fees, instant transfers |

| Venezuela 🇻🇪 | Economic challenges, inflated exchange rates | Direct Bitcoin transfers, saving money and time |

🛠 Tips for Safely Using Bitcoin for Remittances

When it comes to sending money across borders using Bitcoin, it’s like packing a suitcase – you need to know what to bring and what to leave behind to make your journey smooth. 🌐 First off, always double-check the legal side of using Bitcoin in both your country and the recipient’s country. Rules can vary widely, so understanding where Bitcoin stands legally is crucial. You can find reliable information on this by exploring bitcoin and payment channels explained, ensuring you’re not accidentally stepping over legal boundaries.

Finally, just like you wouldn’t share your travel plans with strangers, be careful with your transaction details. ⚠️ Use a secure wallet, prefer transactions over a private network, and only deal with reputable exchanges. Remember, the crypto world thrives on knowledge. By staying informed and cautious, you can navigate the Bitcoin remittance path safely, maximizing its benefits while minimizing risks. It’s about being smart and aware, making sure your money reaches its destination without unnecessary costs or hurdles.