Bitcoin Basics: Understanding the Digital Coin 🪙

Imagine this: a type of money that lives on the internet, that you can’t touch or see in your wallet, but can use to buy your favorite things or send to a friend across the globe in seconds. That’s essentially what Bitcoin is – a digital form of currency that uses super complex codes (think of them as super-duper secure locks) to keep your money safe. Unlike the dollars or euros, which are controlled by governments and banks, Bitcoin operates on a system that’s spread across countless computers worldwide, making it not just international, but also quite hard to tamper with. This means while you’re shopping online or sending money, you’re not relying on a bank or a middleman; you’re part of a huge global network 🌍💻. Plus, with Bitcoin, your identity is hidden behind a kind of digital mask, which is great for keeping your details private. But how does one get Bitcoin? Think of it like digital gold mining; instead of a pickaxe, people use computers to solve complex puzzles 🧩, and in turn, they get new Bitcoins. This all might sound like a sci-fi novel, but it’s happening right now, transforming the way we think about and use money every day.

| Feature | Description |

|---|---|

| Digital Nature | Exists only online, can’t be touched physically |

| Decentralized | Controlled by a network, not a central authority |

| Security | Uses cryptography for safe transactions |

| Anonymity | Users’ identities are hidden for privacy |

| Mining | Process of acquiring new Bitcoins through solving puzzles |

Shopping Goes Digital: Bitcoin in Retail 🛍️

Imagine walking into your favorite store, finding that perfect item, and instead of pulling out cash or a card, you scan a QR code and pay with Bitcoin—this scenario is becoming increasingly common as we move into a digital-first shopping era. Bitcoin, with its decentralized nature, is revolutionizing how we think about transactions, providing a new level of freedom and convenience for both shoppers and retailers. Retailers are now embracing Bitcoin to offer customers a wider range of payment options, enhancing the shopping experience by making it faster, more secure, and sometimes even cheaper thanks to lower transaction fees compared to traditional payment methods. For businesses interested in joining this digital commerce transformation, resources like https://wikicrypto.news/bitcoin-vs-sanctions-the-new-geopolitical-toolkit-explained provide invaluable insights into selecting the right Bitcoin payment gateway, ensuring they’re equipped to meet the demands of tech-savvy consumers. As we continue to navigate the expanding world of e-commerce, Bitcoin’s role is poised to grow, signaling a shift towards a more inclusive and adaptable retail environment.

Online Marketplaces: the Bitcoin Payment Revolution 💻

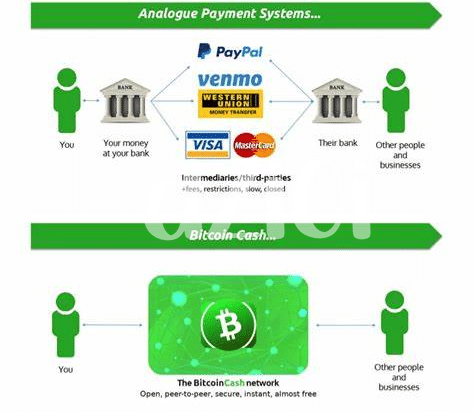

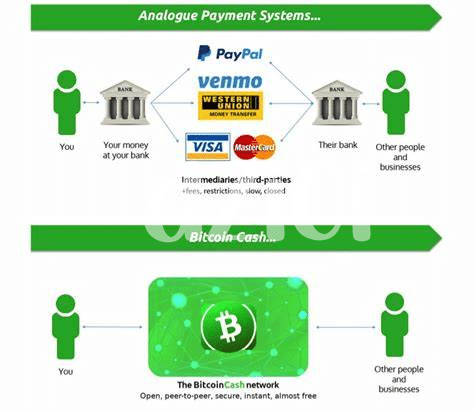

Imagine buying your favorite items from anywhere in the world without dealing with complicated bank fees or worrying about exchange rates. This isn’t a distant dream anymore, thanks to the surge of Bitcoin in online shopping. More and more online stores are now waving the Bitcoin flag, enabling customers to purchase goods using this digital currency. This trend isn’t just about embracing new technology; it’s about tapping into a global market without the traditional barriers. With just a few clicks, you can buy a vintage guitar from Tokyo or a handcrafted rug from Morocco. The process is simple, secure, and, most importantly, fast. Transactions with Bitcoin cut down the waiting time from days to mere minutes, making international shopping a breeze. Plus, it offers a layer of privacy for your purchases that traditional online payments can’t match. But it’s not just about convenience and privacy; it’s a revolution in how we think about money and commerce in a connected world. As we move forward, the integration of Bitcoin into more online marketplaces is set to change the shopping experience, making it more inclusive and accessible for everyone, everywhere. 🌍💳🛒

Security and Privacy: Why Bitcoin Matters 🔒

Imagine going shopping online without having to share your credit card details every time, or even better, making a purchase without your bank being a middleman. That’s where Bitcoin shines in the domain of security and privacy. Unlike traditional transactions, where your financial information is often exposed to various entities, Bitcoin keeps things under wraps. Each transaction is recorded on a public ledger, but the identities behind these transactions remain anonymous. This digital veil not only protects your personal details but also reduces the risk of fraud and identity theft, making every purchase a quiet whisper in the vast internet space.

To understand more about how Bitcoin secures transactions, a great resource is bitcoin payment gateways explained. Here, the technology behind Bitcoin isn’t just about buying and selling; it’s about revolutionizing how we think about financial security and privacy. By eliminating the need for personal data exchange, Bitcoin provides a fortress of solitude for your financial transactions. As we move towards a more digital future, the appeal of a secure and private currency becomes increasingly irresistible, positioning Bitcoin as a potential cornerstone for future commerce.

Bitcoin Vs. Traditional Money: the Future Face-off 💵

Imagine stepping into a world where your wallet isn’t stuffed with paper bills but instead, digital coins light up your phone screen. This is where we see the dance between the new kid on the block, Bitcoin, and the old guard, traditional money. Think of it like a game where both players have their strengths—Bitcoin offers a sneak peek into a future where transactions might zoom across borders in the blink of an eye, without the need for middlemen, making it a tad more exciting and, possibly, cost-effective. On the other side, traditional money, the familiar tunes we’ve danced to for centuries, comes with the assurance of physicality and a well-established system. Yet, the question looms: can Bitcoin’s digital charm woo the world enough to stand toe-to-toe with the heavyweight champ of commerce? The tug-of-war between them isn’t just about which is better but how they might learn to dance together, combining the best of both worlds.

| Feature | Bitcoin | Traditional Money |

|---|---|---|

| Transaction Speed | Fast, can be immediate | Varies, often slower |

| Physical Presence | Digital only | Physical and digital |

| Global Use | Borderless | Subject to exchange rates and regulations |

| Security | High, with encryption | Depends on institution |

Overcoming Challenges: Making Bitcoin User-friendly 🚧

Imagine a future where buying your morning coffee, getting that book you’ve been eyeing, or even paying your bills could be done as quickly and simply as sending a text message. This isn’t a far-off dream but a very real possibility with Bitcoin, a digital type of money that’s been gaining traction. However, for Bitcoin to truly become a part of everyday life, a few bumps along the road need smoothing out. Firstly, it needs to be easier for everyone to understand and use, not just those who are tech-savvy. Think bigger, better apps and tools that make sending and receiving Bitcoin as simple as pie. Also, information on how Bitcoin works should be clearer, so people know exactly what they’re dealing with, like understanding the fine print without needing a magnifying glass. Plus, there’s an exciting world of possibilities when it comes to making shopping, paying, and saving with Bitcoin safe, fast, and, importantly, fun. For those curious about the broader impact of Bitcoin, exploring topics like bitcoin and political donations explained can provide deeper insights into how this digital currency interacts with the global stage. So, as we navigate these hurdles, embracing innovation and education, the future where Bitcoin stands side by side with traditional money, offering a secure, private, and user-friendly option, gets closer every day.